Final Week of Our Premium Database Sale! Ends 2/26/2025

For the next month, our Premium Database will be 30% off to help you land your dream summer 2026 role!

Pay us $45 via debit / credit card (ThePulsePrep—Stripe.com—30% off) and shoot us an e-mail @[email protected]. This provides you with a full year of access and is our final sale for the summer 2026 recruiting season.

Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Coaching Program: Mock Interviews, Resume Reviews, and Gameplanning | The Pulse

95%+ placement rate for our summer 2025 cohort. 2026 placements so far at Blackstone, Morgan Stanley, Evercore, and more.

CRUSH your interviews with us.

Where did you get an offer for summer 2026?

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Reagan Consulting and Petrie Partners opened their summer 2026 apps. 83 firms are actively recruiting for summer 2026 positions

This year, the summer 2026 recruiting season was highly condensed in January and early-mid February where the majority of apps opened and interviews took place. There is still room to secure an offer but being strategic by moving down market will be the key to success. By the end of March, 85% of the SA 2026 recruiting process will be concluded

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

Reagan Consulting: Insurance banking (SA 2026)

Petrie Partners: Boutique O&G (SA 2026)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

60 SA 2025 applications have been released along with 71 FT 2025 apps. We will stop tracking this process at the end of February.

2026 Recruiting is in the very early days. There are currently 4 open applications.

SA 2025 released apps:

West Monroe Partners - Strategy Intern (SA 2025)

CIL Management Consultants - Associate Consultant Intern (SA 2025)

FT 2025 released apps:

None

SA 2026 released apps:

None

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2026: Ruane, Cuniff, and Goldfarb opened its SA 2026 application. Currently 69 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Ruane, Cuniff, and Goldfarb: Value-oriented investors (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 91st update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $45 Credit Card / Debit Card: (ThePulsePrep—Stripe.com—30% off) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $45.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

The Student Loan Story

This week’s update may hit close to home for many of you—today we are discussing student loans. There is ~$1.6tn of outstanding student loan debt and roughly 25% of Americans under the age of 40 carry some student loan balance. This makes up 9% of total consumer debt outstanding.

Upon graduation, I was also a part of that statistic. Thankfully, a guy like me is debt free today. 💯

This will be a classic read to understand the consumer debt payment waterfall and is a must read for anyone thinking about jobs in credit or fintech investing / banking.

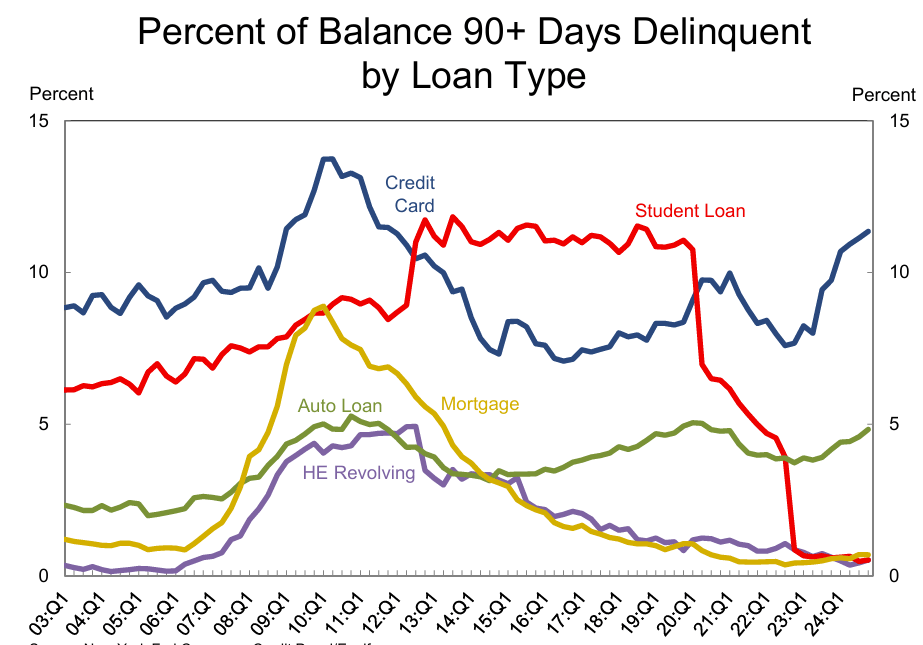

What drew me here is the chart below:

Student Loan DQs are Low (Source: NY FED)

I’m not a tourist in this space. Student loan delinquencies are artificially low.

I love following consumer credit trends, so bear with me here as I tend to get excited about these subjects. We ultimately can’t understand that graph without understanding a quick background of student loans and the history over the last 5 years.

-Quick Background of Student Loans:

Mostly fixed rate products; S+200-300bps (bulk of outstanding loans originated during the low rate environment)

Unsecured products

Average outstanding balance is ~$35,207

Most student loans do not require payment until 6 months after graduation. Subsidized loans won’t accrue interest until 6 months after graduation either

65% originated by the Department of Education, 35% by private institutions (fintechs, banks, etc)

Securitized and sold to investors (credit funds, pension funds, insurance companies, etc) within the student loan ABS market

-History of Student Loans:

2020: Covid hit and student loan payments were suspended from March 13, 2020 to September 1, 2023. Interest was also waived to avoid the compounding of outstanding debt balances

2023: On October 1st, student loan payments resumed with the resumption of interest accrual on September 1st

2023 → 2024: Missed payments were not reported as delinquent to credit bureaus to allow borrowers to adjust to making payments again

2025: ‘Back to normal.’ Student loan repayment is required, interest will accrue, and DQs will be reported to consumer credit bureaus

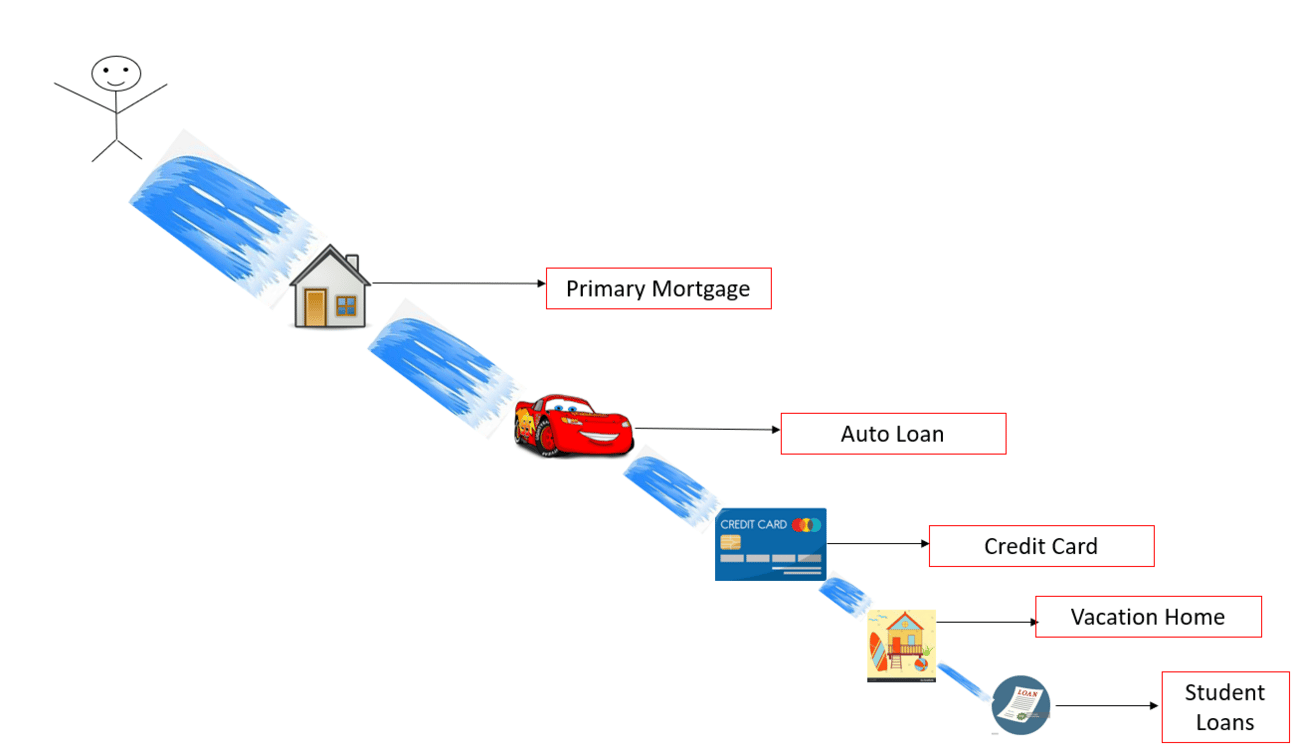

Now, let’s tie the graph above and the history provided to the image below:

Consumer Payment Waterfall (Source: The Pulse)

Student loan DQs today are practically in-line with mortgage DQs, but student loans and mortgages are on polar opposite sides of a consumer’s repayment waterfall.

Would you rather lose your house or piss off the student loan debt collector? As long as the student loan debt collector won’t actually swing by to break your kneecaps, the answer is obvious.

This means that student loan DQs should be greater than mortgage DQs—in this case they should be much greater!

Student loan DQs should probably fall in the 10-15% range vs. the 1-3% range reported today. Tying back our history lesson, DQs are low today because the government artificially inflated student loan performance via their various forms of forbearance and forgiveness around Covid.

Ok, so if DQs tick up on student loans who does that really impact?

Inflated consumer FICO scores will deteriorate

Current student loan ABS investors may realize some stress

Demand for unsecured personal loans or debt consolidation products will increase

We wrote about inflated FICO scores here: "The Pulse" -- #21.

As with many things, DQs tend to be caused from a blend of technical and behavioral factors. If some people stop paying their student loans, others may hop on the bandwagon ultimately yielding stress for bottom-tranche student loan ABS investors. My sample size is small, but I personally know a number of people who simply plan on never repaying their student loans lmao.

As default rates mount on student loan debt, consumers may start looking for options to consolidate debt with unsecured personal loan products. With these, you can effectively take out a loan to pay back other debt and now only have to manage repayment in one place.

An interesting proposition, but more or less just kicking the can down the road.

By no means am I crying wolf here about student loan debt. My primary point is to show that student loan DQs are artificially low and will very quickly rebound to normalized levels.

Idk if anyone is trying to claim ‘this time will be different’ and that somehow student loan DQs will remain lower than pre-Covid levels; but heightened inflation, elevated rates, and decelerating wage growth certainly don’t support that claim.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

PIK Interest

A critical capital concept and a favorite technical question asked by any of the Elite Boutiques: what is PIK interest?

PIK stands for “paid in-kind.” PIK interest is interest that is not routinely paid in cash and is instead accrued and paid at maturity along with the principal of the debt.

PIK is very common in junior debt instruments and preferred equity where opportunistic investors are looking for greater yield. PIK interest is typically more expensive than cash interest because the investor needs to be compensated for the added risk of not getting paid in cash every period interest is due.

Borrowers like PIK interest because they don’t need to make regular cash payments to the lenders and can instead use cash to invest in growth initiatives or pay themselves via dividends.

An example of PIK math:

-$100 loan with 10% PIK payable in 3 years:

Year 1

-Beg. Debt: $100

-PIK Interest Expense: $10

-End Debt: $110

Year 2

-Beg. Debt: $110

-PIK Interest: $11

-End Debt: $121

Year 3

-Beg. Debt: $121

-PIK Interest: $12.1

-End Debt: $133.1

As you can see, PIK interest compounds. Important to note that PIK interest is still baked into a company’s reported interest expense and ultimately reduces net income. However, it is added back as a non-cash expense when calculating free cash flow.

Going Forward:

Are you starting your banking / consulting FT job this summer?

We are carefully rolling out our Buyside Associate prep solutions. This will be the best tool to land a job in PE, PC, HF, or VC / GE after your analyst stint. Please shoot us an email @[email protected], if you’d like to be a part of our first cohort—services will be 100% free.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #91

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions