Biggest Sale of the Season! From now until April 1st, we will be running a 30% sale for the purchase of our Premium Database. This is our biggest sale of the SA 2025 recruiting season and can be captured by venmoing @ThePulsePrep $35

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Goldman Sachs, Capital One, Scotiabank, and Hennepin Partners all opened applications this week. Goldman marks the last bulge bracket to open its application. So far ~75 banks have opened applications. Many apps have closed and interviews are under way across the Street. Please reach out if you’re looking for mock interviews or any coaching!

The process will be wrapped up by May / June of this year with offers being extended already

Newly Released Applications:

Goldman Sachs: Bulge bracket (SA 2025)

Capital One: Large bank, but new IB division (SA 2025)

Scotiabank: Canadian bank (SA 2025)

Hennepin Partners: Small boutique, middle market focus (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: SA 2025: SIX applications have been released (this weeks releases are in bold), and we anticipate lots of action starting this month! Remember to apply as early as possible for the best chance of landing an interview. Reach out with any questions or to schedule a mock interview in advance of spring interviews

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Business Processes Intern (SA 2025).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025)

Bain: Pre-consulting Women's Leadership Summit (Spring 2024)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: StepStone, Ardian, Monomy Capital Partners, and Sands Capital Management all opened SA 2025 apps this week. So far ~52 buyside shops have opened applications

Released apps:

StepStone: Large multi-strategy asset manager known for secondaries investing (SA 2025)

Ardian: Large asset manager looking for primaries + secondaries PE intern (SA 2025)

Monomy Capital Partners: Small PE fund, industrials + consumer focus (SA 2025)

Sands Capital Management: Primarily a hedge fund, looking for a research intern (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 40th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $35 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $35.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Tight Credit Spreads

As mentioned in the "The Pulse" --#37, the market is ripping. What happens when the market does well? Credit spreads tighten!

When credit spreads tighten, the debt markets jump back to life.

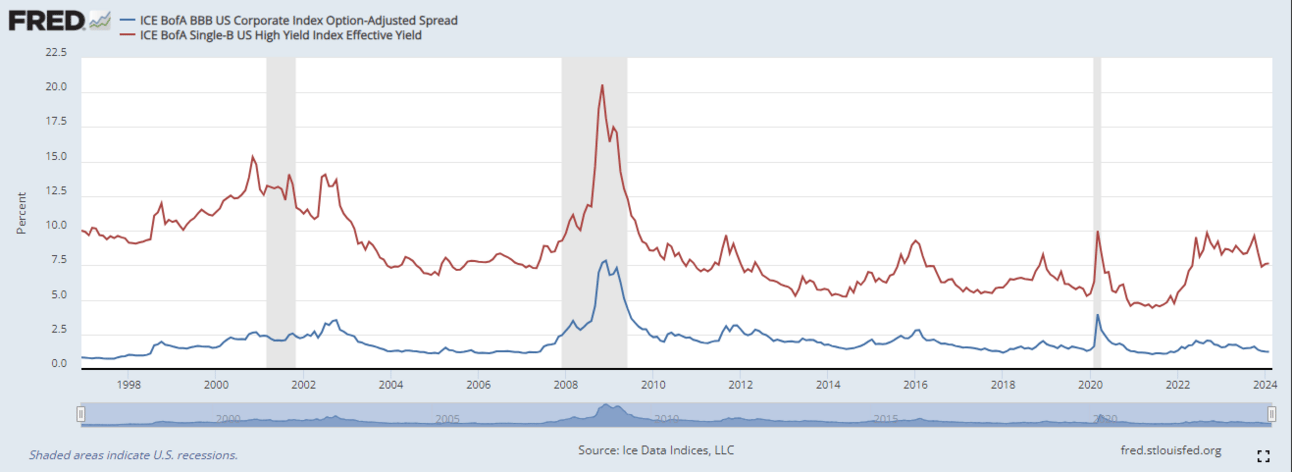

Check out where spreads are today:

Credit Spreads Near Historically Recent Lows (Source: FRED)

Spreads tightened due to two elements (briefly mentioned in "The Pulse"--#36):

Better than expected earnings performance for most major companies. Better performance = stronger ability to issue and price debt

Heightened investor demand to lock in strong yield

Since the base rate, SOFR, is reported at roughly 5.3% today, investors are flocking to the debt markets to capture 7-8% rates of return on investment- grade (IG) corporate debt. In the high yield space (HY), investors can collect roughly 12-13% on their debt investments.

Although, as investors jump back into the debt markets, the demand is outstripping the supply and pushing credit spreads lower.

Debt is usually priced as S (SOFR) + X (credit spread) basis points (bps). Spreads rise when investor demand is limited, and the market is painted as being riskier. When markets do well and demand rises, spreads fall.

For context, the S&P 500 has an annual rate of return of roughly 7-10%. However, investing in the S&P 500 is investing in equity. A riskier investment than any tranche of debt!

So today, investors can generate equity-like returns on debt instruments, which is very attractive from a risk perspective.

With hot investor demand, big issuers of bonds (any large, typically public company) are hitting the market to take advantage of cheaper debt (plays well into the narrative of strong 2024 deal flow: "The Pulse" --#32. The coupon paid to investors is still greater than 5%, but companies will do everything they can to save a few bps and secure cheaper financing.

What is really unique about the situation today is that 2006 is the only other time in the last 20 years when base rates hovered at ~5% and credit spreads were as low as they are today. Shortly after, the world nearly fucking collapsed during the Great Recession.

The real question: is the debt being accurately priced? Or are investors too desperate to lock in > 5% returns? Discuss your view in an upcoming interview!

After all, for every equity deal you work on, you'll likely see 3x the amount of debt deals. Especially if you work at a bank that lends off of its balance sheet!

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Tell me about a recent transaction?

Common question asked in interviews, can be tricky to answer when you’re only a sophomore in college. Read below for our 3-step framework:

Pick an M&A deal from Exec Sum (avoid gigantic headline deals since the interviewer likely has much better insight into the details than you do)

Briefly research the backgrounds of both companies + take note of key numbers (transaction size, financing mix, market caps of the respective companies, revenues of both companies, EBITDA)

State why you think it was a good deal or bad deal (typically want to explain how the merged entity will execute synergies by becoming more efficient or gaining greater market share)

When answering, follow according to the steps of the framework.

Here is an example: “I recently looked at a $X transaction where Company A acquired Company B for [$X of debt, $X of stock, and $X of cash] (skip if numbers aren’t available). Company A is a large [industry] company with a market cap of roughly $X and is X times larger than Company B. Company B is a smaller [industry] company focused on X [goods/services]. I think this was a particularly [good/bad] deal because the newly merged entity will be able to [fill in the executable synergy].

For sake of simplicity, avoid financial sponsor backed deals (deals where a PE company buys another business).

Keep your answer within 30 seconds to one minute. The goal is to see how interested you are in finance and if you can concisely break down complex topics. Pick an area that plays to your strengths. If you like tech, look at a tech deal. However, if you’re recruiting for restructuring roles or some other niche group, you better pick a deal that aligns with that group.

Going Forward:

The “Pay for 3, get 1 FREE” coaching deal has ended. However, coaching will continue. Check out the details below to set up a session:

1 hour session = $50. Venmo @ThePulsePrep

30-minute session = $30. Venmo @ThePulsePrep

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached have received offers at Goldman, JP Morgan, Blackstone, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #40