Never stress about tracking applications or being unprepared for an interview ever again. Check out our Premium Database to take care of all of your recruiting bullshit. Follow the steps below to gain access

Too broke to pay for anything? Refer 3 friends and shoot us an email: [email protected] to receive FREE access

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: No changes from last week’s update. Only RBC has opened its app. Expect more volume around December/January. Just remember to stay ahead of the game with recruiting prep, because there are only 6 months until 75% of the process will be wrapped up!

SA 2024: Once again, we no longer cover SA 2024 within the Premium Database. However, we wanted to mention that a few apps for Citi (FIG) as well as smaller boutiques opened up over the week.

FT 2024: Big movements in the FT space with UBS, Lazard, and D.C. Advisory all opening up applications. Important to note, these roles are group-focused and there are likely only 1-2 spots open to fill in for analysts who jumped to PE or recently left the firms.

Newly released apps:

Lazard: Consumer & Retail Group needs a new analyst (FT opening)

UBS: FT Asset Management position (BB)

D.C. Advisory: FT analyst needed for the Infrastructure Group (underrated group tbh)

See below to gain access to our premium database, updated bi-weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: So far only one firm has released its 2025 application. Recruiting will start a little earlier than it did for 2024

SA 2024: We are in an in-between time for consulting recruiting. Almost all firms have released their applications for 2024 internships and jobs. But SA 2025 hasn’t quite kicked off yet. Firms are wrapping up interviews and many have already given out offers. Some firms have re-released applications so you will see some fresh applications on Handshake for firms that released apps months ago

FT 2024: Not much news here. FT is a bit less structured so you might see some consulting firms posting applications over the next few weeks if they decide they need an extra Associate Consultant. However, the larger, more well known firms are done releasing apps and are at the final stages of hiring for 2024

Newly released apps:

LEK - Associate (FT, February 2024 start)

ZS Associates - Strategy Insights & Planning Associate Consultant (SA 2024)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: No changes here. Only GTCR (PE) and Insight Partners (VC) have released their apps

SA 2024: A few new, smaller funds opened up apps such as Castle Park Investments and Capitala Group

Newly released apps:

Castle Park Investments: REPE shop (Summer 2024)

Capitala Group: Small PE shop (Summer 2024)

GTCR: Large, well-known PE (Summer 2025)

Insight Partners: Large VC, tech-focused (Summer 2025)

Premium Database:

The database is updated bi-weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every two weeks with the latest banking and consulting job postings. We released our 20th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the bi-weekly updates, you pay a one-time fee of $50 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>HH Database Preview--Video

Market Update:

FICO Inflation.

What FICO stands for is not important. (Btw a FICO score is essentially a measure of the creditworthiness of an individual). FICO of 850 (max score) = AAA bond (max rating)

Let’s list some facts:

FICO score of average consumer in 2007: 689

FICO score of average mortgage borrower in 2007: 717

FICO score of average consumer in 2023: 716

FICO score of average mortgage borrower in 2023: 743

Notice the coincidence? The FICO score of the average consumer has risen ~30pts since 2007 which is directly in-line with the change in FICO score of the average mortgage borrower!

What happened to “tightened underwriting guidelines?” Did the average person really become 30pts better at paying off their credit cards since 2007?

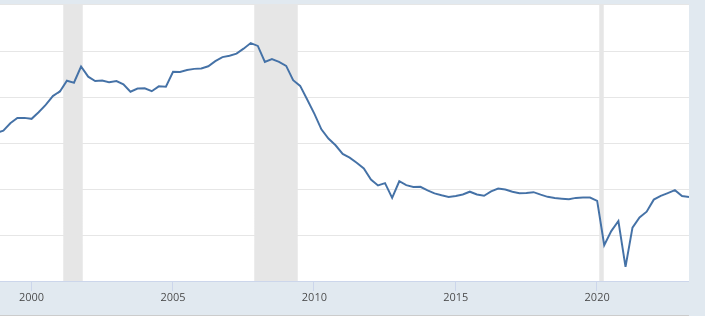

Well, data from the Federal Reserve does show that consumers are foregoing a smaller percentage of their monthly income to debt payments. Check the graph below.

I didn’t want to clutter the image, so I left out the important parts. But even an idiot can tell “graph lower now.”

This shows the consumer debt payment as a % of monthly income (currently 9.6% vs. 12.9% in 2007).

So, what’s the big picture?

Consumer DTI profiles have improved significantly from 2007

More conservative consumer practices and historically low unemployment over the last 10 years have boosted average FICO scores

Another positive to note is that compared to 2007, consumer debt products (mortgages, auto loans, personal loans, etc) have largely changed from floating to fixed-rate products. In 2021, most consumers locked-in rock-bottom rates and have been borrowing less ‘new money.’ Therefore, as rates rise most monthly debt payments should not increase substantially.

Jury still stands on whether lenders have truly tightened underwriting guidelines or are merely riding the wave of better consumer creditworthiness.

So, despite all the noise comparing today to 2007, the story is really very different. Consumers are more prepared to weather a storm than they were in 2007. However, even the sturdiest ships sink amidst the worst storms.

During an interview, be quick to compare aspects of today’s market to 2007, but leave out the differences!

Learning Point of the Week:

Leverage. Leverage is when an individual or a firm borrows money from a different entity to invest in projects. The name of the game is to generate a return from the project that is greater than the principal of the borrowing.

Leverage makes the world go around. Everyone loves to borrow money to buy shit. PE firms love it. Mortgage borrowers love it. I love it.

Here is why leverage is so great.

Let’s say I borrow $10 from my buddy and use $2 of my own funds to buy a large pizza from Domino’s (please never be so down bad where your only option is to finance a pizza).

I could probably take that $12 pizza and go to the library and sell each slice for $2. 8 slices for $2/each = $16. Sweet.

I pay my buddy back $10 and throw in an extra $2 as a thanks for borrowing the money. Now, I’m left with $4.

I pay myself back the $2 and pocket the extra $2. Effectively, I made 100% of my investment. My buddy, he made 20% (not too bad either).

That is why leverage is so great. I can turn nothing into something really quick. However, leverage is a double-edged sword. If no one bought my pizza, I’d have lost $2 and be on the hook to repay my buddy $10! Fuck that!

Going Forward:

We will be slowly changing our name from “HoosHelpers” to “the Pulse.” Ownership has not changed and our services will remain the same. Do you like the change? Have suggestions for a different name? Let us know!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #21