One-time Black Friday 30% sale! From today → 11/26, we are offering a special Black Friday discount to purchase our Premium Database for only $35!

To claim this offer, Venmo @Hooshelpers $35 and shoot us an email @[email protected]. Additional details of the database can be found below. Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Due to popular demand, we added a bunch of Sophomore Summer Programs offered at banks like BofA, Rothschild, and UBS. Find them on the database!

Video of Premium Database——>HH Database Preview--Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Only RBC. Confirmed that major banks will be kicking off apps in January.

FT 2024: Full-time recruiting for 2024 is nearing its end (~85%) complete. No notable new apps, but wanted to point out Credit Agricole, Lazard, and BNP Paribas which all seem to be actively recruiting with multiple open applications for different positions/groups. Not sure what is going on with the French, but weird coincidence that all of these are French banks.

Firms Actively Hiring:

Credit Agricole: Leveraged Finance (FT opening)

BNP Paribas: Public Finance (FT opening)

Lazard: Consumer (FT opening)

See below to gain access to our premium database, updated bi-weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Only one firm has released an application. There shouldn’t be any others released until the spring. Start networking and do research!

SA 2024: It is very quiet. Basically, all firms have filled their roles.

FT 2024: Firms are done with full-time hiring. There might be a few very small firms releasing apps (none you will have likely heard of before).

Newly released apps:

SSA & Company - 2024 FT Business Analyst

Blackpoint Consulting Group - 2024 FT Life Sciences Associate Consultant

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Harris Associates (Investment Manager) released its 2025 Investment Research SA position. Otherwise, only GTCR (PE) and Insight Partners (VC) have released their apps

Released apps:

Harris Associates: Chicago-based investment manager (Summer 2025)

GTCR: Large, well-known PE (Summer 2025)

Insight Partners: Large VC, tech-focused (Summer 2025)

Premium Database:

The database is updated bi-weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every two weeks with the latest banking and consulting job postings. We released our 22nd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the bi-weekly updates, you pay a one-time fee of $35 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $35.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>HH Database Preview--Video

Market Update:

CPI Increased ONLY 3.1% YoY, 0% MoM!

Today, we are discussing:

The latest inflation report: 3.1% YoY, 0% MoM

The history of the coveted 2% inflation target

Predicted rate CUTS in 2H24

First, the latest inflation report was epic.

A 3.1% YoY increase in the CPI for October is the lowest reading in over a year. Quick reminder that August and September CPI readings were both 3.7%.

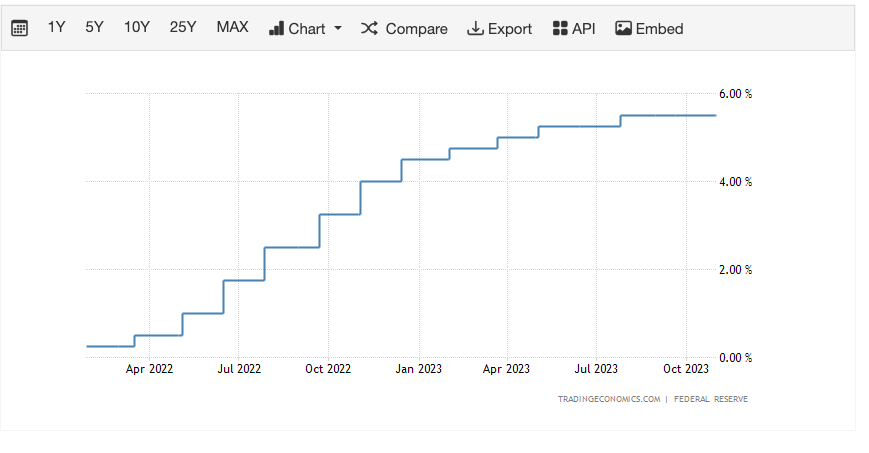

We can deduce that the FED’s decision to hike rates at the fastest pace in history to 5.25% - 5.50% is starting to pay off as inflation creeps closer to the coveted 2% target. Hopefully, this signals the end of quantitative tightening.

FED Rate Hikes (Apr. 2022 → Oct. 2023)

However, let’s talk about the 0% MoM increase in CPI. This is wild. Prices from September to October were sticky. Sticky prices sound great because shit costs exactly the same today as it did a month ago, but sticky prices toe the line dangerously close to deflation. We DO NOT want deflation.

Deflation will kill the economy from all directions. Money stops moving around when people expect tomorrow’s prices to be lower than today’s prices. China is currently experiencing very low levels of deflation, which will certainly stunt their economic growth.

Ok, let’s touch back to the FED’s 2% inflation target. Why is 2% the magic number? Turns out it is all because of some guy in New Zealand…who just made it up during a televised interview.

In 1989, New Zealand was dealing with high inflation and a news channel interviewed the minister of the central bank to discuss his outlook. When asked the question, “what should the rate of inflation be?” the minister just said 2%.

This fucking guy says 2% (circa 1989, colorized)

No scientific reasoning, no math, no group of nerds connecting the dots. Just a number that sounded modest. Pretty lit tbh, lotta alpha dawg activity here.

Thereafter, the people of New Zealand expected inflation to be 2% YoY. So everyone from large corporations to mom & pop shops knew that the average increase in their pricing should be ~2% YoY. Nevertheless, inflation really did level out around 2% in New Zealand.

Within a few years, some European countries recognized New Zealand’s success and copied the model. The United States did not formally adopt this model until 2008 when the GFC happened. So, is this model the right model? Why not 3%? Why not 4%? Those numbers don’t sound too heinous to me.

Well, it turns out that inflation is very behaviorally-influenced. If inflation is high, a consumer might expect prices to just be higher and as long as they’re paying, prices will only continue to rise and inflation will rise as well. It is kind of a snowball effect. So, when the target rate is 2% everyone just expects prices to rise 2% and is OK with paying for that increase across all goods (discretionary and non-discretionary).

So, 3% and 4% may not be bad targets to pursue. However, if the FED backs out of the 2% goal and claims the new goal to be 3% or 4%, people will immediately assume that inflation must be high. Then, they start expecting to pay more for all goods which just drives up inflation further. Because of this behavior, the FED is stuck with the 2% target.

Lastly, let’s talk rate CUTS or quantitative easing as a nerd would say. Back ~1.5 years ago when the FED started hiking, they projected to raise rates to around 5%. So, when they implicitly reference cuts in 2H24, I think it is safe to say that there will definitely be rate cuts starting in 2H24.

Cuts are great because liquidity is improved and debt becomes cheaper which allows companies and people to make bolder investments to spur economic growth. However, I don’t think rates will ever be cut all the way back down to nearly 0%.

Now, the bigger question to ask is “how quickly will the FED cut?” Will it match the unprecedented speed of the hikes? When will the hiking stop? What is the ultimate target for the federal funds rate?

For an interview, ask those questions ^ you’ll sound like a genius and the interviewer will respect that you give a shit about what happens next in the world.

Learning Point of the Week:

WACC

The weighted average cost of capital (WACC) serves as the beloved discount rate for all financial models. WACC more or less is a hurdle return rate a company needs to meet when investing in a project.

Calculation: (((cost of debt x % of capital structure composed of debt x (1- tax rate)) x (cost of equity x % of capital structure composed of equity))).

Cost of Debt: Interest rate of the debt

Cost of Equity: risk-free rate + beta x the market risk premium

Risk-Free Rate: Rate of return of a 10-year T-Bill

Beta: Measure of volatility of a security compared to the market (usually the S&P 500)

Market Risk Premium: Expected market return - risk-free rate of return. Expected measure of alpha delivered from investing in risky assets. (more or less a made up number, but if you just plug in ~6-8% no one will ask any questions)

Now that we dropped a few equations and definitions, we can move on with our discussion.

We can’t understand WACC without understanding capital structures. A capital structure is essentially the composition of the right side of the balance sheet. A capital structure is a breakdown of the tools (debt and equity) used to fund the purchasing + maintenance of the assets for a business.

Capital structures look very different across different industries. Remember our discussion about leverage in "The Pulse" -- #21? Capital structures mirror the same principle of different companies within an industry having a similar capital structure, but companies within different industries often having very different capital structures.

So a WACC is really just a blended average of the costs of the different tools used to finance the assets of a company. Therefore, it serves as the minimum rate of return a company needs to generate on its investments/projects. WACC is famously used in a DCF as the discount rate applied to the projected cash flows.

A good-looking WACC from my experience is anywhere from 7-15%.

Going Forward:

We want to meet you! Keep on the lookout for an email from us as we will be randomly selecting subscribers to book some time to get to know you.

We will be slowly changing our name from “HoosHelpers” to “the Pulse.” Ownership has not changed and our services will remain the same. Do you like the change? Have suggestions for a different name? Let us know!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #25