1 Month Premium Database Sale! Ends 2/26/2025

For the next month, our Premium Database will be 30% off to help you land your dream summer 2026 role!

Pay us $45 via debit / credit card (ThePulsePrep—Stripe.com—30% off) and shoot us an e-mail @[email protected]. This provides you with a full year of access and is our final sale for the summer 2026 recruiting season.

Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Premium Database: Database for banking, consulting and buyside roles | The Pulse

Coaching Program: Mock Interviews, Resume Reviews, and Gameplanning | The Pulse

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Greenhill, Canaccord Genuity, HSBC, and 5 others opened their summer 2026 apps. 77 firms are actively recruiting for summer 2026 positions

Firms across the Street like Morgan Stanley, Lincoln International, and JPM are handing out offers. The recruiting season is moving along as expected with interviews to be conducted throughout February for prominent firms. ‘Superday’ season will certainly hit over the next 2-3 weeks. If you’re not getting interviews, the best thing you can do is continue networking with firms which haven’t released applications yet. Our Premium Database houses over 150 banks, check it out to stay ahead

New SA 2026 Applications:

Greenhill: Solid boutique, acquired by Mizuho (SA 2026)

HSBC: Large multinational bank (SA 2026)

Canaccord Genuity: Elite Canadian boutique, pays above Street (SA 2026)

AQ Tech Partners: Tech-focused boutique (SA 2026)

Cascadia Capital: Boutique bank (SA 2026)

MTS Partners: Healthcare-focused boutique (SA 2026)

AGC Partners: Small, tech boutique (SA 2026)

Hennepin Partners: Boutique M&A (SA 2026)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

58 SA 2025 applications have been released along with 69 FT 2025 apps. This process is essentially complete with the exception of smaller/niche firms.

2026 Recruiting has started but is in the very early days. There are currently 4 open applications. Firms are opening applications much earlier than last year–we can expect this trend to continue.

SA 2025 released apps:

Secretariat - Analytics and Data Strategy Intern (SA 2025)

FT 2025 released apps:

Secretariat - Analytics and Data Strategy Associate (FT 2025)

The Bridgespan Group, non-profit consulting - Associate Consultant (FT 2025)

Brighthouse - Strategist (FT 2025)

Harbor - Associate Consultant - Strategy & Transformation (FT 2025)

Sage Analysis Group - Management Consulting Analyst (FT 2025)

SA 2026 released apps:

RSM - Transaction Advisory Services Intern (SA 2026)

PWC, big 4 - Business Processes Consulting Intern (SA 2026)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2026: Waterfall, Spectrum, Access Holdings, and 4 others opened their SA 2026 applications. Currently 63 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Waterfall Asset Management: $13.0bn AUM specialty finance investor (SA 2026)

Arena Investors: Asset backed / specialty finance investing (SA 2026)

Summit Partners: MM PE (SA 2026)

Access Holdings: MM PE (SA 2026)

Spectrum Equity: Tech-focused growth equity (SA 2026)

CF Private Equity: PE Secondaries (SA 2026)

Norwest Ventures: Small growth equity shop (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 89th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $45 Credit Card / Debit Card: (ThePulsePrep—Stripe.com—30% off) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $45.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

LMEs = Liability Management Exchanges

Liability management exchanges are on the rise. We introduced this topic here: "The Pulse" --#83 / Our 2024 Wins & Losses. Recently, Oaktree posted a fantastic insight into the rise of LMEs: The LME Wave. I’m sure we inspired them to write this piece.

LMEs are Popular (Source: K&E)

Distressed debt / restructuring is one of my favorite areas of finance to analyze from an academic lens. Understanding this area is also key for any of you sweats looking to land Rx seats. Before digging further, I want to preface that I’ve had the fortune of working on a number of cuspy transactions but am not an expert in this field.

I’ll point towards my distressed debt / restructuring friends as the experts here.

Anyways, an LME is when a distressed company turns to its lenders and says “fuck you, fuck our previous credit agreements, I need more money. Are you going to help me or not? If you don’t, you’re cooked.”

If you’d like more technical detail on LMEs, please reference our ‘Learning Point’ below!

The USA is a borrower-friendly country. This dynamic is really good for the economy because it allows for flexibility to take risks and potentially achieve great things. However, it can suck to be a lender when your borrower can’t pay you back.

Today, I will be discussing three separate items:

Why companies become distressed

Why LMEs are on the rise

What the LME wave will bring to the future

Why Companies Become Distressed:

Three factors can push a company towards distress: having a broken business model, having a broken capital structure, or realized ‘stroke of the pen’ / ‘God’ risk.

A broken business model is when a company is unprofitable or stops growing / shrinks over an extended period of time. When that cocktail gets created, the company’s ability to repay its obligations begins to fade (think like 5-6 quarters of severe losses and 0% or negative growth)

A broken capital structure is when a business has too much leverage or no liquidity. A sudden change in the market can quickly push that company to default as they’re unable to cover their obligations

Stroke of the pen / God Risk: New regulation can destroy entire businesses. Imagine if you’re the owner of an importer which strictly buys from China. Congrats, your expenses just multiplied overnight. Or imagine if you were planning to AbnB a home you just purchased in Palisades Park in July? Good luck with that

World’s Smallest Violin for A Guy Who Had $27mm Lying Around (Source: Fortune)

Why LMEs are Heating Up:

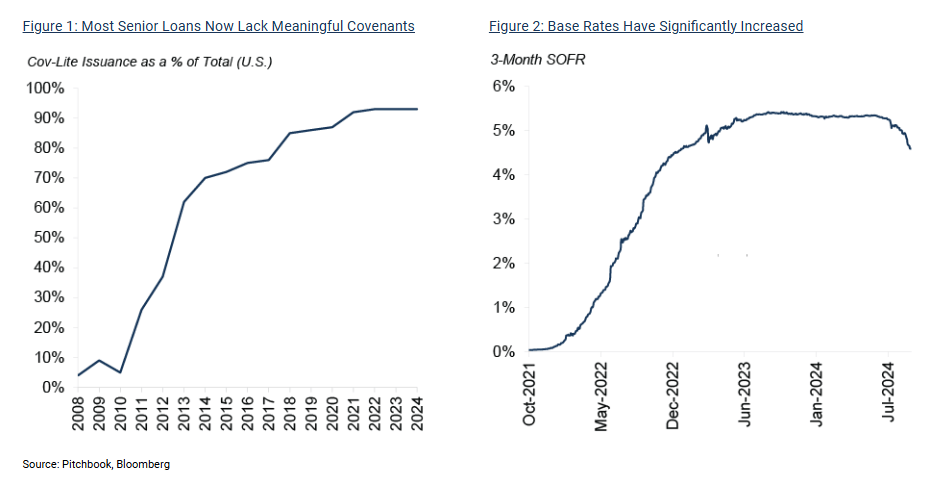

From a technical view, Oaktree summed it up pretty well in the two charts below.

Rates Are Up and Lenders Are Swimming Naked (Source: Oaktree)

Since 2022, rates have skyrocketed and pressured leveraged borrowers with greater debt servicing costs. I know you’re sick of hearing this by now.

Coupled with rates, lenders are just giving money away with no protection (remember folks, always strap up 😉). Now, this largely stems from the heightened competition in credit. There is sooo much new money in credit that investors are clawing over each other to deploy capital which leads to more forgiveness in loans docs. The other evil in the room is that PE shops own more American companies than ever before.

Over 20% of businesses are PE-owned and PE guys have 1 goal. Make money on their investments. Lender covenants don’t really give PE owners the discretion or flexibility to gamble with an investment.

Say it With Me: ‘If you lend to PE, you’ll see an LME!’ (Source: Pitchbook)

The name of the game in PE is the LBO. ‘Leveraged’ is literally in the name. When rates go up, leveraged means risky!

Now, before I throw too much shade around —I do want to address a second-order thought regarding loose credit docs which the legendary Professor David Smith discussed in detail here: Light Covenants or the Right Covenants?

To sum it up, Professor Smith conducted extensive research around the leveraged debt markets to discover that documents do have fewer covenants today. However, default rates have actually trended lower (absent of a crisis). This indicates that docs have mostly been resized to trim the fat of unnecessary restrictions while still embedding core features to protect against losses.

Default Rates Hovering Around Lows Despite Looser Docs (Source: Pitchbook)

So, LMEs are ticking up because rates pressured borrowers, PE guys are crafty to retain value / avoid writing another equity check, and competition to lend has never been greater.

What the LME Wave Will Bring to the Future:

At the end of the day, an LME is still just kicking the can down the road. Docs get ripped open, collateral gets moved around, and new money comes in—- but you’re still left with the core problem: the business is F’d up.

LMEs don’t really fix a broken capital structure. In fact, most forms of LMEs ADD to a distressed capital structure by borrowing more debt. Recovery data shows that lenders recover ~57% in a distressed, non-LME situation and only 47% in a distressed situation where an LME took place.

Some aggressive lenders will get burnt. Will they fold up shop? That depends on their concentration risk and back-leverage to any given name. However, lenders will get more creative with blockers they structure in docs to avoid getting screwed in an LME.

Nevertheless, the criminal is always savvier than the cop. With rates still elevated and 2021 debt maturing, expect more LMEs in 2025.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

LMEs

A critical term to know for sweaty restructuring interviews.

LMEs have been the hottest topic of 2024 and 2025 because NO ONE wants to go to bankruptcy court -- it's simply too expensive.

Examples of LMEs:

-Uptier: New debt issued senior to existing debt --screws over existing lenders (see below for an illustration) ✅

-Drop Down: Move collateral away from existing lenders to a non-loan party, unrestricted subsidiary to raise new debt --screws over existing lenders ✅

-Amend & Extend (Pretend?): Pushing out debt maturities to provide the Company with more time to repay existing debt --screws over existing lenders ✅

-Open Market Purchase: Company buys out existing debt at a discount --screws existing lenders ✅

What's the theme here? Existing lenders are getting screwed!

Lending is a semi-commoditized business, most docs are covenant-lite, and rates rapidly rose 400bps in '22 / '23 = a perfect storm to toy around with the capital structure when facing distress.

Uptier Illustration (Source: The Pulse)

Going Forward:

If you run a club, we want to connect with you to prep your members for interview season. Please shoot us an email @[email protected], would love to make your club the most prepared on campus

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #89

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions