Happy Holidays everybody! This is a fantastic time of year to hunker down and prepare for the SA 2025 recruiting szn!

Want access to an updated database of 200+ banks/consulting/buyside firms? Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

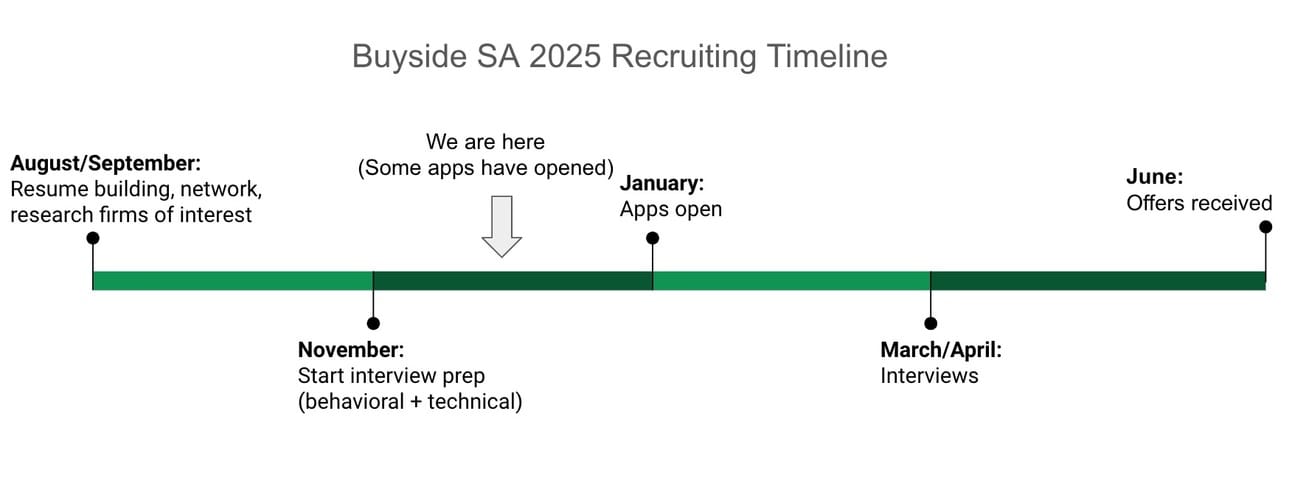

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: January 1st is expected to be a big date for app openings. For 2 months now, we have sounded the alarm. So far, ~12 banks have opened apps.

FT 2024: Only ad-hoc positions will open up for this group. Apply to everything you can, but job security found through a different industry may be the smarter decision at this point IMO.

Gameplan:

SA 2025: January and February will be the BIG months for apps openings. We advise applying early and often to maximize your chances of being invited to interviews. By now, your resume should be ready to go, you should have networked with bankers, and your focus should be primarily on developing behavioral + technical responses.

FT 2024: Our Premium Database will continue to warehouse jobs for the next few months. Otherwise, you need to be leveraging all available connections to secure interviews.

Interview Questions of the Week:

-Behavioral: Walk me through a recent transaction. Do you think it was an accretive or dilutive transaction?

-Technical: You have a company with 50% debt and 50% equity in the capital structure. If the cost of debt is 8%, risk-free rate is 2%, beta is 2.0, and market risk-premium is 12% — what is the WACC? Assume no tax rate.

WACC discussed in: "The Pulse" --#25

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Want access to an updated database of 200+ banks/consulting/buyside firms? Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: We’re in a recruiting dead zone right now. SA 2024 is over but SA 2025 hasn’t kicked off (only one app has opened). Expect apps to open in April/May

FT 2024: Firms have finished hiring aside from any very small/niche firms trying to fill a position.

Gameplan:

SA 2025: Make use of time over winter break and research firms you are going to apply to. Most employees aren’t going to want to do networking calls over the holidays, but you can still perfect your resume and case prep.

FT 2024: Focus on very small firms (<20-30 employees) as they don’t tend to follow typical recruiting cycles. Additionally, you could consider applying to related positions such as strategy roles.

Interview Questions of the Week:

-Tell me about a time you made a recommendation that significantly improved a particular process.

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Buyside:

Where We’re At:

SA 2025: ~8 funds have opened applications. Funds recruit on a similar timeline to banking, but analyst programs are very new and not completely standardized.

Gameplan:

SA 2025: Funds prioritize two aspects of a candidate 1). A willingness to learn and 2). An ability to make money for the firm. If you’re considering the buyside, take a deep look into your resume and see if you answer these two aspects in any way. Tailor your behavioral responses to demonstrate that you’re not just an analyst, you’re a value-add.

Interview Questions of the Week:

-Behavioral: What are your favorite finance / investing books?

-Technical: When does a dividend recapitalization make sense? Why does a fund do it, and how does it work?

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Premium Database:

The database is updated bi-weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every two weeks with the latest banking and consulting job postings. We released our 24th update last week.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the bi-weekly updates, you pay a one-time fee of $50 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>HH Database Preview--Video

Market Update:

Basel III Endgame, is it really that bad? A light Christmas Eve read.

First, a brief overview of Basel.

The Basel framework is a set of international bank regulations determined by a bunch of old heads in Basel, Switzerland. What is proposed at Basel, is not set in stone. To enforce Basel framework, a country’s financial governing body (FDIC, FED, etc in the US) needs to adopt it.

The first Basel accord was proposed in 1988; however, Basel framework has received much greater attention post-GFC when capital requirements were heightened significantly. Today, we discuss Basel III framework.

Gorgeous ahhh place: Basel, Switzerland

The main function of Basel is to set capital requirements according to the risk profiles of certain activities or asset classes within a bank. Bank capital is money outside of deposits which serves as a cushion to protect deposits in the event a bank’s value begins to erode (it is more or less a bank’s equity).

How do capital requirements work?

A bank needs to hold X amount of capital as a % of certain assets held on a bank’s balance sheet, according to their risk profiles. For example, a term loan B has a very different risk profile than a T-Bill, so a bank originating term loan Bs will need to hold a much larger % of capital against this asset opposed to something less risky like a T-Bill.

Hence, the reason why banks look to syndicate TLBs. They want this risk off of their balance sheets because it is expensive to hold.

Holding this asset as an investment will actually hurt the bank’s returns because the capital requirements are so high. Therefore, a bank looks to originate the loan, make the origination + administrative fees, and sell this shit to other investors who are not subject to capital requirements.

Capital requirements negatively impact a bank’s returns because this is money sitting on the sidelines, unable to be invested. You always want your money to go to work to avoid the opportunity cost of not being invested or not using it to buy things.

So, what is Basel III Endgame proposing? Simply said, greater capital requirements across nearly all asset classes and all bank activities.

Naturally, bank leaders are pissed! This means that banks will make less money on their financial products.

Couple of big dawg bank CEOs (credit: Bloomberg)

Not only will banks make a little less money, but the trend of capital to alternative providers like fintech and private credit will only increase. Banks are more or less forced to exit certain businesses due to the stringent capital requirements.

Pros: If a bank fails, it is a tsunami of negative effects. If some random private credit shop blows up, there will only be a small ripple of negative effects.

Emphasis on RANDOM. If Blackstone blew up, we would be fucked due to the concentration of important LPs invested in their funds (insurance companies, pension funds, endowments, etc)

Cons: Alternative loans are historically more expensive than bank loans.

As more capital flows into alternatives, there will be greater pressure to compete on pricing, but for now a loan from private credit is more expensive than a bank loan

So, Basel III was drafted after the banking crisis in March 2023 and final comments arguing against the proposed capital requirements are due January 16th, 2024. The plan will be implemented over 3 years to give banks time to adjust their books.

Unfortunately, basic questions about important regulation do appear in some interviews. Now you know what to discuss related to Basel III Endgame.

Disclosure: Nothing in here is financial advice or should be used for investment decisions.

Learning Point of the Week:

How to answer a question you don’t know:

Little bit of a different format from the traditional corporate finance topic. Nonetheless, it is important to not look like an idiot during an interview.

Setting the scene:

It is the final interview of the Superday with Evercore, my fake smile is cutting through my cheeks, my pits are sweaty (little bit of swamp ass too), and my brain is absolutely fried after 2 and a half hours of interviewing.

I’m all ready for a chill behavioral interview with a second year analyst and then disaster strikes. Buddy asks me the most fucked up merger math question in history. I’m a sophomore in college and have not taken a single business course.

The only thing I know about M&A is that it stands for murders mergers and acquisitions.

At this point, all of my technical ‘knowledge’ is regurgitated straight from technical guides found online! (check the Premium Database for everything & more).

I didn’t know how to respond, I fumbled and tried to answer the question. Buddy said “yeah …..ok I guess that makes sense.” Kiss of death.

This means my answer was so incredibly wrong that he doesn’t even have the heart to explain to me how bad it was.

So, that’s a fun story. I did not move on in that process lmao.

How can we avoid this? Two simple strategies:

“At this stage in my journey I am just soaking up all of the knowledge I can and have not had the opportunity to learn about this subject in detail. However, after I take X class next year or get enrolled in X business school, I will have developed the skills and knowledge to dig into this type of question. If there are any resources you know of for me to get a head start, I’d greatly appreciate the insight.”

Less of a play by play, but the second strategy is to answer the question in pieces. The hardest questions are compound, so answering one by one in the simplest way possible is an effective way to take a stab at it. If you get like 85% of the question right, the interviewer may cut you some slack.

Whatever you do, do NOT go on yappin for 2-3 minutes about bullshit you don’t know the answer to. Everyone in the room will know you’re clueless and you will NOT move on to the next round or receive the offer.

The strategies I provided are also NOT perfect.

Some interviewers will think you’re a clown for being unable to answer any question. However, I personally admire someone for acknowledging what they don’t know.

In an interview, keep a level head. Everything is just a learning experience. The best thing you can do to avoid a bad situation is being over-prepared. Shameless plug again for our Premium Database which has all of the resources necessary to be over-prepared.

Going Forward:

We will be slowly changing our name from “HoosHelpers” to “the Pulse.” Ownership has not changed and our services will remain the same. Do you like the change? Have suggestions for a different name? Let us know!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #30