Our Premium Database: Database for banking, consulting and buyside roles | The Pulse

Coaching Program: Mock Interviews, Resume Reviews, and Gameplanning | The Pulse

95%+ placement rate for our summer 2025 cohort. 2026 placements so far at Blackstone, Morgan Stanley, Evercore, and more.

CRUSH your interviews with us.

Together With

Introducing Buyside Hub, the Buyside Analyst’s destination for 1) Compensation Data and Culture Info, 2) an Industry Forum, and 3) Buyside Jobs

Mostly applicable for full-time analysts; however, it’s never too early to start thinking about next steps!

Compensation and Culture Data: View accurate and detailed Wall Street compensation data. We already have thousands of wall street compensation datapoints flowing into the platform. You'll be able to learn more about buyside funds, as users regularly submit anonymous reviews that provide a look into a fund’s culture.

Industry Boards: We have several different forums to interact with: a Main feed and then feeds such as Private Equity, Credit, Hedge Funds, Investment Banking, Venture Capital, and Stocks.

You can create an anonymous username and add a profile picture, and then interact with other users, similar to comparable social networks.

Job Boards: Access our Job Boards to get a targeted look at free finance jobs that are relevant for you.

Buyside Analysts who contribute compensation and culture datapoints get full access for free!

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Campbell Lutyens, Pharus, Agentis Capital, and one more opened their summer 2026 apps. 87 firms are actively recruiting for summer 2026 positions

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

Agentis Capital: Canada-based boutique, infrastructure banking (SA 2026)

Pharus: Tech-focused advisory (SA 2026)

Northborne Partners: Small boutique (SA 2026)

Campbell Lutyens: Seconaries advisory, boutique (SA 2026)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

We have stopped tracking 2025 recruiting. 2026 Recruiting is in the very early days. There are currently 4 open applications.

SA 2026 released apps:

None

Buyside:

Where We’re At:

SA 2026: Altamont Capital Partners opened its SA 2026 application. Currently 70 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Altamont Capital Partners: PE, $4bn AUM (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 92nd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $45 Credit Card / Debit Card: (ThePulsePrep—Stripe.com—30% off) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $45.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

The Wealth Effect

When the value of your stocks and shitcoins rise, you spend more money. You just don’t recognize it.

This is the wealth effect and today we are going to pull it apart.

First, a few quick economic points:

Federal Funds Rate: 4.25 - 4.50%

PCE: 2.5%

Unemployment: 4.0%

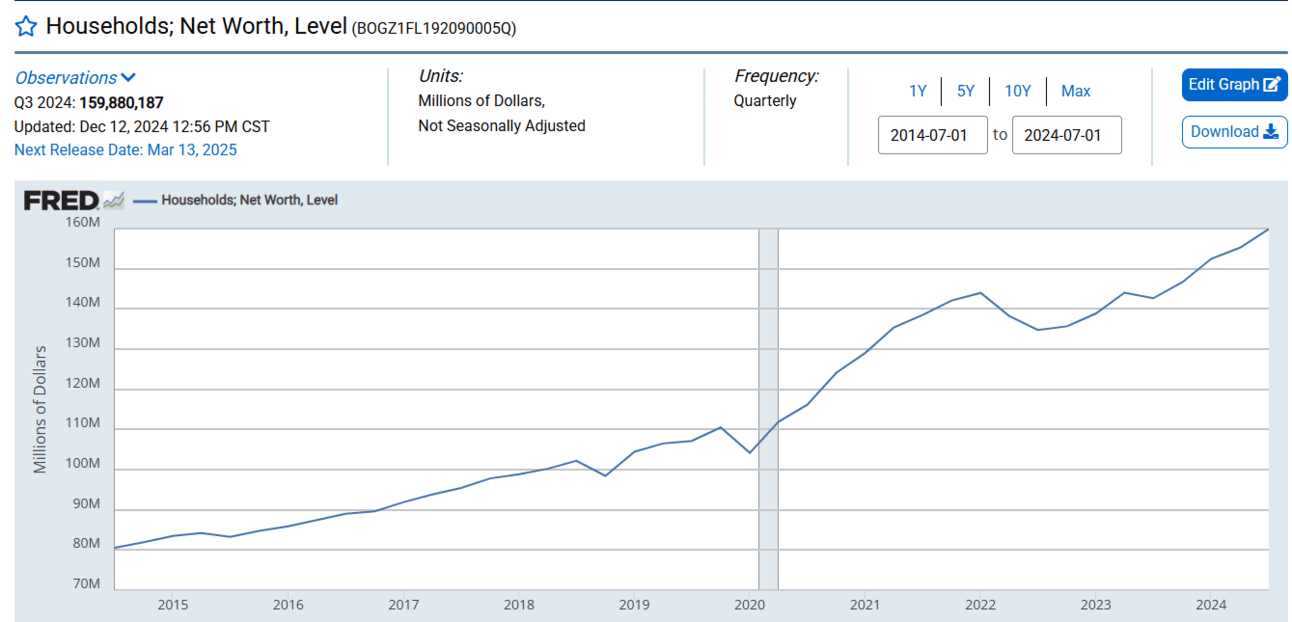

Household Net Worth Doubled Over 10 Years (Source: FRED)

The United States experienced a fantastic boost to wealth over the last 10 years with COVID serving as a catalyst for faster growth. This also contributed to heightened consumer spending. Alongside a low-rate environment and heavy government stimulus, inflation blew up across the world.

Over the last few years, the U.S. consumer experienced:

Increased savings

Increased asset values

Lower unemployment

Strong wage growth

Rapid uptick in inflation

Rates moving from ultra-lows to historical highs

This promoted a healthy spending environment because cash kept coming in the door and people felt wealthier from asset appreciation; despite the noise from inflation and recently elevated rates.

You see, when the value of assets rise people just feel wealthier. They feel like they can spend more. Even if there is no material change to their income (ie cash in the door)! This behavioral effect has served as a tailwind for consumer spending and robust economic growth over the last few years.

However, the party can’t last forever! The value of your stock, house, and shitcoins are only paper gains until you sell them.

At some point, you do need more cash to fuel greater spending. Right now, I’m not seeing that extra cash:

Wage growth is decelerating (albeit greater than inflation)

Greater dividends from asset appreciation are just being reinvested

Rent is a possibility, but rental growth is slowing and only ~4% of the population are landlords charging others for rent

Interest income from assets is falling alongside rate cuts

Inflation is lower, but persistent around the mid 2s to low 3s

Most consumer debt is fixed, so debt service is either constant or more expensive as maturities roll off within the elevated rate environment

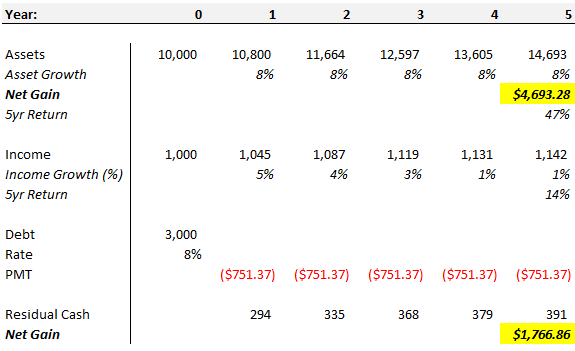

A simple demonstration below:

Cash = Income - Debt Service (Source: The Pulse)

For consumers, most of their debt will be fixed-rate but their income is variable. We touched upon this in greater detail here: "The Pulse" -- #69 / 50 States, 50bps of Cuts. Consumers either have a). illiquid, non-cash generating assets (stocks, crypto, houses, etc) or b). liquid, variable rate assets (money market accounts, high yield savings accounts, some corporate credit exposure, etc)

This means people will have less cash coming in the door as rates move lower, yet stay elevated on a historical basis.

An understated problem with the wealth effect is that there is a ceiling. As asset values rise, consumers spend more which ultimately winds down their liquidity. Savings accounts get drained over time and are not replaced because consumers feel wealthier as long as asset values continue to rise.

Personal Savings Rate at 4.6% (Source: FRED)

The personal savings rate is much lower than what it stood at during Covid and is a hair lower than pre-Covid levels. This is a factor of the wealth effect.

Spending money is fun and it can be hard to dial it back. Paying debt sucks, but it has to be done. The collision of those two drivers yields a poor consumer liquidity position when incomes (cash in the door) decelerate and debt payments + other expenses (cash out the door) remain the same or get more expensive!

When liquidity dries up, the party stops. Consumer spending decelerates and asset values ultimately fall.

Similar to last week, I’m not trying to cry wolf here. I’m just writing about stuff I’ve been thinking about.

The silver lining to support further consumer spending is the ‘great wealth transfer.’ Baby boomers make up 20% of the population and hold over 52% of the wealth. They’re entering retirement and will be winding down their asset balances to spend on golf outings in West Palm, cruises to nowhere, and the occasional grandkid gift.

That new stream of cash via asset sales will be a great boost to consumer spending and might be enough to keep the engine running.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Case prep for dummies

Every consulting job you apply to will have a case interview.

Doesn't matter whether you're applying to McKinsey & Company, Bain & Company, Boston Consulting Group (BCG), or Oliver Wyman.

This helps them gauge how you think, how you communicate, and your approach to problem solving–-the consultant's whole toolbox.

Sitting down with a live interviewer is intimidating. So, the most important thing here is reps.

At the end of the day, the only way to get comfortable doing anything is to practice. The same goes for case prep.

Here are a few tips for you:

Practice doing cases out loud. ✅

You won’t be doing cases in your head when you interview so why do it when you practice? This will also help you be more concise.

Study the case process for the firm you are applying to. ✅

Some of them have specific cases that they typically give. This way you can 'see the pitch before it's thrown.' ⚾

Practice with a friend. ✅

Everyone thinks differently and may approach a problem from a different angle. Practicing with a friend will help you solve problems more efficiently.

Stay up to date on the news. ✅

Business and political trends all play a role in firm strategy, so being able to identify trends and apply them to cases or even just appear well-read is helpful.

FYI, you can download MBB cases here:

📌 https://lnkd.in/gAXpbJs

📌 https://lnkd.in/et6-v_Hj

📌 https://lnkd.in/eG7MurVS

Going Forward:

Are you starting your banking / consulting FT job this summer?

We are carefully rolling out our Buyside Associate prep solutions. This will be the best tool to land a job in PE, PC, HF, or VC / GE after your analyst stint. Please shoot us an email @[email protected], if you’d like to be a part of our first cohort—services will be 100% free.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #92

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions