SA 2025 recruiting szn has started with interviews right around the corner! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>HH Database Preview--Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: No new postings this week. A total of 11 firms have released SA 2025 apps with Deutsche, Guggenheim, and Wells Fargo all CLOSING within a week. Likely 80-90% of all BBs and EBs will open apps before the end of February

FT 2024: PWP released a new app. Otherwise, ~10-15 more firms closed applications. With this, FT 2024 recruiting is over. Ad-hoc roles will open, but we will look to discontinue our tracking within the next month

Applications Closing Soon:

Guggenheim: Closes January 7th, strong boutique (SA 2025)

Deutsche: BB, apps closing January 4th (SA 2025)

Wells Fargo: Closest non-BB, apps close January 7th (SA 2025)

Newly Released Applications:

Perella Weinberg: Elite boutique looking for a restructuring analyst (FT 2024)

See below to gain access to our premium database, updated bi-weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Only one firm has released an application, and others won't be released until March/April

FT 2024: FT hiring is over aside from any very small firms trying to fill an associate consultant position

SA 2025 Released Apps:

Curtis & Co: Boutique firm (SA 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: No new releases. Audax, Apollo, and Riverside are all closing within the next two weeks. No pressure here, this is only a small population of funds recruiting for SA 2025

Released apps:

Apollo: Mega-fund. Released Real Estate Credit role. Closing TOMORROW (SA 2025)

Audax: Large firm closing January 4th (SA 2025)

Riverside: MM PE closing January 16th (Summer 2025)

Premium Database:

The database is updated bi-weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Historic tracker of when apps were released last year for each firm

Information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every two weeks with the latest banking and consulting job postings. We released our 25th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the bi-weekly updates, you pay a one-time fee of $50 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>HH Database Preview--Video

Market Update:

Trends of Share Repurchases vs. Dividends vs. IPOs.

For this week’s market update, please reference the “Learning Point of the Week” section below to get up to speed on the basics of share repurchases, dividends, and IPOs.

When does a company plan to repurchase shares? When does a company issue dividends? When does a company plan to “go public” through an IPO?

Let’s start with share repurchases.

There is a long standing debate about whether share repurchases are an efficient use of a company’s capital or a mere excuse for not pursuing growth initiatives. Some people say excess cash is much better spent in R&D or for capex.

Nevertheless, everyone can agree that share repurchases directly increase a company’s stock price. Thinking with simple math of the market capitalization formula (MC = shares outstanding x share price), if there are fewer shares outstanding because a company repurchased them, the market cap doesn’t change so the stock price must increase. Is this really a bad thing? On paper, shareholders are benefitting from greater ownership of the business.

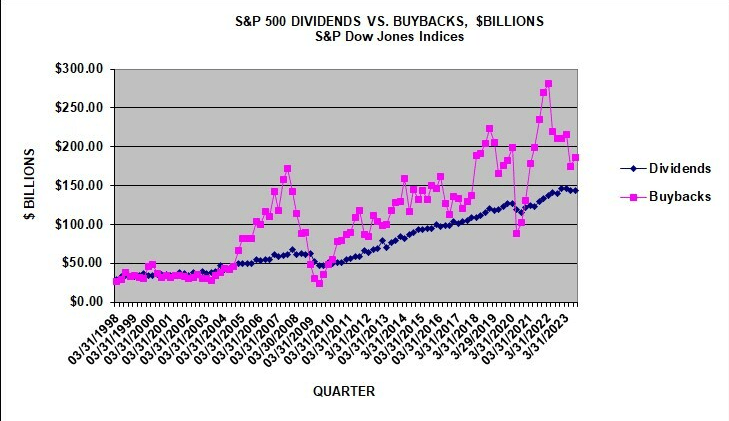

Share repurchases have become more and more popular over the last ~40 years thanks to changes in tax laws in the 1980s making repurchases more preferable than dividends, from a tax perspective. Ever since 1997, the volume of share repurchases has outpaced dividends.

Share repurchases are more popular than dividends (credit: S&P)

One would think a company repurchases shares when its stock price is trading down from historical averages. However, as seen from the graph above, the opposite is true. Repurchases typically happen in years of outperformance.

A company repurchases shares when the stock is trading higher primarily due to the fact that better stock performance typically correlates with better business performance, which typically correlates with stronger cash flows. These stronger cash flows are then used to buyback shares, albeit at the elevated price.

It would be a bad look for a company to announce a share repurchase program and then fail to deliver on its promise if they aren’t generating enough cash to execute.

However, as seen from the graph, share repurchase programs are definitely flexible given the changes in volume according to the performance of the market.

Moving on to dividends.

Dividends are one of the oldest forms of returning value to shareholders. Quite simply, the company is literally mailing you a check of a % of its profits as a thanks for owning a % of the business.

Now, investor behavior is much different regarding dividends vs. share repurchases. As mentioned above, if a company fucks up and can’t deliver on its share repurchase program, investors won’t be thrilled but they aren’t going to tweak about it too much. However, if a company fucks up and reduces its dividend payment, investors start dumping stock at a brutally fast clip.

Part of this rationale stems from the old school dividend discount method of valuing a company; where a stock’s price would be derived from the present value of all future dividend payments. Therefore, reducing dividends would directly reduce the stock price within the model.

So, referring back to the graph above, we can see that dividend payouts are really steady over the course of the last ~20 years because companies can’t really afford to act against their promises to deliver dividend payments. If they did, their stock price would get fucked.

Ok, IPOs.

Companies go public for a ton of different reasons, but the core driver is the ability to raise capital from public markets investors (anyone outside the small world of private equity, growth equity, hedge funds, and venture capital).

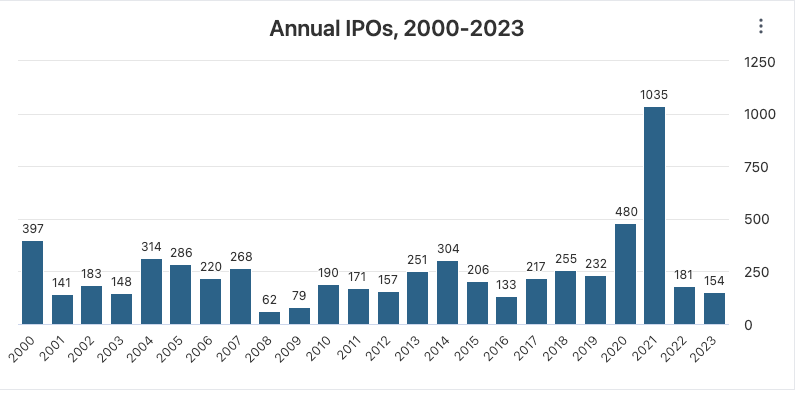

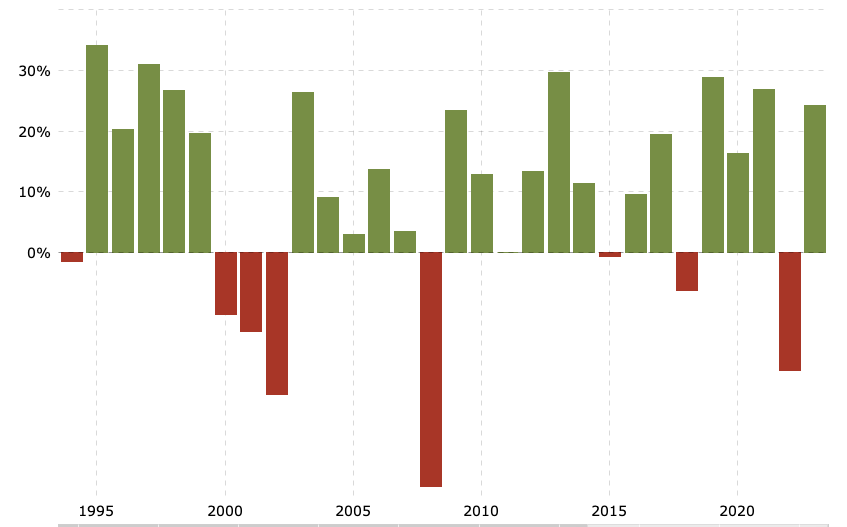

Lately, IPOs have been muted. Companies naturally want to sell their shares when markets are skyrocketing. This helps them raise the most amount of capital without incredibly diluting their ownership. Check the graphs below for a side-by-side comparing IPO volumes with S&P 500 returns in a given year.

Unholy quantity of IPOs in 2021 (rip ECM guys; credit: Stock Analysis)

When the market rips, companies IPO (credit: Macrotrends)

So, what do we see here. We see that companies IPO during periods of market positivity. We also see that companies are late to the party, and the largest IPO volumes happen ~1 year after major market upswings.

2021 was ballistic thanks to low rates, government stimulus, and lofty valuations

Regardless, markets tend to be frothy when companies are IPOing, which makes them difficult to invest in. People don’t like to sell things they deem to be undervalued, companies behave in the same way and don’t like to sell undervalued stock.

In 2024, we are likely to see an uptick in IPO volume (~300-400) IPOs on the basis of recently frothy markets, muted IPO volume in 2022 & 2023, and sponsors (PE + VC) looking for liquidity options that don’t involve debt, since debt will still be relatively expensive in 2024.

For an interview, understand why companies may repurchase shares, issue dividends, or IPO. Also, form a view on what volumes look like going forward.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Share Repurchases vs. Dividends vs. IPOs

These are all various strategies companies can use to alter the equity portion of their capital structures.

Share Repurchases: A share repurchase is when a company buys back its own shares from the market

-Pros: boosts shareholder value by taking shares out of the market, effectively increasing a shareholder’s ownership of the business

-Cons: opportunity cost of cash. Cash could be used for other growth initiatives such as R&D, capex, or M&A

Dividends: A dividend is when a company uses cash to pay shareholders, more or less a form of income

-Pros: incentivizes shareholders to buy and hold stock for the long-term

-Cons: investors HATE when dividends are reduced. Potential lifetime cash outflow for a company

IPO: An initial public offering is when a company ‘goes public’ and sells shares to the public markets for the first time

-Pros: great way to raise equity capital from new investors, better marketing + presence, transparency, and potentially better borrowing terms

-Cons: expensive due to new regulatory costs + quarterly maintenance of performance and agency costs of management striving towards stability vs. growth

Knowing the differences between share repurchases, dividends, and IPOs are critical for every job in finance because of the direction relation to how a company uses or raises capital.

Going Forward:

Curious to learn more about any given topic? Write us an email, we would love to incorporate your suggestions into future releases.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #31