SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 or pay with credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” section below for more details.

Last year, 85% of students coached received offers.

No bread? No problem! Check out our referral program to unlock resume reviews, the Premium Database, and coaching sessions—for FREE! (see details in the “Going Forward” section)

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Grace Matthews and Credit Agricole opened their applications alongside the reopening of Aeris Partners’ app. Over 113 banks opened applications for SA 2025 recruiting

FT 2025: Grace Matthews opened its application this week. There are currently 15 firms actively recruiting for FT 2025. Please reach out if you are looking for coaching!

New SA 2025 Applications:

Grace Matthews: Boutique, chemicals-focus (SA 2025)

Credit Agricole: Large French bank, energy group (SA 2025)

Aeris Partners: Small boutique, app re-opened (SA 2025)

New FT 2025 Applications:

Grace Matthews: Boutique, chemicals-focus (FT 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: 16 SA 2025 applications have been released so far. We're still early in the process, but make sure to apply early and often!

FT 2025: 3 applications are open across LEK, Charles River Associates, and New Markets Advisors. We will continue tracking these as we anticipate volume to pick up beginning in August. From now through September will be prime time for the FT recruiting season.

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025 - Closed)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025 - Closed)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025 - Closed)

Berkeley Research Group: Associate Consultant Intern (SA 2025)

Oliver Wyman: Summer 2025 Intern (SA 2025 - Closed)

Bain: Associate Consultant Intern (SA 2025)

Cavi Consulting: Consulting Associate Internship (SA 2025)

McKinsey: Summer Business Analyst (SA 2025)

BCG: Associate Consultant Intern (SA 2025)

Redstone Strategy Group: Consulting Intern (SA 2025 - Closed)

KPMG: All Practices including management consulting (SA 2025)

Alpha FMC: Consulting Intern (SA 2025)

DSP Strategy: Consulting Analyst Intern (SA 2025)

FT 2025 released apps:

LEK: Associate Consultant (FT 2025)

Charles River Associates: Associate (FT 2025)

New Markets Advisors: Associate Consultant (FT 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: No new updates here. This process is 90% complete

SA 2025 released apps:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 58th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com)) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Longest Yield Curve Inversion Ever

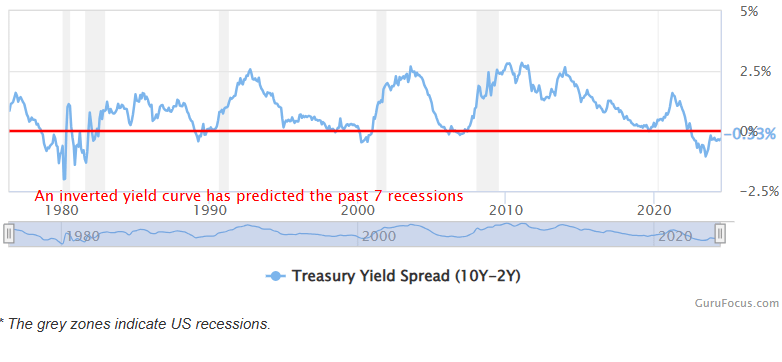

The yield curve typically refers to the difference between the yields of the 10-yr and 2-yr Treasury bonds. Typically, an investor expects a 10-yr Treasury to throw off more yield (%) than a 2-year because you are risking the return of principal repayment over a longer horizon.

Would you want your friend to pay you back tomorrow or 10 years from now? Same concept applies to bonds.

However, the yield curve is inverted. You can currently clip a greater return on a 2-yr T-Bond than a 10yr.

Historical 10yr / 2yr Inversions and Recessions (Source: GuruFocus)

As you can see, yield curve inversion does happen from time to time and usually a recession is soon to follow. As of writing, the yield curve has been inverted since July 2022, the longest inversion in history. The inversion is always quite ‘deep’ which may be significant for predicting the severity of a recession.

Does that mean a recession is soon to follow? History tells us yes.

Yet, if you look deeper into the timing of that graph shown above, you can see that the timing of the recession post yield curve inversion isn’t consistent. A recession can arrive during inversion or up to nearly 5 years post-inversion!

So, is it a great indicator of recession? It’s good, but not perfect. And there isn’t a perfect indicator of recession because then everyone would be too prepared for the recession to ever happen.

You see, a recession has been anticipated since 2021 when markets reached previous ATHs.

Now, markets have reached new peaks, and a true recession is yet to occur.

In 2022, companies reduced headcount, tightened their investment buckets, and properly managed their debts to avoid poor performance. This overpreparation for the ‘immediate recession’ has helped mitigate any drastic negative changes to the labor market. Strong labor market = money to spend = continued economic performance.

Extra money floating around from Covid stimulus also helps maintain spending and investment.

Will the recession ever happen? It is hard to tell, but right now the 2yr / 10yr inversion seems to be the black sheep undermining the booming success seen across financial markets.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

No 2025 internship, what now?

If you didn’t lock in a SA 2025 banking or buyside internship, you’re kinda cooked at this point.

There are too many optimistic stories shared about this ultra-competitive process. The reality is, there a million things that can lead to anyone not getting the offer.

So, what can you do?

Continue networking

Gotta keep up the momentum here because you never know when you’ll finally make that one key connection which can lead to a job today or even 10 years from now.

Work in a different, but related industry

If you have your mind set on IB or PE, it isn’t the end of the world to not have a SA 2025 internship in banking or private equity. However, you do need to build some type of transactional experience. Look for strategy roles, asset management roles, entrepreneurial roles, etc. You need something where you can mirror transactional discussion when re-entering the full-time recruiting pool.

Try to find your true passion

We are incentivized to encourage students to head into IB, consulting or the buyside. However, the churn in these industries is immense. The hours are brutal, the work can be disenchanting at times, and the pay doesn’t compensate the loss of important life experiences (traveling, relationships, hobbies, etc). So, skip the bullshit. Take a summer to reflect on what you really like and want to do with your life—doesn’t have to be finance or consulting to be successful.

If you didn’t lock up that SA 2025 offer, we are sorry and it’s a bummer. But when you’re on your death bed, we really hope that the biggest regret in your life wasn’t that you were unable to work 80-100 hours/week over a summer at the prime age of 21.

Perspective and patience.

Going Forward:

Building a great PE tool (targeting summer 2025 release). Please let us know what you want to see!

Coaching Details:

1 hour session = $50. (Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

30-minute session = $30. Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #58