Pay for 3 coaching sessions, get 1 FREE! For the next month, we will be offering an exclusive offer to pay $150 to receive 4 coaching sessions with a current or future analyst (Venmo @ThePulsePrep). Interviews are right around the corner and we want you to be as prepared as possible. Last year, 85% of those coached received offers! See the “Going Forward” section in the bottom of the newsletter for additional detail.

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Bank of America, UBS, Jefferies, and Intrepid Investment Bankers all opened applications this week. So far ~55 banks have opened applications with 11 openings this week. The SA 2025 recruiting process is already 30% complete with some apps closed and interviews beginning across the street. The only major app we are waiting for is Goldman Sachs, which should be March 1st. Please reach out if you’re looking for mock interviews or any coaching!

Advice: Drop the networking. Every analyst is flooded with messages from students desperate for a call. Right now, your time is better spent making sure that you apply to all open apps and that your techs + behaviorals are interview-ready

Newly Released Applications:

Bank of America: Bulge Bracket (SA 2025)

UBS: Bulge Bracket, ate Credit Suisse for lunch last year (SA 2025)

Barclays: Bulge Bracket—UK roots (SA 2025)

Citigroup: Bulge Bracket—undergoing a restructuring (SA 2025)

Evercore: Very strong elite boutique, best PE placement (SA 2025)

Jefferies: Largest middle-market bank (SA 2025)

Macquarie Group: Australian-based bank (SA 2025)

Eastdil Secured: M&A boutique (SA 2025)

D.C. Advisory: Boutique (SA 2025)

Shea & Company: Small boutique (SA 2025)

Intrepid Investment Bankers: Boutique in NYC (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Four firms have released applications. As previously mentioned, brace yourself for March/April/May as that is the hot zone for app releases. Use your time now to prep (network, build the perfect resume, case prep) so that when apps are released you can apply ASAP

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Management Consulting Intern - Women's Consulting Experience (SA 2025).

Curtis & Co: Boutique firm (SA 2025)

Protiviti: Tech Consulting (SA 2025)

Pre-Consulting:

Bain: Consulting Kickstart Program (Interactive, virtual series designed to give freshman/first year undergraduate students who identify as Black, Hispanic/Latin American, and/or Indigenous heritage, exposure to business leaders and the exciting world of consulting)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: D.E. Shaw, Silversmith Capital Partners, and Evergreen Services Group all opened SA 2025 apps this week. So far ~40 buyside shops have opened applications, with many applications rolling off by the end of March.

Released apps:

D.E. Shaw: Multi-strategy hedge fund (SA 2025)

Silversmith Capital Partners: Boston-based growth equity shop (SA 2025)

Evergreen Services Group: ESG-focused PE fund (Summer 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 36th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

America’s Most Infamous Asset Class

The residential mortgage-backed security is infamous for being the financial instrument that caused the Global Financial Crisis (GFC) in 2008. Today, we are going to review this asset class and break down all of the creative ways lenders look to capitalize on your home’s debt. (In case you missed it, we visited the resi mortgage market in: "The Pulse" --#27)

First, a note about mortgages and how they are packaged into mortgage-backed securities (MBS).

A mortgage is debt you use to purchase your home (usually ~80% of the home’s value assuming a standard 20% downpayment). It is essentially a term loan as the lender offers one large lump sum in exchange for the payment of principal + interest over a certain period (5, 10, 15, 20, or 30 years). The payment of that principal and interest is a stable cash flow from the borrower to the lender; therefore, it creates an opportunity for the lender to sell the rights of that cash flow to a different investor! In turn, a security is created.

Better yet, why not take thousands of mortgages and package them into a single instrument to offer to investors? This is the creation of the classic MBS. Lenders typically originate loans, make an origination fee, and look to package these loans into a MBS to sell to other investors which provides them with more capital to continue funding individual mortgages. More or less a strong example of don’t eat where you shit.

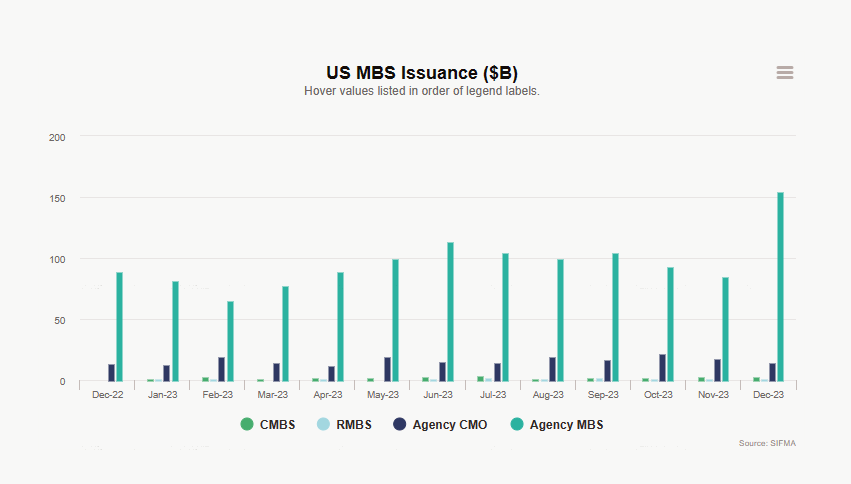

Now that we discussed mortgages and how a mortgage-backed security is created, let’s point our focus to historic MBS volume.

MBS Markets are BACK! (Source: SIFMA)

What do you notice?

December 2023 experienced an explosion in MBS issuance which has bled over into the start of 2024. This is unusual given that 30-year mortgage rates are still sitting around 7%, nearly 4x greater than 2020 and 2021.

As always, there is a technical and behavioral reason at play.

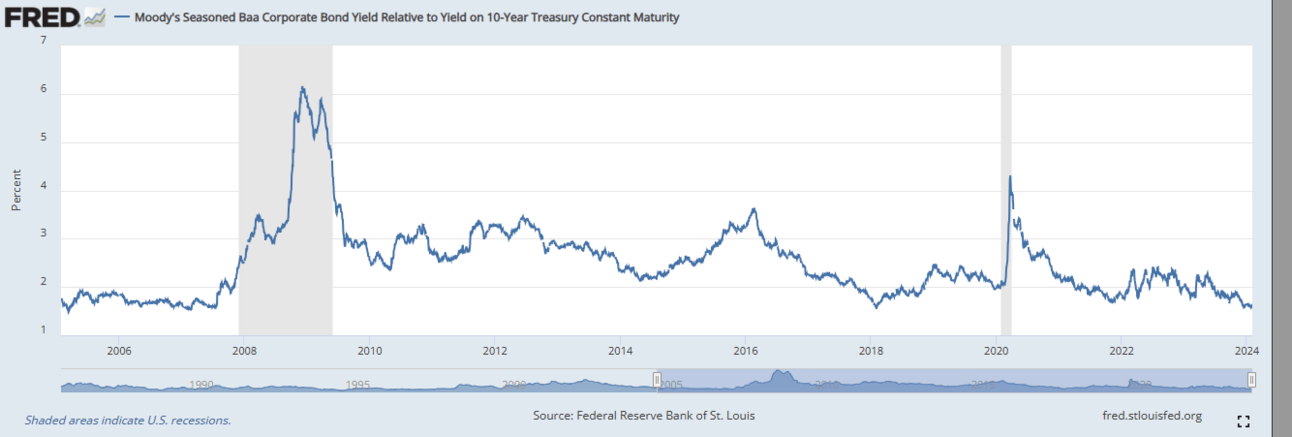

From a technical standpoint, there is crazy demand for high yield debt as investors look to buy debt before the FED cuts rates. This demand is reflected in the ultra-depressed credit spreads (spreads are the additional yield demanded by investors to compensate for buying anything that isn’t risk-free):

Credit Spreads near ATLs (Source: FRED)

By nature, more expensive debt is riskier because it makes it more difficult for the borrower to repay. Nevertheless, investors are buying debt at an unbelievable clip in the hunt for yield.

Ok, so we see that investors want yield but what is the behavioral rationale for the spike in MBS issuance? Well, people are getting used to this ‘higher for longer’ concept and are slowly re-engaging with buying + selling activity in the residential mortgage space which is slowly thawing the resi mortgage market. After all, there is an inelastic demand component to home buying/selling so people couldn’t sit on the sidelines forever to wait for rates to drop.

What other opportunities are present in the resi mortgage space?

Junior lien products (HEI, reverse mortgages, second mortgages, sale leasebacks, etc) all opportunities for borrowers and lenders to capitalize on record levels of home equity.

With home values near ATH, borrowers are sitting on hundreds of thousands of dollars of relatively illiquid home equity. As consumer savings are further eroded, junior lien products become more attractive for borrowers to tap into their home equity to fund other purchases.

Given the rate environment and the structural risk of junior lien products being subordinate to conventional mortgages, these products are offering very attractive, near equity-like returns (10% +). After all, who doesn’t pay their mortgage? (Lmao)

Bottom line: investors want returns and the mortgage market is a great place to find great risk-adjusted returns. In an interview, be prepared to discuss the direction of credit spreads and what that means for the debt markets.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Take Action, Send Out the Application!

Apply early and often—seriously our best piece of advice with regards to entry-level banking/consulting/buyside recruiting

Here is why applying as early as possible and to as many places as possible gives you a HUGE advantage in the recruiting process:

Apps are rolling. There are X amount of spots open, so having your resume at the top of the pile makes it easier for the reviewer to say “hey, there are X number of spots open, they might make a good fit—let’s schedule an interview.” vs, “we have already given out 85% of offers, this candidate isn’t strong enough to meet our requirements for the remaining 15% of the pool”

Similar to the first point, but your competitors (other students applying) are all coming in with the same resume (everyone has an equal amount of minimal tangible experience). By nature, the first resume reviewed is significantly less boring to read than resume #29,707

Entry level banking/consulting/buyside jobs are super similar across all firms (pay included). Therefore, there is 0 downside to applying everywhere you can. If you get an interview somewhere you never want to work at, fuck it, it will make good practice

More time to prep for technicals and behaviorals. If you send the app in, all you can do is wait for the interview—which leaves plenty of time to zero in on your interviewing skills

Some people think you need to network with at least 3-5 people before applying, I think this a bunch of bullshit. Intern recruiting is a pretty low priority for most firms given the fact they can just re-hire for full time analysts if the interns all suck. At the end of the day, it doesn’t matter how many people you’ve networked with if you never submit the application

Think practically. Firms want to hire intern classes as quickly as possible to minimize the amount of time + money needed to fill spots. Therefore, applying within the first 1-2 weeks of an app opening provides you with an extreme advantage during the review process

Going Forward:

Pay for 3 sessions, get 1 FREE! We will pair you with a current or future analyst to help with everything from:

Resume Review

Mock Interviews

Developing Recruiting Preparation Plans

Last year, 85% of those coached received offers! Venmo: @ThePulsePrep $150 to claim this offer; sessions are ~1 hour long and we are fully flexible to your schedule

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #36