Have all of your recruiting prep at your fingertips, in one place, along with apps for over 200+ banks/consulting/buyside firms tracked for you in our Premium Database.

Follow the instructions below to gain access or email us: [email protected]

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Rumor has it that big banks will be kicking off applications as early as January 1st! This means that most interviews will likely take place in February/March. As always, we recommend applying as early and often as possible to ensure your resume is at the top of the pile. Right now, RBC is still the only bank that opened SA 2025 apps

SA 2024: This process is mostly complete, but there are still apps being opened for ad-hoc hiring. If you’re still recruiting for SA 2024, then you need to capitalize on every opportunity presented to you

FT 2024: This process is 70% complete. Firms will continue to hire on an ‘as-needed’ basis. You should definitely be interview-ready and at the very minimum, all of your apps should be submitted

Gameplan:

SA 2025: Does your resume look like shit? Well, by now it shouldn’t. Format is the most important aspect of your resume for SA 2025 apps (yes, more important than your previous experience). Meet with us or meet with your friends to discuss best practices for undergraduate banking resumes. If your resume looks like shit, firms will throw it in the trash before wasting time reading it

SA 2024: You should be open to working at smaller, “less prestigious” banks to at least lock something up for the summer. Sure, it can be a hit to your ego, but there are some great experiences to be had at a smaller boutique/regional bank

FT 2024: You need to have a good feel for what groups/roles you really want to work in. Product group? Coverage group? Tech? Industrial? Have a good reason to explain why you’re a great fit for X role at X bank in X group

Interview Questions of the Week:

-Behavioral: Why do you want to work at X bank? Why investment banking?

-Technical: What are the most common valuation methods? What are some less common methods?

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Want access to an updated database of 200+ banks/consulting/buyside firms? Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Quiet so far. Only one firm has released an application

SA 2024: Recruiting for summer 2024 is pretty much over. There will be some smaller firms posting applications here and there, but the larger, more prestigious firms have filled almost all of their roles

FT 2024: There’s a bit less structure to FT recruiting so you might see some firms posting applications over the next few weeks if they decide they need an extra Associate Consultant. However, the larger, more well known firms are done releasing apps and are at the final stages of hiring for 2024

Gameplan:

SA 2025: Have someone you trust look at your resume to make sure it’s perfect (typos are the kiss of death). Also, make sure you are quantifying your achievements. Lastly, spend some time networking and researching firms of interest

SA 2024: If you’re still recruiting for SA 2024 roles make sure you’re networking so that you can get a referral to the firm of interest. Do lots of case prep so you can crush them in the interview. There will be fewer opportunities so capitalize on any upcoming interviews by preparing thoroughly.

FT 2024: Prepare for upcoming interviews by doing case prep with a buddy. If you’re still trying to land interviews, speak to professionals at the firm of interest to try and get a referral (it makes a big difference)

Interview Question of the Week:

Describe the last time you made a mistake or caved under pressure. What did you do to recover?

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Buyside:

Where We’re At:

SA 2025: From our experience some of the more prestigious funds (Sixth Street, Bain Capital, KKR, etc) will release apps early around February/March. It can be harder to find professionals to network with at these firms, but equally as important as with banking and consulting. Networking with funds is also more useful in our view because most funds do have differentiated strategies vs. banks/consulting firms which tend to offer very similar services

SA 2024: Smaller funds are still recruiting with tight deadlines (~1 month). Definitely want to pick a fund where you can see yourself building an early career because it can be more difficult to jump around especially if you’re slotted for a very niche role

Gameplan:

SA 2025: Speak with professors or speak with us to get a better gauge for the different types of investing (PE/Hedge/Credit/VC). Entering the process blind will not be successful. You can get away with knowing virtually nothing for banking apps, but fund’s pay close attention to a candidate’s interest

SA 2024: Have a good story explaining why you’re looking for opportunities in investing vs. banking/consulting to start your career. Many investors view training at a bank or consulting firm as essential for a promising career in investing as these institutions teach the fundamentals of working in finance

Interview Question of the Week:

-VC Question: What are a few startups you think compliment our investment thesis and portfolio? Why should we look to invest in them?

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Premium Database:

The database is updated bi-weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every two weeks with the latest banking and consulting job postings. We released our 20th update last week.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the bi-weekly updates, you pay a one-time fee of $50 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>HH Database Preview--Video

Market Update:

The U.S. Dollar is mad strong right now.

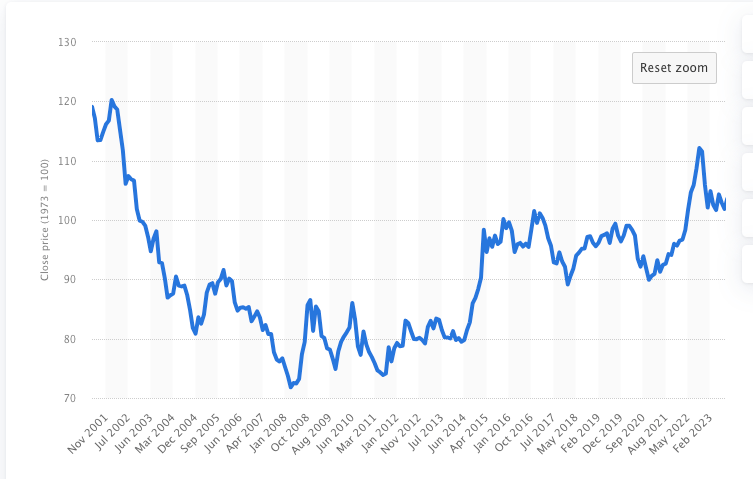

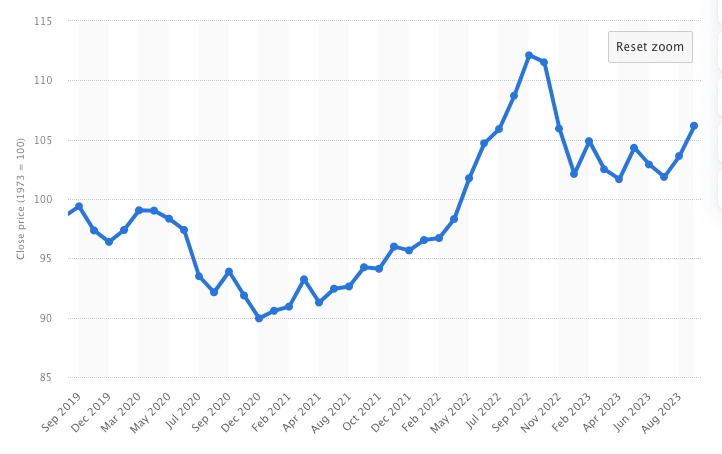

Take a look at the $USD index below.

Once again, it doesn’t take a genius to see that ‘graph up = valuable $USD.’ Thanks to Statista for the image.

So, why does anyone care if the U.S. dollar has become more valuable? Isn’t that a good thing?

Let’s take a step back. As many of you know, the U.S. dollar is the reserve currency of the world. Other countries love to use the U.S. dollar in cross-border transactions to make processes easier and anchor a relative value for whatever they’re transacting upon.

Other countries also love to use the U.S. dollar in times of distress where their currencies may be extremely volatile. Take a look at Argentina. Their rate of inflation is ungodly which makes the Argentine peso useless. So, Argentinians have been looking to the $USD as a safe haven to convert their worthless pesos.

Why has the value of the U.S. dollar risen? Great question. Supply and demand is the answer (as it tends to be for most questions related to value). Let’s walk through a timeline to figure it all out. Starting with Covid.

Dollar falls and rises with Covid timeline

March 2020: FED cuts rates to all-time lows and prints money to purchase U.S. treasuries and stimulate the economy. From the graph above, you can see that the value of the dollar fell

March 2022: FED starts to hike rates and pauses its purchase of U.S. treasuries to combat inflation. The value of the dollar spiked

October 2022: ChatGPT is released to the public and the fight against inflation looks successful. The value of the dollar falls as the stock market begins to rally

August 2023: Geopolitical tensions causes global uncertainty and the fight against inflation looks to be less effective. The value of the dollar rises

So, as the FED paused their purchase of U.S. treasuries, they effectively look reduced $USD supply. However, global demand for the $USD has risen with recent geopolitical instability.

Cons of $USD strength: It is worth pointing out the inverse correlation between $USD price and performance of U.S. equities. There are many drivers behind this inverse relationship, but it is worth noting the fact that a rising $USD hurts exporters because their products become more expensive and therefore less desirable to foreign consumers. Nearly 40% of the revenues of all companies within the S&P 500 are driven by foreign demand, so a reduction in foreign demand will hurt the bottom line of most companies.

Pros of $USD strength: Greater purchasing power for importers and vacationers. Your money is worth more in other countries than it has been before. Go take that vacation now before the FED starts printing money again!

In an interview, you should be able to tie the movement of the $USD to your outlook on the market. Many people don’t bother to learn about this shit, which creates a great opportunity to impress your interviewer.

Learning Point of the Week:

Multiples. A multiple is used for comparing certain metrics of one company (EBITDA, leverage, etc) to metrics of another company (usually a competitor within the same industry). Effectively, multiples are used to assess where a company fits amongst its peers in an industry. Is it a large player? Does it trade high? Does it have substantially more debt?

Examples:

Enterprise Value/EBITDA: Known as an EBITDA multiple. This is a quick way to determine if a company is over- or under- valued compared to its peers (different analysts may arrive at different EBITDA multiples for the same company because EBITDA is not a GAAP defined measurement and can be calculated differently from one analyst to the next). Essentially, you’re measuring how many times more a company is being valued compared to its EBITDA, which is a proxy for cash flow. If you take a group of software companies and the average EBITDA multiple is 6x, but the company you’re valuing has an EBITDA of 10x, then that company might be overvalued

Stock Price/EPS: Known as a PE multiple. The price to earnings ratio is another method used for comparing the relative value of one company to a group of peers (important to note that this multiple can only be applied to publicly traded companies). The PE multiple effectively shows the amount an investor is will to pay for $1 of a company’s earnings. Higher PE multiples generally mean a company is overvalued

Debt/Equity: Known as the leverage ratio. The leverage ratio shows you how much ‘equity cushion’ a company has. A greater leverage ratio generally means a company is riskier because it has more debt to service. Different industries tend to have different average leverage ratios that companies float around. For example, it might be completely normal for an auto manufacturer to have a 4.0x D/E, but super unusual for a software company to have anything greater than 1.0x D/E

There are hundreds of other multiples/ratios used by analysts to compare companies. So, it is important to remember that you usually need to spread a few different multiples to determine where a company truly fits amongst a pool of peers. A more common phrase for multiples analysis is ‘Comparable Companies Analysis.’

Going Forward:

We will be slowly changing our name from “HoosHelpers” to “the Pulse.” Ownership has not changed and our services will remain the same. Do you like the change? Have suggestions for a different name? Let us know!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #22