Pay for 3 coaching sessions, get 1 FREE! For the next month, we will be offering an exclusive offer to pay $150 to receive 4 coaching sessions with a current or future analyst (Venmo @ThePulsePrep). Interviews are right around the corner and we want you to be as prepared as possible. Last year, 85% of those coached received offers! See the “Going Forward” section in the bottom of the newsletter for additional detail.

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: PJT Partners, TPH & Co, and Crosstree Capital all opened applications this week. So far ~44 banks have opened applications. For perspective, we are ~25% complete with the SA 2025 recruitment process given the number of apps open and rolling off within the next month. Please reach out if you’re looking for mock interviews or any coaching!

Interview processes have kicked off at some of the smaller boutiques, so be sure to have your behavioral + technical knowledge perfected

Newly Released Applications:

PJT Partners: Very strong boutique (really good PE placement). Looking for SAs within Rx + Special Sits group (SA 2025)

TPH & Co: Strong energy and renewables boutique. A subsidiary of PWP (SA 2025)

Crosstree Capital: Small boutique looking for SAs with a life sciences background (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Four firms have released applications. KPMG has released their deal advisory intern for summer 2025. This is a financy role – their more traditional "management consultant intern" role will be released in the coming weeks. Be prepared for app releases to heat up around March. Apply to roles early – this is really important!

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Management Consulting Intern - Women's Consulting Experience (SA 2025).

Curtis & Co: Boutique firm (SA 2025)

Protiviti: Tech Consulting (SA 2025)

Pre Consulting:

Bain: Consulting Kickstart Program (Interactive, virtual series designed to give freshman/first year undergraduate students who identify as Black, Hispanic/Latin American, and/or Indigenous heritage, exposure to business leaders and the exciting world of consulting.)

Apply ASAP if you’re interested!

Also, make sure you're taking advantage of this quiet period of consulting recruiting by perfecting answers to behavioral questions and case-prepping.

Buyside:

Where We’re At:

SA 2025: Weiss Asset Management, LLR Partners, and Lead Edge Capital all opened SA 2025 apps this week. So far ~37 buyside shops have opened applications across PE, PC, VC, Growth, and HF

This process is ~20% complete as buyside firms tend to move on an ‘as-needed’ basis. However, the larger firms like Blackstone definitely operate similar to most banking processes and are likely interviewing before the end of March

Released apps:

Weiss Asset Management: Hedge fund / asset manager with $2.9bn AUM (SA 2025)

LLR Partners: LMM PE fund (SA 2025)

Lead Edge Capital: Growth equity (Summer 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 35th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Comp & Bonuses

Well, 2022 was a (mostly) shit year for comp + bonuses and it looks like 2023 is off to a shitty start too.

Before diving in, a snapshot of the market:

Real GDP rose 3% 4Q23 (supports unexpected 2023 growth story)

Credit spreads are at post-GFC lows (investors rush to lock in high yields before rate cuts)

Global supply chain bottlenecks in the Red Sea and Panama Canal may lead to sticky inflation at 3-4% as the labor market remains tight

Debt maturity wall in 2025 and 2026 likely to benefit private credit investors as Basel III regulation will be enforced starting July 2025 (see "The Pulse" --#24 for a deeper dive into the growth of PC)

Ok, let’s assess Wall Street compensation (purely looking at banks).

Every year big names in the FinMeme game, like Litquidity, post comp surveys to provide pay transparency across the industry: Lit's 2022 Comp Survey

These are helpful for future analysts to get a rough estimate of what total pay looks like for working 100 hours a week (tbh pay is kinda garbage at an hourly level; definitely not even close to tech hourly pay).

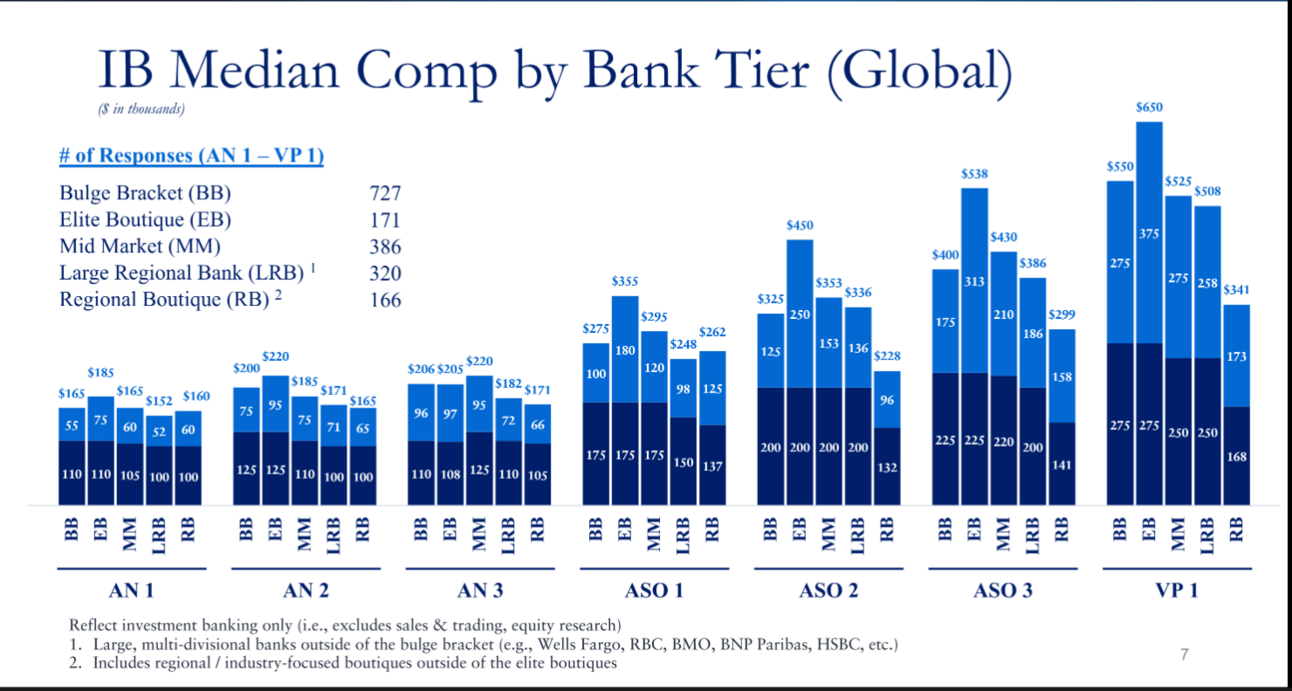

Source: Litquidity Comp Survey

As you can see, total comp typically flows in this direction from highest to lowest:

Elite Boutique: Highest base salaries and highest bonuses (~70-90%) on behalf of leaner teams, yet marketable deal volume

Bulge Bracket: Strong salaries with ~40-70% bonuses. On behalf of much larger overhead and larger deal teams

Other Boutiques: Average salaries, but sometimes huge bonuses (~70-120%) if a few large deals are closed in a given year

Other Large Banks & Regionals: Mid salaries and mid bonuses due to mid deal flow and bloated teams

Just want to mention, total hours worked typically flows in the same direction. So, just because your buddy locked up a gig at Evercore for $130k base and $90k salary, doesn’t mean he’s got it all figured out. (Buddy better enjoy staying up to 3am at least 4 nights a week).

Now, what else is important to know about comp (especially bonuses):

Base salaries were increased from ~$85k - $110k in 2020 & 2021 due to complaints + salaries were not increased for like 20 years (Wall Street Salaries Rise)

Strong deal flow = strong bonus. YOU DO NOT GET PAID IF DEALS DON’T CLOSE

Bonuses are NOT guaranteed. Sure, there are buckets ranking analysts from best to worst, but the spread is like maybe $30K. So, you can be the grittiest, smartest analyst on Wall Street, but if your bank isn’t making bread and the worst analyst gets $0 bonus, you’ll only be getting paid ~$25K - $30K (an insulting number compared to a year with strong deal flow)

Bonuses are taxed at 40%. They are marked as “Other Special Income” and are taxed at the highest tax bracket. $80K bonus is only $48K after tax

Ok, now that we discussed the important aspects of pay, let’s assess the early findings for 2023.

Similar to 2022, 2023 was also a pretty shitty year for comp. Official numbers have not been posted but the rationale for shitty comp is so obvious:

There was literally a banking crisis in March of 2023. SVB, Credit Suisse, First Republic, and Signature Bank all closed up shop. Some people were calling for GFC 2.0

M&A was practically nonexistent

IPOs were muted (see "The Pulse" --#31 for more color on IPO volume)

Higher rates = locked up debt markets (for most of the year)

Bake these factors together and it makes sense that 2023 comp reports are off to a bad start. However, unlike prior years, we are seeing tremendously variability in comp in 2023 across different firms. For example, comp at firms like Citi has been garbage because Citi is undergoing Project Bora Bora (a full scale restructure of operations. When the bank is closing up entire divisions ie: the munis and distressed debt sales desks, you aren’t going to get a big bonus

On the other hand, comp at JPM has been really strong so far on behalf of outperformance relative to other banks in 2023.

Moral of the story, comp on Wall Street is variable and as analyst it is largely out of your control. Your bonus is exactly what it sounds like, A BONUS. It is not guaranteed and is more dependent on macroeconomic vs. microeconomic factors.

Hopefully 2024 will be a better year for everyone.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Walk me through an LBO

Definitely a grittier question to be asked in a summer analyst banking or PE interview, but totally plays.

What is an LBO? LBO stands for ‘leveraged buyout’ and is known to be one of the juiciest tools of financial engineering in history. Essentially, you want to find a cheap, stable (cycle-resistant, high customer retention, deep competitive mote, strong management, etc) company and then tack on as much debt as possible to grow the enterprise value. Then, sell that company after holding it for 3-7 years to make a profit (often trading hands to another PE firm, selling it to the public (IPO), or selling it to a more strategic buyer (competitor).

How the LBO process works:

Significant diligence and assessment of comparative valuations to determine the relative value of the business in question

Draft assumptions of the purchase price by applying an LTM EBITDA multiple or adding a premium to the stock price (if the company is public)

Create a Sources & Uses to assess the amount of financing needed for the transaction (want as much leverage as possible to boost your return)

Project out cash flows over the hold period using all excess cash to pay down debt

Apply an exit multiple to the last year’s EBITDA and then pay off all remaining debt. Your end value is your exit equity value

Calculate the IRR from year 0 (equity check written) to the final year (equity check expected to be received). Compare the calculated IRR with your fund’s hurdle rate to determine the viability of the investment

Now, an LBO isn’t all financial engineering. Oftentimes a PE firm will execute some level of operational improvement (firing people, growing revenue streams, etc) to add value to the transaction. However, adding a shit ton of leverage and assessing capacity for multiples expansion are certainly large drivers of the transaction’s value.

For an interview, be sure to understand what an LBO is, what a good LBO candidate looks like, and the basics of how an LBO process works.

Going Forward:

Pay for 3 sessions, get 1 FREE! We will pair you with a current or future analyst to help with everything from:

Resume Review

Mock Interviews

Developing Recruiting Preparation Plans

Last year, 85% of those coached received offers! Venmo: @ThePulsePrep $150 to claim this offer; sessions are ~1 hour long and we are fully flexible to your schedule

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #35