SA 2026 interview szn is right around the corner! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 or pay with credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” section below for more details.

Last year, 85% of students coached received offers.

No bread? No problem! Check out our referral program to unlock resume reviews, the Premium Database, and coaching sessions—for FREE! (see details in the “Going Forward” section)

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Surprising late-season activity here. Mizuho opened an ER application and FMI opened its SA position. Over 114 banks recruited for the SA 2025 season. We are gearing up for the SA 2026 season! It will kick off as early as October.

FT 2025: Goldman Sachs and Berenson opened up their FT applications this week. There are currently 17 firms actively recruiting for FT 2025. The bigger banks will begin kicking off FT 2025 recruitment processes as they finalize intern return offers. Expect interviews to kick off in late July. See our ‘Learning Point’ section for a timeline update of our coverage. Please reach out if you are looking for coaching!

New SA 2025 Applications:

Mizuho: Equity Research (SA 2025)

FMI Corporation: Boutique bank, offers consulting services too (SA 2025)

New FT 2025 Applications:

Goldman Sachs: Bulge Bracket (FT 2025)

Berenson & Company: Merchant Bank (FT 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting: KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025 - Closed) PWC: Business Processes Intern (SA 2025 - Closed). Curtis & Co: Boutique firm (SA 2025 - Closed) Protiviti: Tech Consulting (SA 2025 - Closed) RSM: Tech, Risk, and Business Improvement Intern (SA 2025 - Closed) Deloitte: Business Technology Solutions Summer Scholar (SA 2025 - Closed) Berkeley Research Group: Associate Consultant Intern (SA 2025) Oliver Wyman: Summer 2025 Intern (SA 2025 - Closed) Bain: Associate Consultant Intern (SA 2025) Cavi Consulting: Consulting Associate Internship (SA 2025) McKinsey: Summer Business Analyst (SA 2025) BCG: Associate Consultant Intern (SA 2025) Redstone Strategy Group: Consulting Intern (SA 2025 - Closed) KPMG: All Practices including management consulting (SA 2025) Alpha FMC: Consulting Intern (SA 2025) DSP Strategy: Consulting Analyst Intern (SA 2025) FT 2025 released apps: LEK: Associate Consultant (FT 2025) Charles River Associates: Associate (FT 2025) New Markets Advisors: Associate Consultant (FT 2025) McKinsey: Business Analyst (FT 2025) Apply ASAP if you’re interested! |

Buyside:

Where We’re At:

SA 2025: Cornerstone Partners opened its SA 2025 apps this week. So far ~104 buyside shops have opened applications

SA 2025 released apps:

Cornerstone Partners: ~$24bn AUM investment manager (SA 2025)

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 59th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com)) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

What’s happening with interest rates?

I know we’ve talked about the Fed and what’s going on with interest rates a lot, but we’re going to provide another brief update because of how important the topic is.

If you’ve been reading “The Pulse” for a while, I’m sure you are well aware of what high interest rates mean for our economy (and your IB/Buyside/Consulting job). In short, when interest rates are high the cost of capital is higher and there is less investment and economic activity. Would you rather buy a new forklift when the interest rate on your loan is 1% or 5%? That 1% interest rate would be very appealing right now.

For that exact reason, economic activity is slower when rates are higher—-however, the Fed needs to keep rates higher to curb lingering inflation.

What do higher rates mean for your IB job? There is less deal flow because the cost of capital is much higher making deal financing (and the growth prospects for businesses being acquired) less appealing. This is important because as the Fed decreases rates, M&A activity will pick up and they will need more of you guys (SA and FT Analysts) to staff on deals! Check out: "The Pulse" --#32 (beehiiv.com) for more detail here.

On Tuesday, Fed Chairman, Jerome Powell addressed the Senate Banking Committee and expressed that the Fed was paying close attention to the slowing job market and that rate cuts would be coming soon. Most economists expect the first rate cut to come in September with another one likely to follow before the end of the year. The latest reports have shown inflation continuing its downward trend and the labor market cooling. Since the Fed has an employment mandate in addition to an inflation mandate, Jerome Powell has stated they feel comfortable cutting rates before inflation reaches that 2% target.

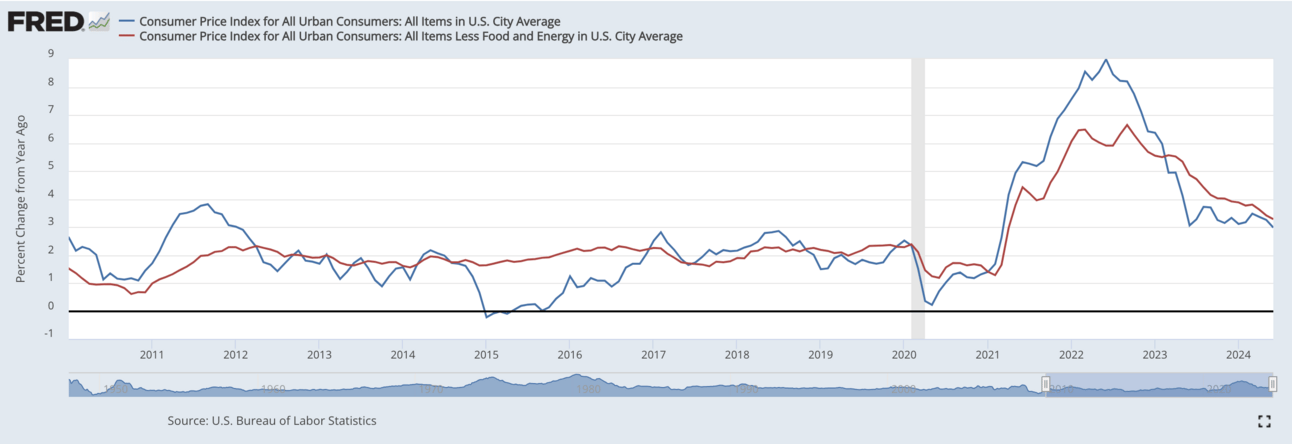

The most recent report of CPI (consumer-price-index) fell in May bringing the year-over-year inflation figure to 3%, a significant improvement from the peak figure of 9.1%!

Consumer Price Index (Source: FRED)

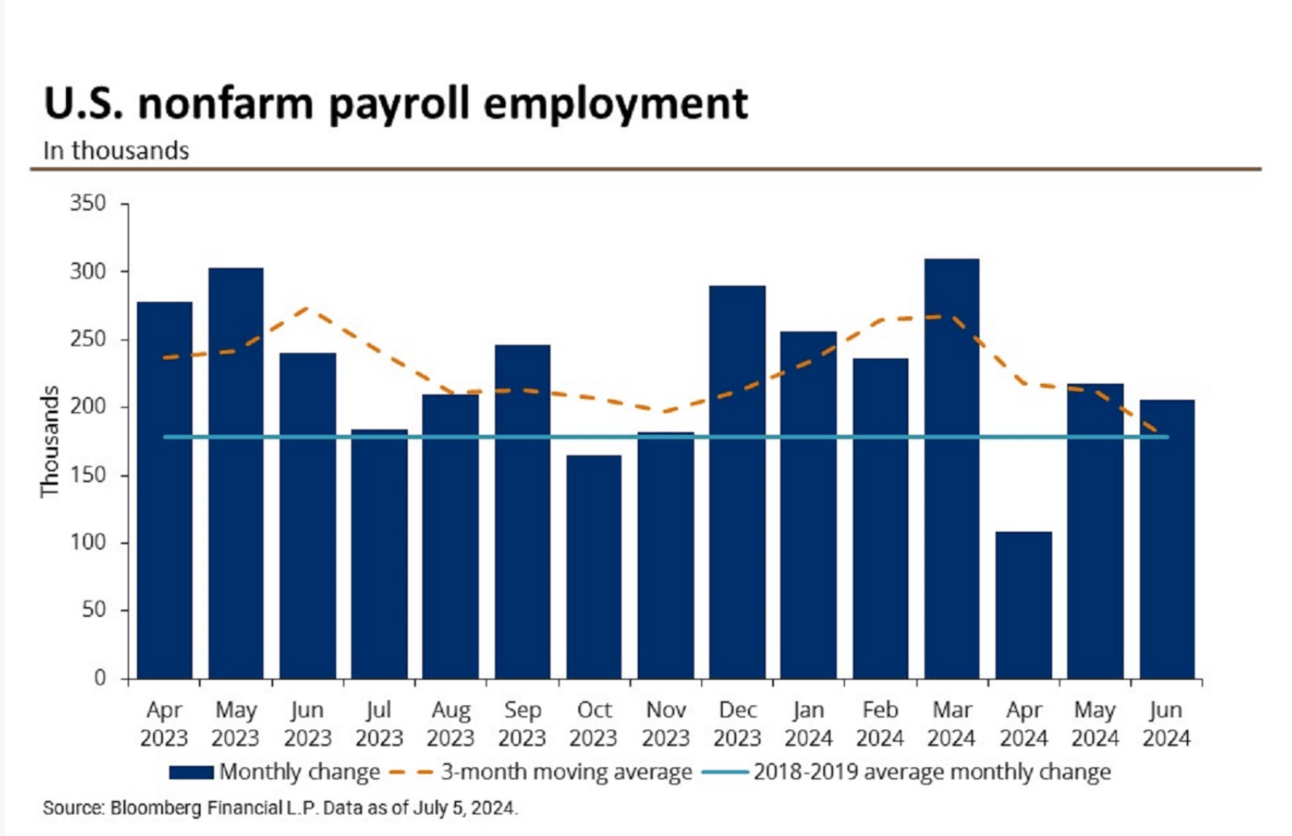

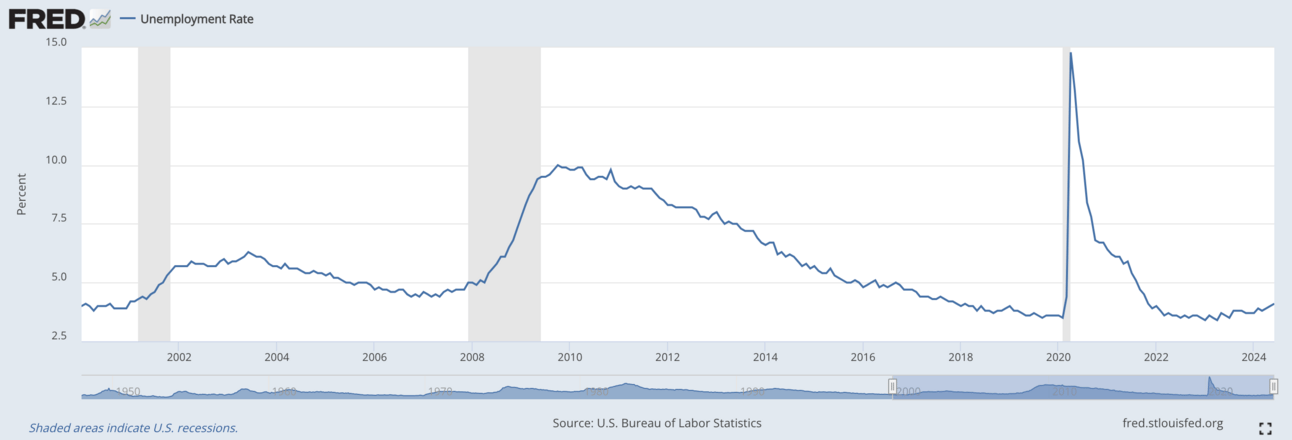

The most important aspect of Jerome Powell’s speech on Tuesday was the language signaling a slight shift in focus from inflation to employment. As job growth has slowed and the unemployment rate rose to 4.1% in June, the Fed will need to proceed cautiously to have a successful “soft landing”.

Source: Bloomberg

Unemployment Rate from 2000-2024 (Source: FRED)

On the graphs above, we can see unemployment ticking up and inflation ticking down. These are all good signs for the economy but it is a very delicate balance. Interest rate cuts in a non-recessionary environment would be very good for economic growth and M&A deal flow.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Timelines (SA 2026, SA 2025, FT 2025 Banking / Consulting / Buyside)

For lack of bullshit, we compiled timelines of the different processes. If someone tells you something different, they’re capping.

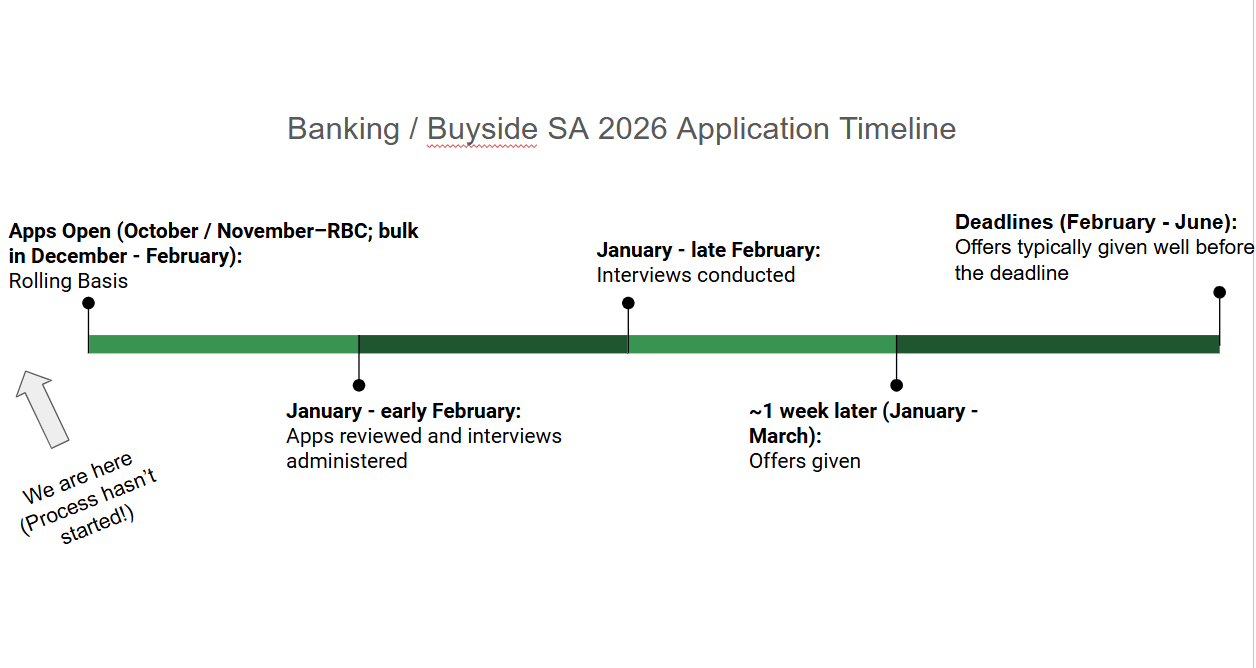

SA 2026 Banking / Buyside:

Process Is Right Around the Corner!

This process is yet to begin, but with 95% certainty RBC will open its SA 2026 app as early as October / November of 2024!

Here is the gameplan:

Begin networking in August / September (~3-5 LinkedIn messages or emails via RocketReach daily) should lead to ~30% conversion to conversations—check out our Premium Database for a list of contacts to network with!

Craft your resume—check out the Breaking Into Wall Street resume template. We are happy to review as well!

Apply as soon as apps open! Don’t wait a second! If you’re not first, you’re last in this process

Develop your interview prep. Study behaviorals + technicals daily (30mins in the morning, another 30 at night). We can help with coaching here! 85% of those coached received offers

Nail your interviews, get the fucking offer!

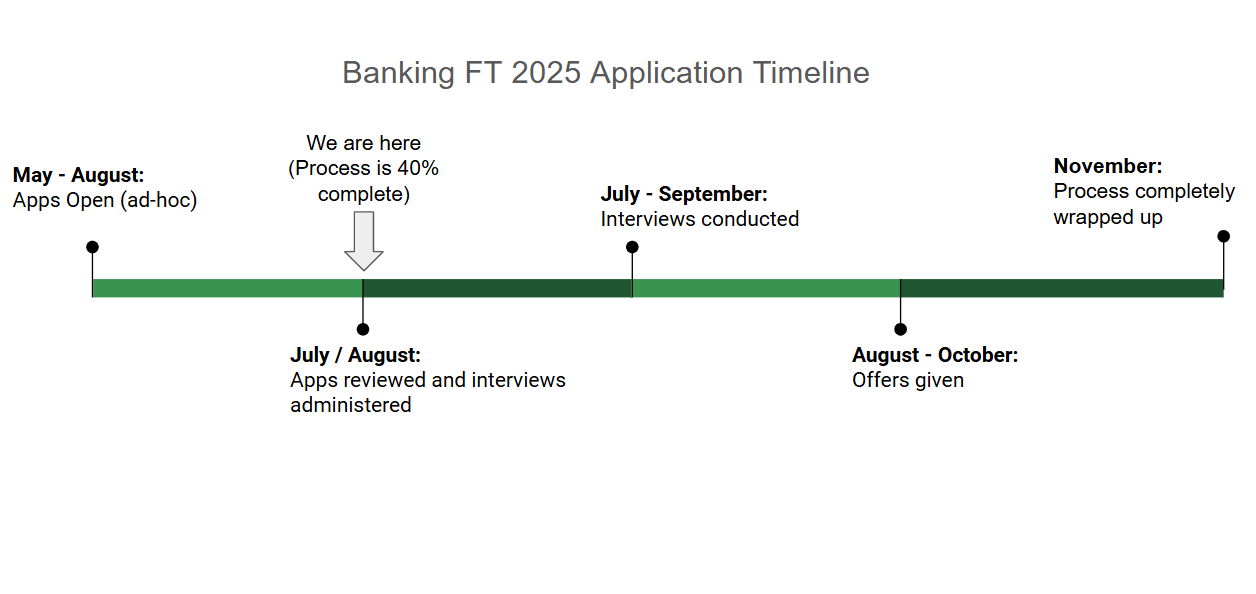

FT 2025 Banking:

Process is 40% Complete!

By now, your networking should be wrapping up with intense focus on prepping behaviorals + technicals. Firms are finalizing headcount expectations and will be interviewing in the next 2-3 weeks with most offers distributed by mid-late September.

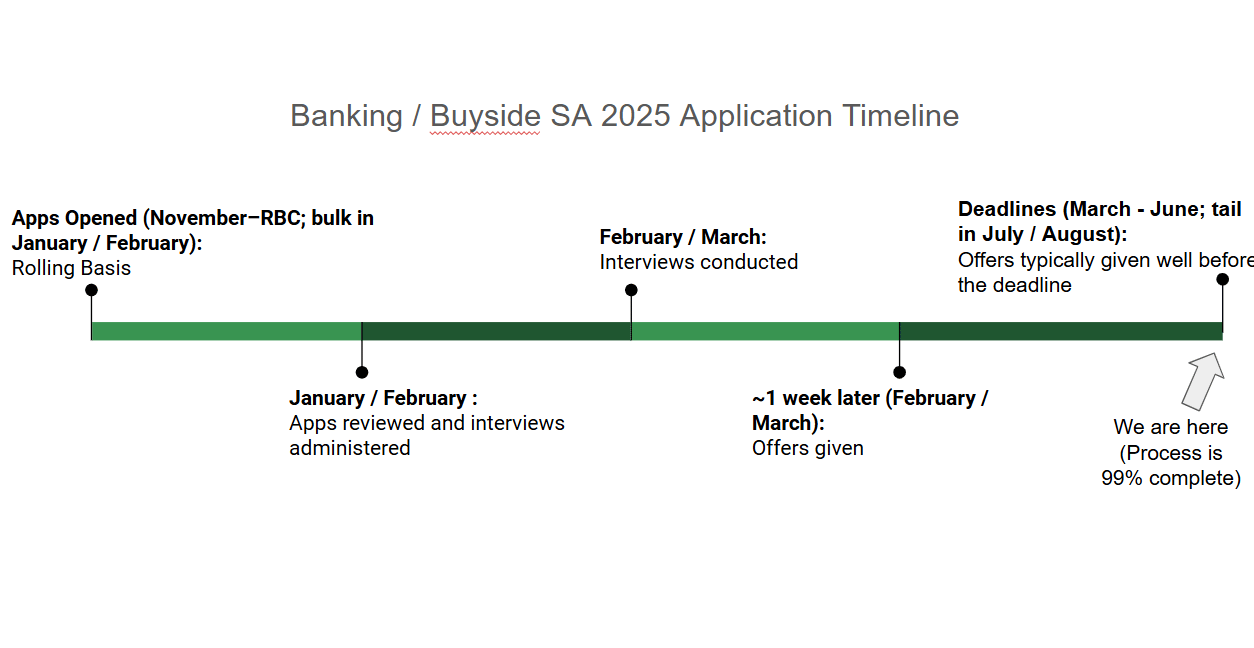

SA 2025 Banking / Buyside:

Process is Largely Over

We are still tracking this process, but it is mostly wrapped up. If you’re still shooting here, please reference the ‘Learning Point’ section of "The Pulse" --#58 / Longest Yield Curve Inversion Ever (beehiiv.com) for guidance.

SA 2025 Consulting:

We are in the middle of this process with most of the “elite” firms having released applications. Smaller firms will continue to release apps until November, but MBB and Big 4 firms will have their processes wrapped up by September/October.

Going Forward:

Building a great PE tool (targeting summer 2025 release). Please let us know what you want to see!

Coaching Details:

1 hour session = $50. (Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

30-minute session = $30. Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #59