Biggest Sale of the Season! From now until April 1st, we will be running a 30% sale for the purchase of our Premium Database. This is our biggest sale of the SA 2025 recruiting season and can be captured by venmoing @ThePulsePrep $35

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Oppenheimer, Campbell Lutyens, and Edgemont Partners all opened applications this week. So far ~85 banks have opened applications. Interviews are under way across the Street with firms such as Guggenheim, JPMorgan, and Evercore interviewing candidates right now. Please reach out if you’re looking for mock interviews or any coaching!

Newly Released Applications:

Oppenheimer: Solid boutique (SA 2025)

Campbell Lutyens: Specialize in secondary investments advisory (SA 2025)

Summit Partners: Small boutique (SA 2025)

Edgemont Partners: Healthcare-focused boutique (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: SIX SA 2025 applications have been released so far along with a few sophomore programs. As a note, these Sophomore programs are typically a few days long and a great way to show interest and learn more about the company/industry. However, they are by no means necessary to landing a summer or fulltime role. Beginning in late March and April, recruiting will pick up. Our logic for late March/April? Last year MBB (McKinsey, Bain, and BCG) released their round 1 applications in April. Given the trends of top firms hiring earlier, we believe recruiting will start on a slightly earlier timeframe this year.

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025)

Bain: Pre-consulting Women's Leadership Summit (Spring 2024 - Closed)

Cornerstone Research: Sophomore Summit (Spring 2024)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Rialto Capital, Rockefeller Capital Management, and Fosun Group all opened SA 2025 apps this week. So far ~63 buyside shops have opened applications

Released apps:

Rialto Capital: Real estate-focus (SA 2025)

Singular Square: Small asset manager (SA 2025)

Rockefeller Capital Managment: Small asset manager (SA 2025)

Fosun Group: China-based (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 42nd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $35 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $35.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

The Wall Will Fall

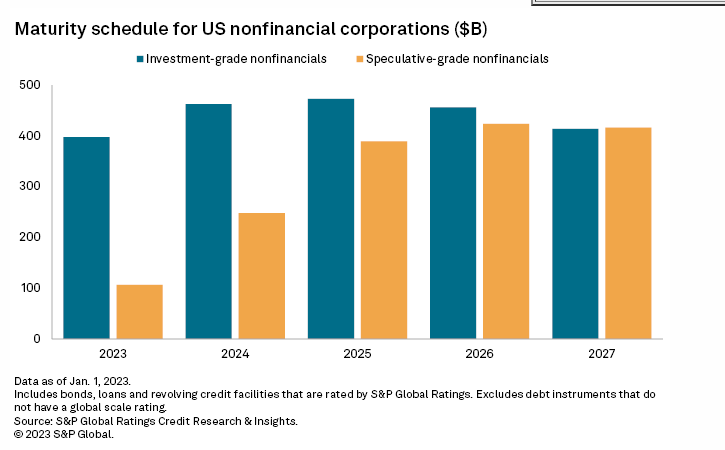

There is roughly $2.0tn worth of corporate debt maturing in 2025 and 2026.

Lotta Debt Needs a Refi (Source: S&P Ratings)

So, who cares?

Well, this debt was initially financed in the low-rate environment circa 2020 and 2021—-as stated in previous editions, rates have risen nearly 400% since. SOFR today stands at ~5.3%, leading to a cost of debt of 6-8% for investment-grade companies and 8-13%+ for non-IG companies.

The knee jerk reaction is, “oh shit that is mad expensive, companies are not going to be able to refi all of that debt—which should lead to defaults.”

However, High Yield Harry and I thought differently. We stated our thoughts in "The Pulse" -- #24 (beehiiv.com) and Interview with High Yield Harry (beehiiv.com).

We looked under the hood and realized that defaults and bankruptcies were not going to be the first option. Instead, our current environment paints a pretty picture for amending and extending this debt or as HYH quoted “amend & pretend.”

In the first 3 months of 2024 alone, roughly $100bn of junk bonds scheduled to mature in 2025 have been refi’d. That number will only grow as the maturity dates creep closer.

Why and how is this debt getting refi’d in today’s higher rate environment? Great question, let’s dig in.

We identified 4 reasons supporting amending & extending of debt coming due in 2025 and 2026:

Covenant-lite loan docs written at origination have room to be beefed up

-Cheap capital in the post-GFC era forced lenders to compete heavily for deals resulting in weaker credit agreements and indentures. To avoid default (which can hurt the lender just as bad as it hurts the company), lenders will opt to just beef up the old docs when refinancing old paper. New covenants, stronger collateral, and basket additions are all different ways for a lender to strengthen their deals.

There is so much new money in private credit with funds thirsty to deploy capital

-In 2020, there was ~$875bn of AUM allocated to PC, with $1.4tn as of the start of 2023—predicted to grow to nearly $2.3tn by 2027 (Bloomberg). In essence, more money committed to PC and other credit strategies (credit hedge funds, etc) will lead to more capital deployment, helping refinance old deals.

Spreads have tightened to post-GFC lows

-We covered this recently in "The Pulse" --#40 (beehiiv.com). However, the general thesis is that more investors want exposure to credit with rates being relatively high. Greater demand for credit pushes spreads lower as investors compete for new issuances

Behaviorally, people and companies are becoming more accustomed to rates being higher for longer

-Companies are realizing that sub 1-2% rates are unlikely for the near future and they need to learn how to manage with greater interest expense. The two options they can pursue are resizing operations (cutting headcount, marketing expense, etc) to help offset greater interest expense or issuing less debt to support the business. In 2022, the thesis was that we were headed for a recession, which caused most companies to batten down the hatches and resize operations—sets them up pretty well to service greater interest expense

Bundle all of these reasons together and you have a perfect storm for amending and extending debt coming due in 2025 and 2026. Default rates are expected to rise slightly, but not enough to scare lenders away from putting capital to work.

For an interview, form a view on the maturity wall in 2025 and 2026. I can guarantee you’ll be working on refinancing some of those deals by the time you hit the desk lmao.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

PIK Interest

A critical capital concept and a favorite technical question asked by any of the Elite Boutiques: what is PIK interest?

PIK stands for “paid in-kind.” PIK interest is interest that is not routinely paid in cash and is instead accrued and paid at maturity along with the principal of the debt.

PIK is very common in junior debt instruments and preferred equity where opportunistic investors are looking for greater yield. PIK interest is typically more expensive than cash interest because the investor needs to be compensated for the added risk of not getting paid in cash every period interest is due.

Borrowers like PIK interest because they don’t need to make regular cash payments to the lenders and can instead use cash to invest in growth initiatives or pay themselves via dividends.

An example of PIK math:

-$100 loan with 10% PIK payable in 3 years:

Year 1

-Beg. Debt: $100

-PIK Interest Expense: $10

-End Debt: $110

Year 2

-Beg. Debt: $110

-PIK Interest: $11

-End Debt: $121

Year 3

-Beg. Debt: $121

-PIK Interest: $12.1

-End Debt: $133.1

As you can see, PIK interest compounds. Important to note that PIK interest is still baked into a company’s reported interest expense and ultimately reduces net income. However, it is added back as a non-cash expense when calculating free cash flow.

Going Forward:

The “Pay for 3, get 1 FREE” coaching deal has ended. However, coaching will continue. Check out the details below to set up a session:

1 hour session = $50. Venmo @ThePulsePrep

30-minute session = $30. Venmo @ThePulsePrep

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached have received offers at Goldman, JP Morgan, Blackstone, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #42