FT 2026 banking and consulting recruiting is heating up.

Check out our Premium Database for access to applications tracked across 500+ firms, insider interview detail, and hundreds of ours of interview prep material.

Pay us $65 via debit / credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. This provides you with a full year of access and the database will be sent to you every Sunday.

Additional details of the database can be found below. Gain an edge over everyone else.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: No new updates here—won’t see anything here until September

SA 2026: No updates here. 105 firms are recruiting for SA 2026

FT 2026: BlackArch Partners, GLC Advisors, and Marriot & Co. opened their apps. 8 firms are actively recruiting for FT 2026

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

None

New FT 2026 Applications:

BlackArch Partners: MM boutique in Charlotte, NC (FT 2026)

GLC Advisors: Boutique restructuring shop (FT 2026)

Marriot & Co: Richmond-based boutique (FT 2026)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

LEK released its FT Associate application.

SA 2026 released apps:

None

FT 2026 released apps:

LEK - Associate Consultant

Buyside:

Where We’re At:

SA 2026: GIC opened their app this week. Currently 108 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

GIC: Singaporean SWF (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 109th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

Real Estate vs. Private Equity Investing

Everyone seems to want to go into private equity, making real estate the red-headed stepchild. Unless you’re investing in luxury hotels, real estate is much less sexy. After all, buying an apartment building in Cleveland is definitely less interesting than investing in an AI company.

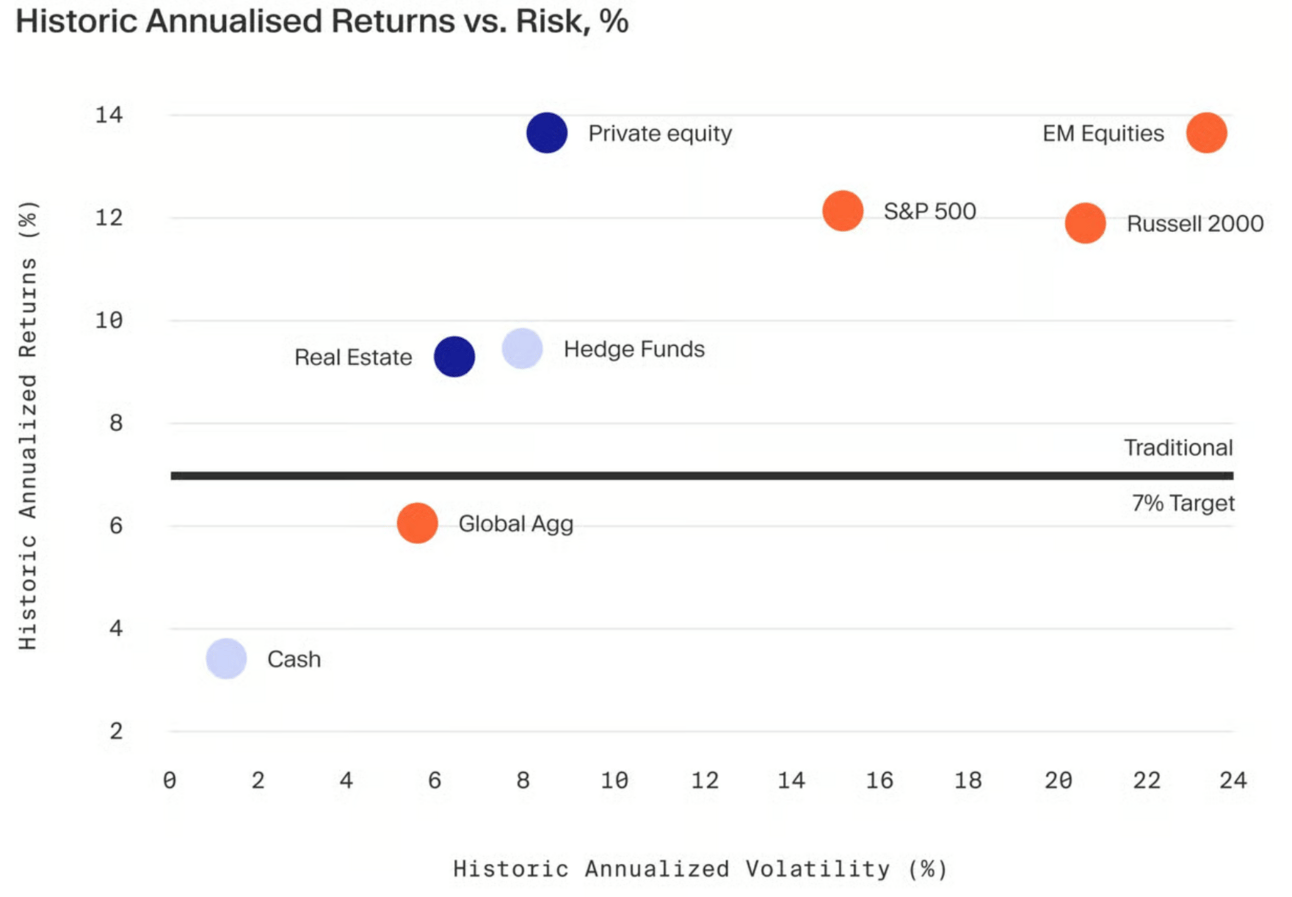

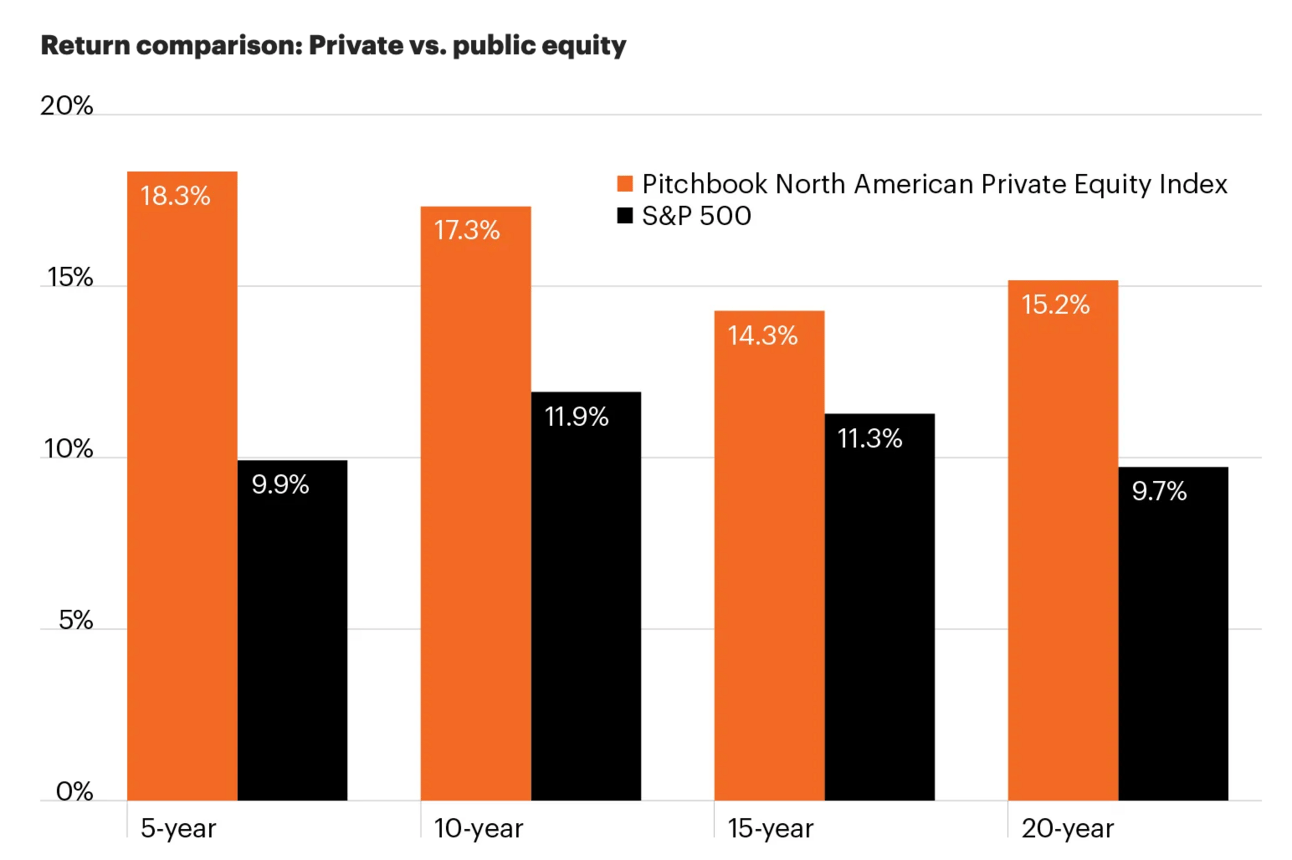

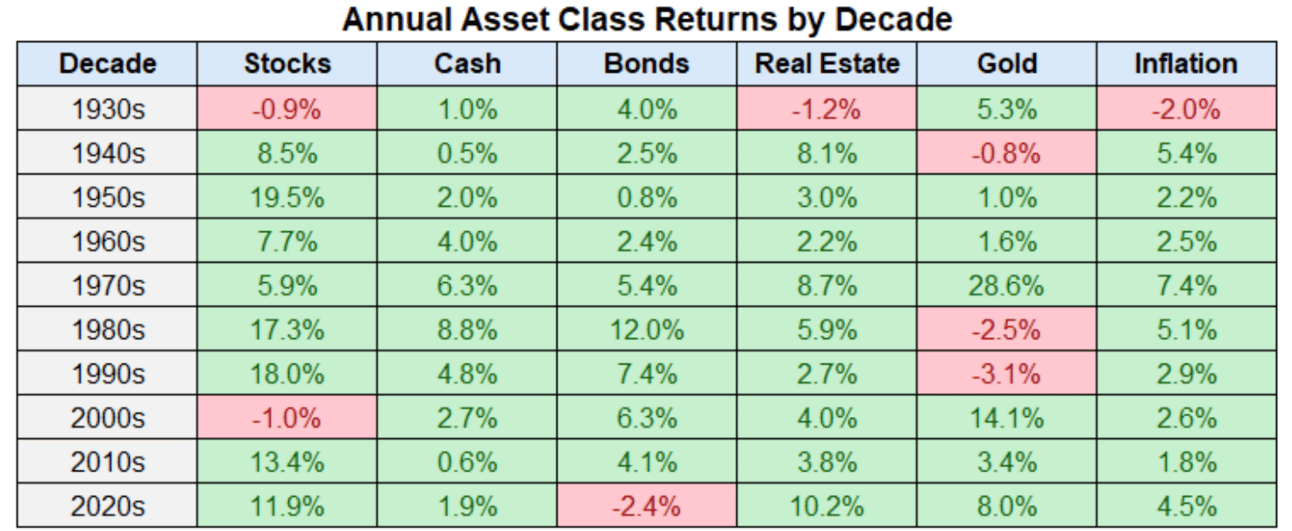

But how do the two industries compare, and what are the returns like? As you might expect, PE has historically higher returns, mainly due to its growth-oriented strategies and higher risk-reward profile.

Source: Moonfare

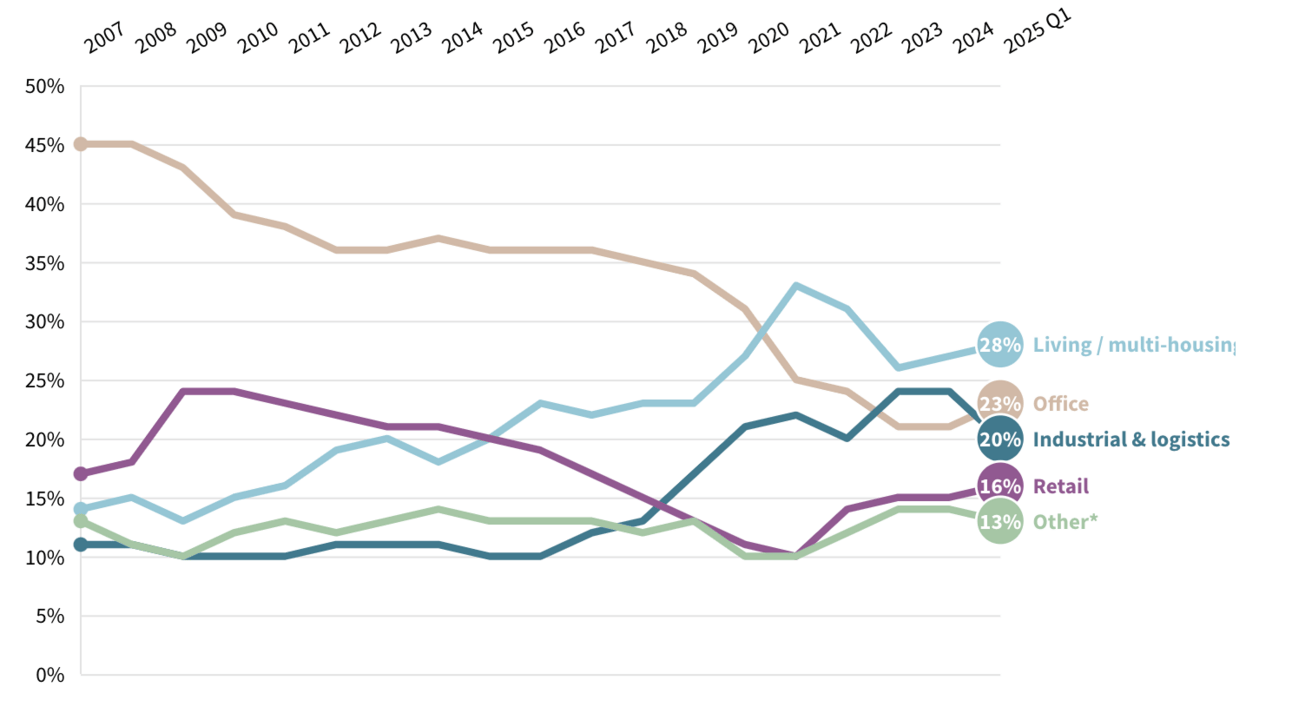

Real estate investments, especially in core properties like residential or commercial buildings, typically generate stable income through rent and long-term appreciation. Investors can benefit from tangible assets, tax advantages, and a hedge against inflation. But there is rarely crazy upside.

Source: JLL (Real estate investment by sector)

In contrast, when KKR buys a company and hires McKinsey to streamline operations (“aka fire 20% of the workforce and integrate some AI solutions”), there is a lot of engineering they can do to improve efficiencies and grow the business.

Private equity also benefits from a “scale begets scale” effect in that larger firms attract better deals and talent, which reinforces performance. Like real estate, PE is also illiquid and carries higher risk, meaning that investors are compensated with higher returns because they are locking up capital for longer periods.

Real estate liquidity is pretty variable. Closed-end PE real estate funds have the same constraints as more traditional PE vehicles, with slightly shorter maturities on average.

Real estate investors operate with significant constraints, be it zoning laws, capital constraints, etc. Operational synergies are not really the name of the game here since scaling a real estate portfolio requires substantial capex and management infrastructure, unlike private equity, which has many more tools available to create value.

If you want to make large changes like converting an office to an apartment, you’ll need to spend a lot more money on capex to get this done. Additional cash outflows beyond the purchase of the property impair returns. In traditional PE, you can improve a business by divesting a unit, firing people, entering new geographies, etc—these actions can all be significantly less capital intensive than any RE project.

Over the past decade or so, PE has delivered net annual returns in the range of 12–16% for top quartile funds. In contrast, private real estate has typically generated annual returns in the range of 6–10%, depending on leverage and market conditions.

Source: Pitchbook (2024)

Source: New York University

This is not meant to discourage careers in real estate investing, just to point out that real estate typically offers more modest returns and is more capital-intensive (and therefore also very dependent on the macro environment). It definitely has a place in the modern portfolio, but traditional private equity offers more upside because there are so many more levers to pull.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

How to Pitch a Stock

Pitching a stock is a key skill for landing a role at any firm that invests in public markets. Your pitch should be no longer than 120 seconds. A few general guidelines below:

Don’t say anything generic (META, GOOGL, AAPL, NVDA, etc)

-Your interviewer probs knows more about it than you

Pick a name that is easy to understand (1-2 lines of business, ability to last for 10+ more years). Description of the business model is the first 10-20 seconds—how do they make money? What do they spend money on? Why is the industry ripe for investment?

-Consumer and tech companies are usually pretty easy to digest from a 10-K

State where it trades relative to the peers and the market (S&P 500 or NASDAQ). 5 seconds

-If your company has a P/E ratio (The Pulse --#22) greater than peers or the market, it’ll be really easy for the interviewer to call you out

Understand and mention some financials. How much revenue? What are the margins (gross, EBITDA, EBIT)? How much FCF? How much leverage? Asset-heavy or asset-lite? 10-20 seconds

-Yes, you can totally be asked nitpicky, numbers questions. It sucks, but you have to know some round numbers here

Describe why these factors make it a good long or short. Is it a capital appreciation play (more of a growth stock)? Or is this a cash compounder (more of a value / dividend play)? 10-20 seconds

Don’t be afraid to lie here. State round numbers. “Revenue is about $2bn growing at 10% YoY” vs. actual revenue of $1.8bn growing at 7% YoY. This is the devil’s advice—make your life easy here.

Odds are the interviewer doesn’t know / care to find out about every finite detail of the shit you’re pitching.

Going Forward:

Happy Hour July 10th in NYC—location TBD

If you haven’t already, let us know if you’ll be able to swing our happy hour on July 10th at 7pm! There will be a fat bar tab.

Are you coming to Happy Hour?

Congrats! Please share our newsletter with your younger peers looking to recruit for banking / consulting / the buyside.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #109

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions