Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions

Premium Database: Database for banking, consulting and buyside roles | The Pulse

Coaching Program: Mock Interviews, Resume Reviews, and Gameplanning | The Pulse

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: PJT, LionTree, Guggenheim and 4 others opened their summer 2026 apps. 37 firms are actively recruiting for summer 2026 positions. As previously mentioned, the turn of the new year was a huge mover for firms to open apps…I guess they feel less shitty about opening apps 5 days into 2025 vs. late 2024 for summer 2026 jobs

New SA 2026 Applications:

PJT: Elite boutique, great Rx team (SA 2026)

Guggenheim: Largest ‘elite boutique’ by headcount / balance sheet (SA 2026)

LionTree: Strong tech-focused boutique (SA 2026)

Leerink: Tech-focused boutique (SA 2026)

Brown, Gibbons, & Lang: Boutique generalist (SA 2026)

Piper Sandler: Solid generalist boutique (SA 2026)

Nomura: Japanese bank (SA 2026)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

56 SA 2025 applications have been released along with 62 FT 2025 apps. This process is largely complete. Just small firms looking for one-off hires.

2026 Recruiting has started but is in the very early days. There are 2 open applications–we don’t expect additional apps to open for a few months.

SA 2025 released apps:

Metropolitan Strategies and Solutions, Federal Consulting - Strategy & Analytics Intern (SA 2025)

FT 2025 released apps:

None

SA 2026 released apps:

None

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2026: KKR, Blackstone, Ares and 3 others opened their SA 2026 applications. Currently 28 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

KKR: Large, multi-strat asset manager—PE focus (SA 2026)

Blackstone: Largest alternative asset manager > $1.0tn AUM (SA 2026)

Ares: Large, multi-strat alternatives investor, credit focus (SA 2026)

Point 72: $172bn AUM hedge fund (SA 2026)

Bain Capital: Investment arm of Bain (SA 2026)

Nonantum Capital Partners: MM PE shop (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 85th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $65 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

2025 Deal Flow

2025 is slotted to be a stronger year for deal flow than 2024—all things considered.

Unless a major war breaks out or macroeconomic forces like inflation really kick up due to proposed legal action (ie tariffs)—all signals are pointing North for greater deal volume across M&A, IPOs, LBOs, and credit markets in 2025.

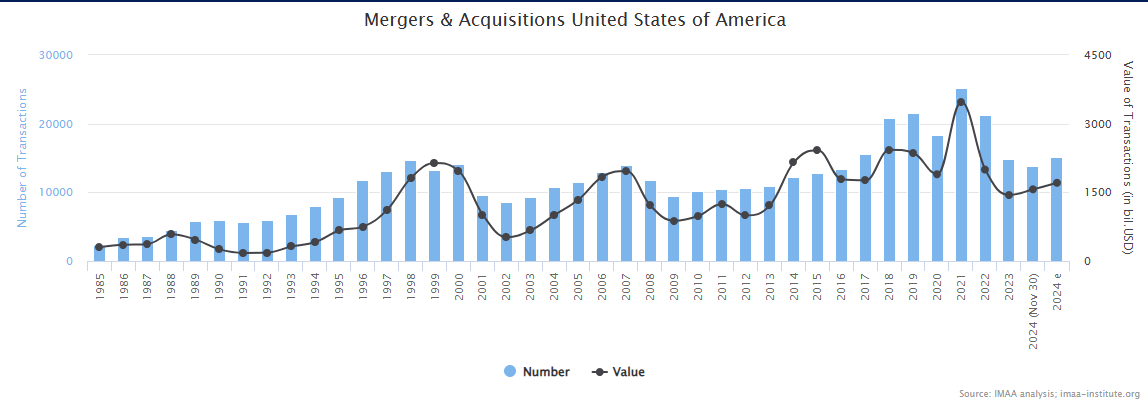

M&A Deal Volume:

2025 M&A volume is poised for a stronger year. As the economy woke up from an inflation and rate-fueled hangover in 2022 & 2023, M&A activity picked up in 2024, but was pretty mid.

~$2tn of U.S. M&A volume in 2024 (Source: IMAA)

However, 2025 will be different. In 2025 we have:

Deregulation

Onshoring

Lower Rates

Persistently Elevated Dry Powder

You can’t sit on the bench forever.

Over the past few years, Lina Khan, the former FTC chair, has been shooting down mergers left and right. A few to name—-Albertson’s & Kroger, Spirit & Jet Blue, and Capri & Tapestry all got cooked by Lina Khan in the name of ‘preserving the competitive business landscape.’

As mentioned in our other recent releases, Trump is rolling back a good book of corporate regulation which should be a tailwind to support M&A activity over the next 4 years. 2025 will be a launching point, but likely won’t see historic M&A volume because bills can’t be passed over night.

Besides deregulation, the onshoring trend, lower base rates, and mountains of asset manager dry powder + corporate cash will also support elevated near-term M&A activity.

IPO Deal Volume:

As mentioned in our latest release, "The Pulse" --#83 / Our 2024 Wins & Losses, 2024 IPO volume was better than 2022 and 2023, but was still pretty shitty. No one really knew what was going to happen in 2024 and that uncertainty was a huge roadblock for 2024 IPO volume. 2025 should see a solid improvement in IPO volume to ~300 IPOs.

Markets eclipsed ATH in the back half of 2024. Companies tend to IPO about a year after markets start ripping. This reflects the time delay between tipping off a bank about running an IPO process and actually being able to get to market—tons of red tape needs to be cut before going public.

At a paltry IPO volume of ~220 in 2024, we should be slotted for ~300 IPOs in 2025 as companies term out of the private markets and look to sell stock at strong valuations.

Some large fintechs like Klarna have already filed plans to IPO in 2025. What are other large fintechs going to do? Raise a series Z from private markets?

These investors need an exit!

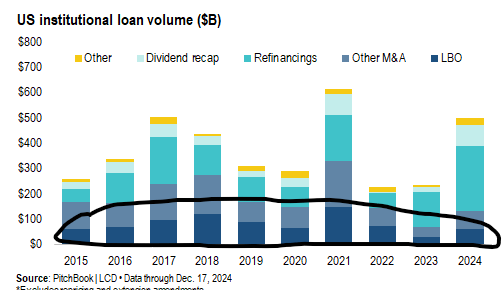

LBO Deal Volume:

This will largely be rates driven, but LBO deal volume is expected to improve on behalf of lower base rates in 2025.

2024 proved that many leveraged companies were capable of withstanding a dramatic rate hike. With cleaner balance sheets and strong quarterly performance, there is a prime opportunity to re-lever these businesses as rates fall.

Additionally, proposed corporate tax cuts may allow sponsors to supplant those cost savings with greater debt—fueling a better case to juice returns off an LBO.

PE guys also NEED to deploy capital.

On a technical basis, funds run on strict timelines for investors to deploy capital and exit their investments (recently the exiting phase has become a little more of a gray area). On a behavioral basis, PE guys are ex-bankers who are itching to do deals.

With muted LBO transactions over the past 3 years, a rebound is overdue.

2025 Should Show Strong LBO Volume (Source: Pitchbook)

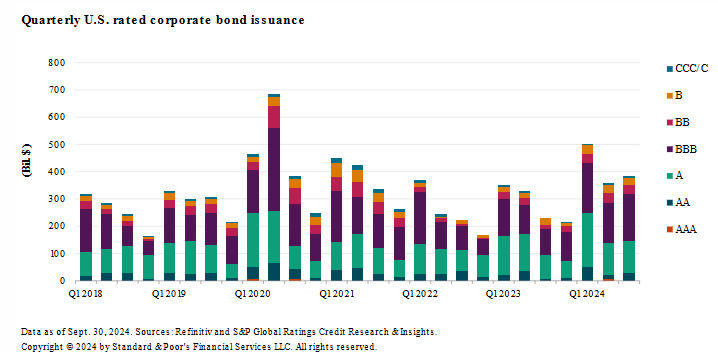

Credit Deal Volume:

The credit markets saw the strongest rebound in 2024 when compared to M&A, IPO, and LBO volume. If you sat in a lev fin, private credit, or public credit seat you were kept pretty busy throughout 2024. In 2025, you’ll be a little busier.

Peep the chart above for loan issuance and the chart below for bond issuance:

IG and Non-IG Issuers Came to Market in 2024 (Source: S&P)

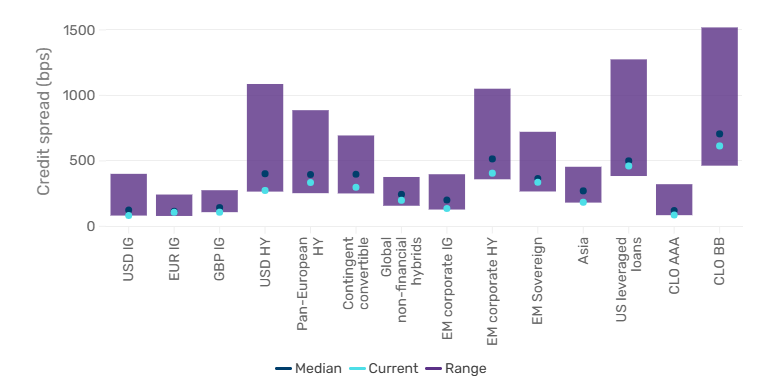

This was largely a spread-driven play as credit spreads tightened to post-GCF lows in 2024:

Spreads Across Risk Buckets at Lows (Source: Man Group)

So, 2024 saw a rebound in credit issuance but that issuance is still below 2017, 2020, and 2021 volumes. In 2025, we should see a moderate uptick in credit issuance.

This uptick is backstopped by greater M&A / IPO / LBO volume and lower, yet elevated base rates—partially offset by modest spread widening as spreads literally can’t go lower.

Another catalyst for greater credit issuance will be the need to finance AI-related capex and any other investment tied to onshoring. However, the timing of this need is uncertain and likely won’t cause a huge need for credit in 2025 relative to standard needs such as acquisitions and refinancings.

Issuers won’t have a problem finding investors due to the mountains of capital plowed into credit over the last 2-3 years. Similar to PE, credit investors are on the clock to deploy—they also want to lock in strong relative yields.

For an interview, you need to form a view on deal volume for 2025. After all, your employment depends on whether deal volume is up or down. I want to make it clear that our 2025 deal forecast is anchored to today’s corporate and consumer performance. Any materially negative changes will certainly hinder volume across the respective markets.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

This week, we discuss IRR math.

Interviewers may ask a question like:

‘I invest $100 today and earn $300 when I sell in Year 5. What’s the IRR of the transaction?’

Really difficult to do that IRR calc in your head, but really easy to see that you made 3.0x in 5 years (MoM or ‘money on money’ or MOIC or ‘money on invested capital’).

Memorize these key 5-year return metrics:

-2.0x MoM = 15% IRR ✅

-2.5x MoM = 20% IRR ✅

-3.0x MoM = 25% IRR ✅

-3.5x MoM = 30% IRR ✅

Please note that these ONLY work for 5 year investments with NO intermittent cash flow.

Thankfully, most interview questions related to this will be a 5 year timeline.

——————————————————————

-Calculating IRR in excel = EASY

-Calculating IRR in your head = HARD

-Memorizing key MoM multiples and their respective IRRs?

=

EASY!

IRR is the internal rate of return. Commonly applied when calculating transactions such as LBOs.

Going Forward:

If you run a club, we want to connect with you to prep your members for interview season. Please shoot us an email @[email protected], would love to make your club the most prepared on campus

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #85