SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” section below for more details.

Last year, 85% of students coached received offers.

The Wall Street Rollup:

Introducing the Wall Street Rollup (The Wall Street Rollup (beehiiv.com))

WSR is a 2x/week, finance, markets, and investing newsletter that you can digest in a few minutes.

The Wall Street Rollup was formed to deliver a high-quality aggregator of Earnings, Transactions, and Headline updates (I personally love the transactional content).

This is the Finance Newsletter that Students need to keep up to date with the industry.

Join the Free Newsletter read by 15,000 professionals from Investment Banks, Asset Managers, and more.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Centerstone Capital and Clearsight Advisors opened applications this week. So far ~96 banks have opened applications. Please reach out if you’re looking for mock interviews or any coaching!

Newly Released Applications:

Centerstone Capital: Little boutique (SA 2025)

Clearsight Advisors: D.C.-based boutique (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Ten SA 2025 applications have been released so far along with a few sophomore programs. Oliver Wyman released their SA 2025 intern role two weeks ago, Bain released their 2025 intern position last week, and Cavi Consulting released its SA 2025 intern position this week.

We are still early in this process. MBB typically have two deadlines for SA roles. However, they read applications on a rolling basis so it is best to apply early!

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025 - Closed)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025)

Bain: Pre-consulting Women's Leadership Summit (Spring 2024 - Closed)

Cornerstone Research: Sophomore Summit (Spring 2024)

Berkeley Research Group: Associate Consultant Intern (SA 2025)

Oliver Wyman: Summer 2025 Intern (SA 2025)

Bain: Associate Consultant Intern (SA 2025)

Cavi Consulting: Consulting Associate Internship (SA 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Capula Investment Management, Abrams Bison Investments, and Constitution Capital Partners all opened SA 2025 apps this week. So far ~81 buyside shops have opened applications

Released apps:

Capula Investment Management: Hedge fund (SA 2025)

Abrams Bison Investments: Hedge fund (SA 2025)

Constitution Capital Partners: Boutique PE (SA 2025)

Capital Property Partners: RE brokerage (SA 2025)

Garden City: PE business development (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 47th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Latest IPO Performance

In "The Pulse" --#31 (beehiiv.com), we discussed share repurchases vs. dividends vs. IPOs to share the dynamics of the timing and rationale of these corporate events.

We explained that companies tend to IPO when markets are ripping because they can usually sell their stock at lofty valuations to attract a greater sum of capital. After all, the primary goal of an IPO is to raise as much non-interest bearing capital as possible, at the least possible level of dilution.

However, we did not touch upon post-IPO performance.

First, let’s review the performance of some large recent IPOs:

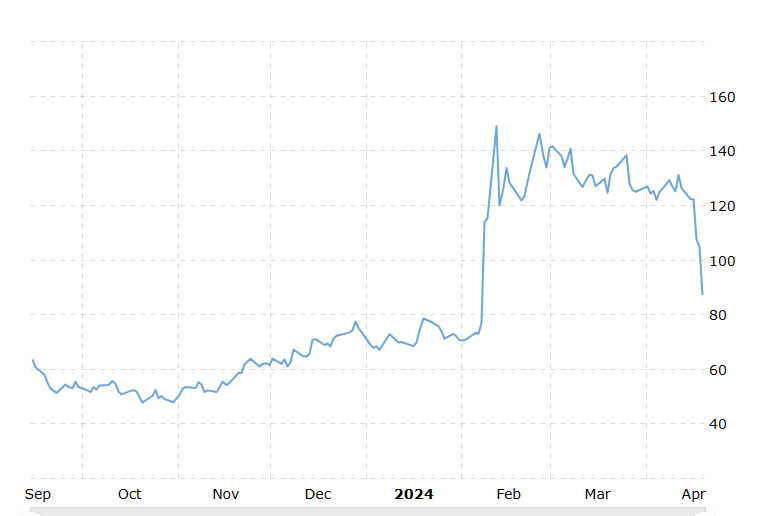

Arm Holdings (NASDAQ: ARM):

+40% since IPO in September 2023

In September of 2023, Arm IPO’d and raised $4.9bn at a ~$54.5bn valuation. Arm is a semiconductor designer. Semiconductor stocks such as Nvidia and AMD have ripped this year on behalf of AI-induced enthusiasm.

So, Arm has done pretty well on behalf of the AI craze. Yet, performance has certainly been volatile since the IPO. A forgotten fact about Arm is that the Company isn’t actually a newly public offering. In fact, Arm IPO’d on the London Stock Exchange way back in 1998, was taken private by Softbank in 2016, and then IPO’d on the NASDAQ in September of 2023. Investors have been broadly familiar of this business and its operations for the past 25 years!

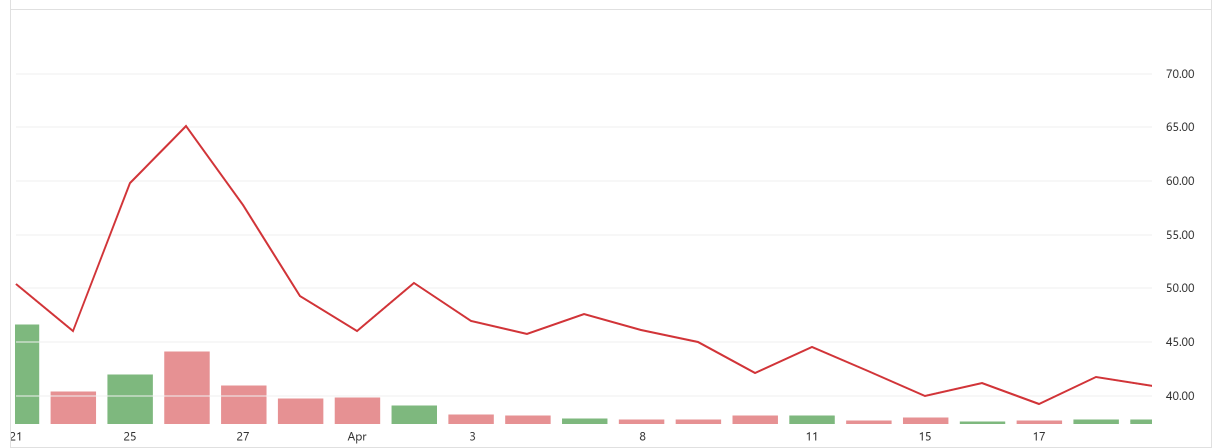

Reddit (NYSE: RDDT):

-13% since IPO in March 2024

I’m sure many of you are familiar with Reddit. It is a primarily anonymous online community for nerds, gamblers, comedians, and niche enthusiasts. Very few people publicly announce that they use Reddit, however, I’ll bet a large majority of you have hopped on the site at least once or twice for any number of reasons (some reasons more wholesome than others).

Reddit actually IPO’d at a valuation roughly 33% lower than their previous private capital raise in 2021. They raise $748mm on a $6.5bn valuation. People waited years for these guys to IPO just to see that they’ve never been profitable.

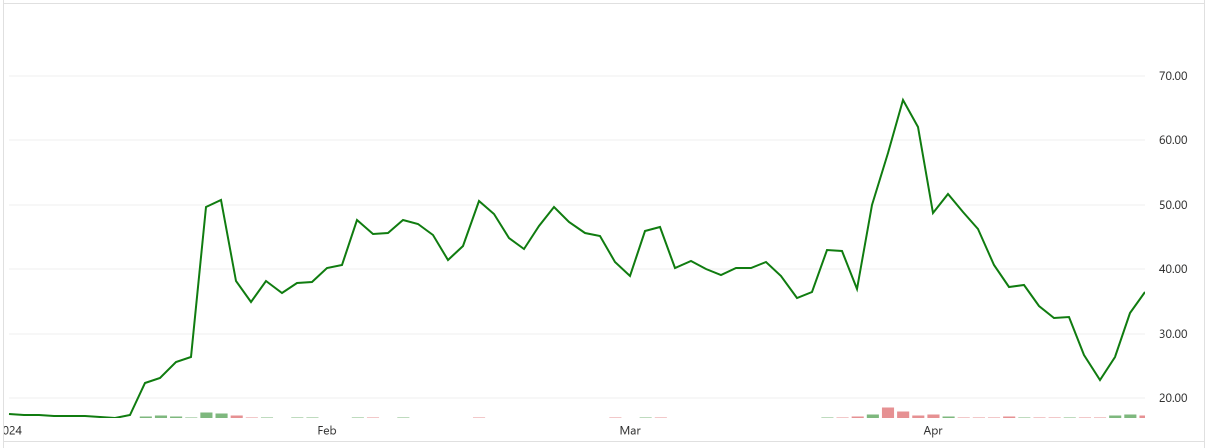

Truth Social (NASDAQ: DJT):

-50% since IPO in March 2024

Donald Trump’s social media platform, Truth Social, went public via a SPAC (HH #10 (beehiiv.com) on March 26th, 2024. At the time, it traded around $70 and has since dropped to ~$35.

The platform only has 5mm users vs. Meta’s 3bn users (roughly 1 of every 2 people in the world has a Facebook account; this concentration is much higher across developed countries such as the US). Truth Social is also unprofitable.

So why the fuck did I show all of these graphs?

IPO investing a losing game for the short-term investor. Prices tend to pop post-IPO as markets remain frothy. However, after roughly 1-2 quarters of earnings digestion, investors figure out all of the shitty elements of the business and look to re-price the stock to a more reasonable valuation.

There are many different ways to IPO. A Company can migrate from a different stock exchange (Arm), be taken private and re-IPO (also Arm), go public via SPAC (DJT), or raise endless rounds of venture capital funding to eventually go public (RDDT).

Every Company IPOs at a different stage. Arm has been around for decades, Reddit has been around for about a decade, and Truth Social was launched about a year ago.

Understanding the nature of IPOs is critical for a job in banking, private equity, or consulting. An IPO is a large milestone for any company and investing in IPOs certainly requires a long horizon + a great deal of belief in the Company’s mission.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

‼️ DUMB Brags in Banking ‼️

LinkedIn saw it first!

1. Working Late (like past midnight) 🌙

-Who cares? You’re paid a salary and your bonus is capped at roughly 100% as a junior (you’re not bringing in any business). And yet, people love to say “oh god I was getting destroyed, like 100+ hours this week”

2. Having a shitty manager 👔

-Little more niche, but some people love telling others about how much their boss sucks?? Not sure why this is “flexed” but you’ll def see it in the industry

3. Client calls 📞

-As a junior, you’re taking notes camera off. That’s it. Maybe you’ll ask a question or two as you get older. Enough said here

4. Late night meals + Uber 🍜

-You shouldn’t be proud about getting compensated with roughly $50 of food and Uber total for working until midnight or later. Once again, who really cares?

5. Deck Length. 🍆

-It’s not about the size of the deck, it’s about the content lmao. A 100 page deck won’t be read, a 5 page deck will.

“I spent all night on this 100 pager. It was brutal.”

Heard too many times.

Want to receive a resume review, Premium Database, or coaching session but don’t want to shell out any bread? Check out our referral program below to unlock free access to our services!

-3 referrals = resume review

-5 referrals = Premium Database

-10 referrals = coaching session

Going Forward:

Want to make some bread selling the database or coaching other students? Shoot us an email and we would love to work with you.

Last year, we paid $ thousands to our members who helped sell the database.

Coaching Details:

1 hour session = $50. Venmo @ThePulsePrep

30-minute session = $30. Venmo @ThePulsePrep

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #47