In partnership with: Caseify

Secure your dream MBB offer with Caseify.io, the first-ever AI platform offering fully conversational mock case interviews.

Practice with 100+ unique cases across MBB, Big 4, and Tier 2 firms

Experience ultra-realistic interviews with natural, voice-based conversations powered by state-of-the-art AI technology

Receive instant feedback pinpointing exactly how to improve

Approved by McKinsey partners who recognize its effectiveness for candidate preparation

Exclusive offer for subscribers of The Pulse: Get 1-monthfreeaccess to Caseify.io using code THEPULSE100 at checkout. Hurry up because the code expires on April 20th.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Founders Advisors opened its application this week. 97 firms are recruiting for SA 2026.

FT 2026: Qatalyst Partners and Founders Advisors opened their applications this week. 2 firms are actively recruiting for FT 2026. Apps for both only available on Handshake.

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

Founders Advisors: Birmingham-based M&A boutique (SA 2026)

New FT 2026 Applications:

Qatalyst Partners: Elite tech boutique (FT 2026)

Founders Advisors: Birmingham-based M&A boutique (FT 2026)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

Oliver Wyman has released their full-time and summer analyst roles. There are currently 6 applications open. As the speed of application releases picks up make sure to apply early and often.

SA 2026 released apps:

None this week.

FT 2026 released apps:

None this week.

Buyside:

Where We’re At:

SA 2026: Constitution Capital Partners and Rudius Partners opened apps this week. Currently 90 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Constitution Capital Partners: Middle market PE (SA 2026)

Rudius Partners: Long-only HF (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 98th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

‘Investibility’

As a guy buried in Excel and Powerpoint for ~70 hours each week, I can get distracted by data-driven insights. I can lose touch with the fact that value is not what the numbers say, value is simply what someone else is willing to pay for something.

Is something investible? Or is it not? What comes to mind…

SpongeBob Selling Pretty Patties

You remember this shit? When SpongeBob sold ‘Pretty Patties?’ This is a raw example of value. At one time, Pretty Patties had more value than the legendary Krabby Patty. Besides food dye, they were not made differently, someone was simply willing to pay more for a colorful Pretty Patty than the standard Krabby Patty.

Circling back to investing, your capital gains are reliant on someone else paying more for shares that you own. Is the company you own investible? Or is it not? In other words, what is the ‘investibility’ of the company you own?

‘Investibility’ is not a real word. It should be.

Unless you’re being compensated with real income, like dividends, your gains are all on paper. Not real money. Therefore, to make a return you need someone else to pay more for your shares than what you bought them for. In frothy markets, this is colloquially referred to as the ‘Greater Fool Theory.’ The numbers can say whatever they want, but you cannot actually make money unless someone else buys your slice.

This cold fact has never been more real than today.

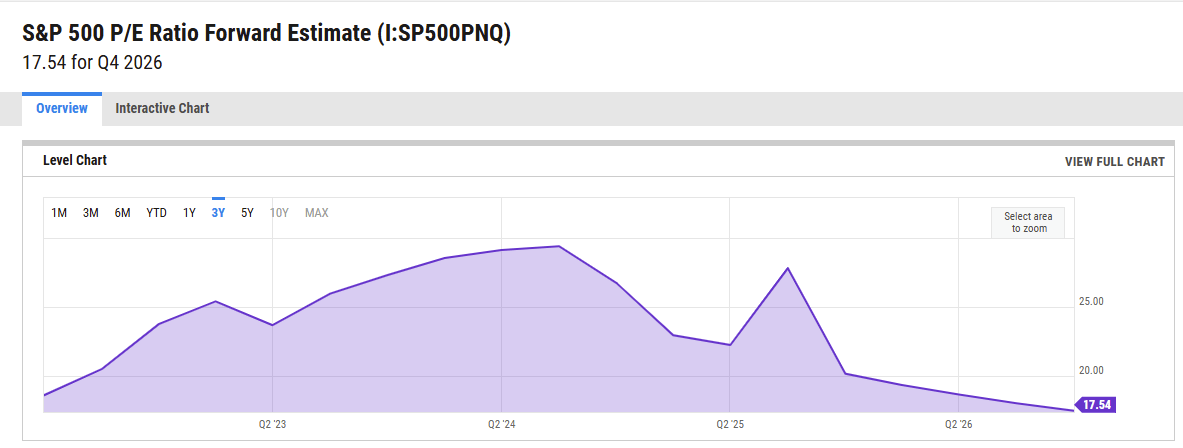

S&P 500 Forward PE Cut in Half (Source: Y Charts)

Only 4 months ago the S&P 500 traded close to a 30.0x PE multiple. Now, it is trading closer to 18.0x. Tariffs played a heavy hand here for sure, but the real underlying driver of this drop is that people woke up and said “maybe this is not worth 30.0x anymore.” Tariffs don’t actually buy or sell the market, investors do.

What does a long-only HF and a VC firm have in common?

Taking a bet that someone else will pay more for things they are buying today. Taking a bet on the ‘investibility’ of a business. Their gains are not real until they sell. Their simple thesis is “I believe someone else will pay more for this in the future because…”

My point here is that burying your head in numbers and news does no good unless someone else sees your vision. Monitoring capital flows should be a critical piece of everyone’s investment criteria, and it really is not discussed enough.

In 1985, the S&P 500 index was $179.83. Yup, triple digits. Now, it’s closer to 5 digits trading at $5,363.36 (an increase of 2,882%!). This is a testament of compounding, inflation, and much more capital injected into the system.

Also, in 1985, there were only 5 billion people in the world. There are 8.2 billion people today. Since 1985, the retail investor has also gained infinitely greater access to investing. That has led to trillions of additional capital injected into the system. For those who were already invested, this was a pretty strong tailwind.

The More People That Hit The Slots, The More The Jackpot Grows!

Think about how much more capital will get invested throughout your lifetime. Will that capital follow what you’re invested in? What is the ‘investibility’ of the shit you own?

Now, we get to the most important question. How can you determine the ‘investibility’ of something?

It’s part science, part art. Sometimes investible assets are found by following trends (AI), sometimes they are found by following fundamentals (blue-chip stocks), and sometimes you just get lucky ([insert random shitcoin]). The easiest thing you can do is to have some skin in the game and just be patient.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Case Prepping

Case studies test your analytical abilities and business acumen. Here are a few pointers.

1). Practice with a friend.

-There are so many case prep materials out there that anyone can access so you cannot really gain an edge by having unique material. However, I think students underweight the importance of running case prep with their peers. Practicing with others forces you to verbalize your ideas and allows you to see how other students approach a problem. Sharing your ideas will make you better at case studies and give you a substantial leg up.

^maybe even practice with AI like this week’s sponsor, Caseify.io.

2). Practice a lot.

-When I interview, I get a little nervous. By practicing over and over you will be able to enter the interview with confidence and attack any case they give you. Additionally, the way you approach each case will be based on the assumptions they give you and the ones you make yourself. Lots of practice will help you learn how to quickly make and apply assumptions.

3). Your interviewer can help you.

-Interviewing is stressful but your interviewer is your friend when it comes to case studies. Allow them to guide you and don’t be afraid to admit when you’ve made a mistake. If the interviewer provides a suggestion that might help you with the case or questions your logic—- say, “Thank you” and incorporate their suggestion. They want you to succeed and are a resource for you.

Shoot us an email ([email protected]) if you would like us to send you mock cases prepared by Bain, BCG, and McKinsey!

Going Forward:

Are you starting your banking / consulting FT job this summer?

We are carefully rolling out our Buyside Associate prep solutions. This will be the best tool to land a job in PE, PC, HF, or VC / GE after your analyst stint. Please shoot us an email @[email protected], if you’d like to be a part of our first cohort—services will be 100% free.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #98

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions