In Partnership with: Banking Playbook

248 pages of curated insider information to navigate through the investment banking recruiting process. This is the 400 questions guide on steroids.

Technicals, behaviorals, networking, dress code, finding applications, and more.

If you’re gearing up for FT 2026 recruiting or are looking to get a jump start on SA 2027 recruiting, then you need to check this out.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: No new applications this week. 97 firms are recruiting for SA 2026. If you haven’t gotten an offer, start pivoting to consulting tbh or gear up for the FT 2027 recruiting process

FT 2026: No new updates. 2 firms are actively recruiting for FT 2026

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

None

New FT 2026 Applications:

None

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

McKinsey and Bain released their full-time and summer analyst roles. There are currently 10 applications open. Make sure to apply early!

SA 2026 released apps:

McKinsey - Summer Business Analyst (SA 2026)

Bain - Associate Consultant Intern (SA 2026)

FT 2026 released apps:

McKinsey - Business Analyst (FT 2026)

Bain - Associate Consultant (FT 2026)

Buyside:

Where We’re At:

SA 2026: Accel-KKR, Bay Point Advisors, and Capula Investment Management opened apps this week. Currently 93 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Accel-KKR: Middle market PE, tech focused (SA 2026)

Bay Point Advisors: MM Private Credit, based in Atlanta (SA 2026)

Capula Investment Management: Global HF, trading & research (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 99th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

Can Private Equity Continue to Grow?

I’m guessing that many of you have aspirations of a career in private equity. After all, it has been one of the most lucrative career paths for the last few decades.

Given the fantastic run that PE has had, I often wonder if the growth can continue (As an aside, investors will go where the returns are so this is ultimately a question of whether PE funds can a) generate strong returns and b) return $ to LPs).

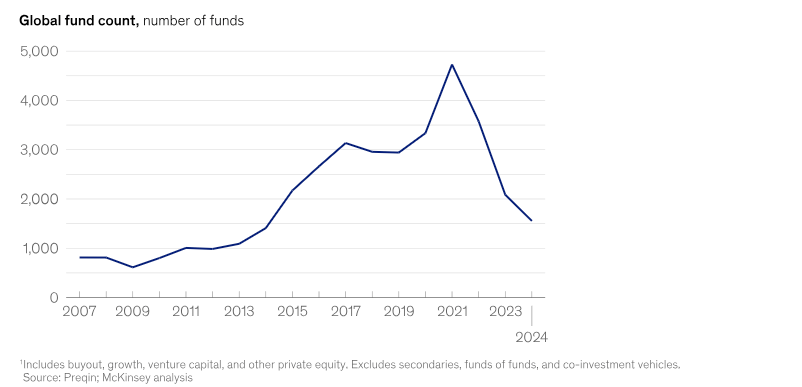

Over the past few years, the AUM of PE firms has grown pretty consistently, especially as the industry has consolidated. We discussed the consolidation of PE here: "The Pulse" --#81 / The Consolidation of Private Equity

Source: Preqin; McKinsey Analysis

Before diving into the future outlook of PE, let’s very briefly discuss the two biggest factors that have allowed PE firms to generate excess returns.

First, PE firms can play an active role in the businesses they invest in. Firms can contribute directly to strategy and value creation while being aligned with other investors. They also have the resources for add-on investments that can grow businesses efficiently and at scale.

Second, PE firms have a long time horizon. Unlike in public markets, where firms report quarterly earnings and are therefore less inclined to make changes that hurt their bottom line, private companies can make long-term, strategic moves even if it hurts their short-term profitability. This is a luxury that public companies do not have.

So what are some of the headwinds?

We are no longer in the low-interest rate environment that PE funds benefited from during COVID, and there is more competition than ever. On top of that, Trump’s tariffs are making business decision-making nearly impossible. Who would want to make important business decisions (such as M&A) when policy could change within 24 hours?

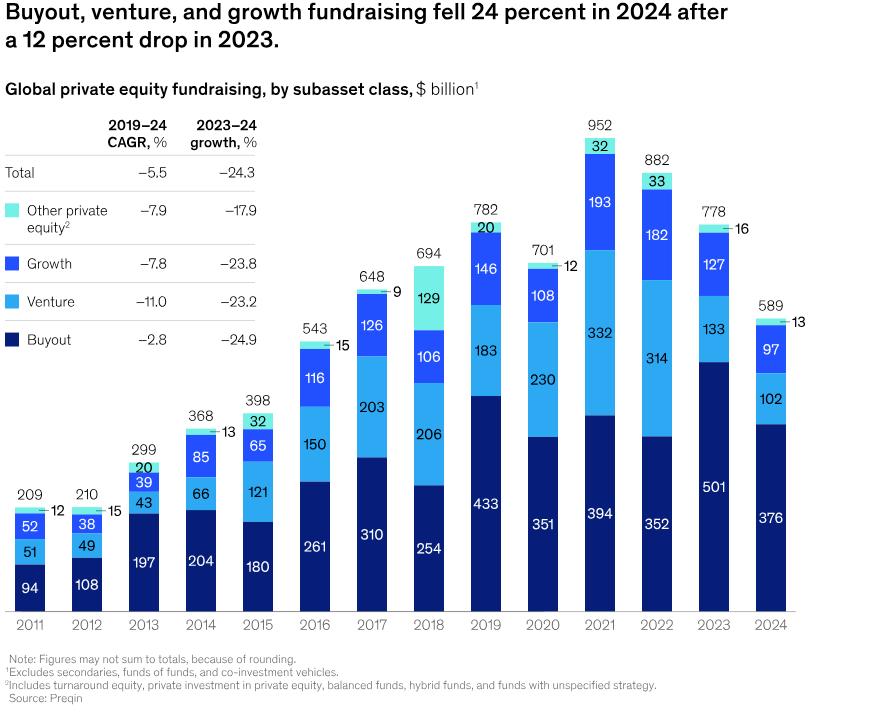

2025 was supposed to be the year that M&A and IPOs had a strong rebound, but the Trump administration’s policies greatly hinder deal-making. LPs might have to wait a little longer to get capital returned to them, which makes raising additional funds difficult.

Source: Preqin

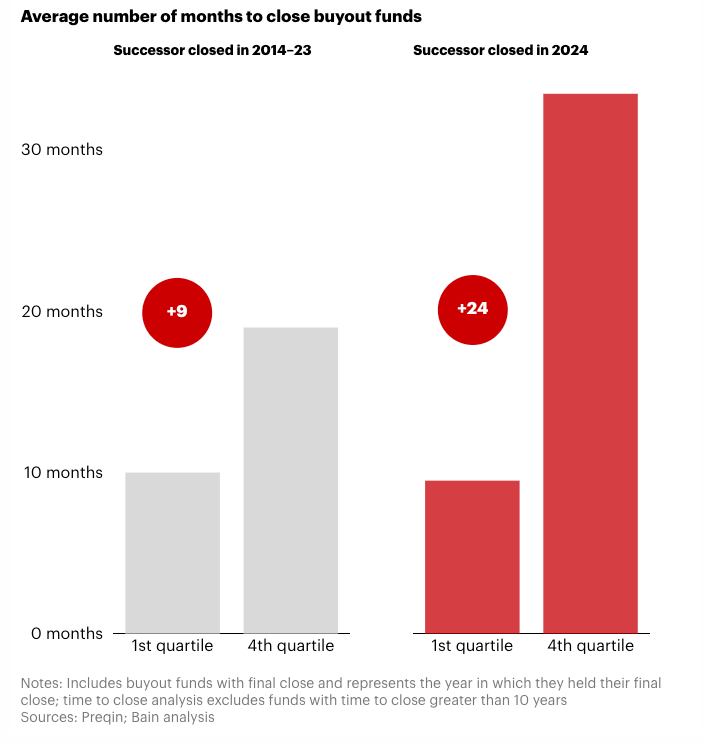

Source: Preqin, Bain Analysis

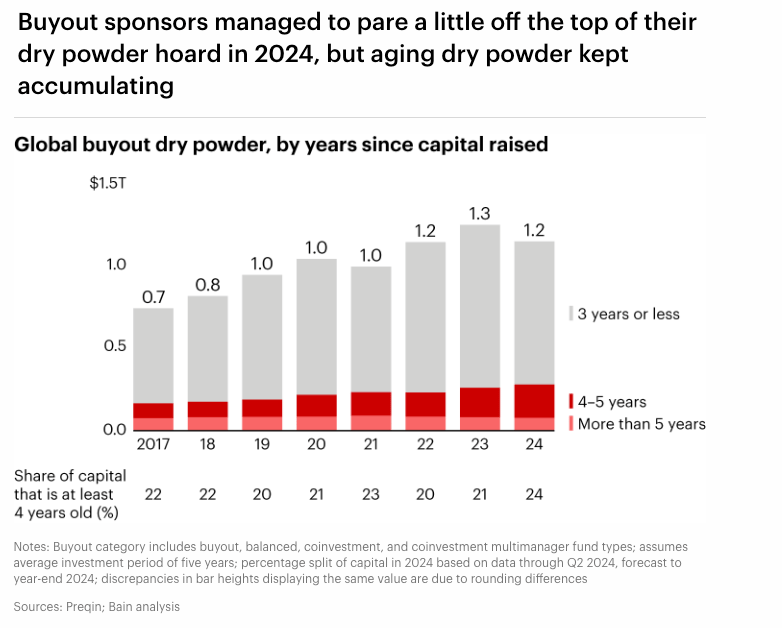

We can also see in addition to fundraising difficulties, firms are having trouble putting aging dry powder to work.

Source: Preqin, Bain Analysis

The combo of having trouble selling companies to return cash to LPs and also having aging dry powder is pretty lethal. This is not a very compelling value prop to potential LPs when you are trying to raise for your next fund.

But who knows, maybe tariffs will be removed and banking regulations will be loosened, allowing for crazy deal volume. At this point, it is difficult to make any predictions. PE is certainly a very important asset class that is not going anywhere, but it is tough to imagine it will have the same tailwinds over the next two decades as it did in the previous two.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

When should you hit submit on your consulting application?

Given that McKinsey and Bain released their 2026 consulting applications, I figured this would be a timely topic.

The short answer is as soon as you are ready. In other words, you should be submitting the best product you possibly can because these are incredibly competitive roles.

However, I understand that answer is not hugely helpful. If you have been reading our newsletter for a few months, you should already have your resume perfected, networked with professionals at the firms of interest, and be case-prepping. So ideally you can submit your app ASAP.

If you don’t feel like you have networked enough, I would still suggest applying ASAP. You can continue to network after you’ve applied. Time is not your friend here. The sooner you get that application submitted, the sooner it can be reviewed and hopefully progressed to the next round.

As a side note, Bain has two application deadlines - one in June and the other in September. I would suggest applying for the first round if at all possible. The logic being that they simply have more spots to give earlier on.

Shoot us an email ([email protected]) if you would like us to send you mock cases prepared by Bain, BCG, and McKinsey!

Going Forward:

Are you starting your banking / consulting FT job this summer?

We are carefully rolling out our Buyside Associate prep solutions. This will be the best tool to land a job in PE, PC, HF, or VC / GE after your analyst stint. Please shoot us an email @[email protected], if you’d like to be a part of our first cohort—services will be 100% free.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #99

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions