Black Friday Sale! 30% off the Premium Database THIS WEEK ONLY (12/1 → 12/8)

Check out our Premium Database for application updates on over 300+ banking / consulting / buyside firms. The only resource you’ll need to navigate the summer 2026 recruiting season.

Venmo @ThePulsePrep $35 or pay with credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Union Square Advisors opened its summer 2026 apps. 9 firms are actively recruiting for summer 2026 positions with many January deadlines. December and January will be HOT for application openings! You need to be preparing behaviorals and technicals now to be prepared for interview season around February and March

FT 2025: No updates here. This is our last week covering FT 2025 positions. We will begin our FT 2026 coverage in June. 62 firms opened apps for the FT 2025 season. Some firms will continue to open up ad-hoc apps, but this process is dead

New SA 2026 Applications:

Union Square Advisors: Tech-focused boutique, has the Olympian rowing guy (SA 2026)

New FT 2025 Applications:

None

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

53 SA 2025 applications have been released along with 57 FT 2025 apps. Lock up an offer before recruiting season ends! If you have any questions shoot us an email.

SA 2025 released apps:

Capvision - Summer Research Associate (SA 2025)

FT 2025 released apps:

Actionist Consulting - Business Analyst (FT 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2026: Global Atlantic Financial Group announced its application. Currently 9 buyside firms recruiting for SA 2026 seats

New SA 2026 released apps:

Global Atlantic Financial Group: Investment intern at KKR-owned insurance company (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 79th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $35 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $35.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Why High Rates Didn’t Destroy the Economy

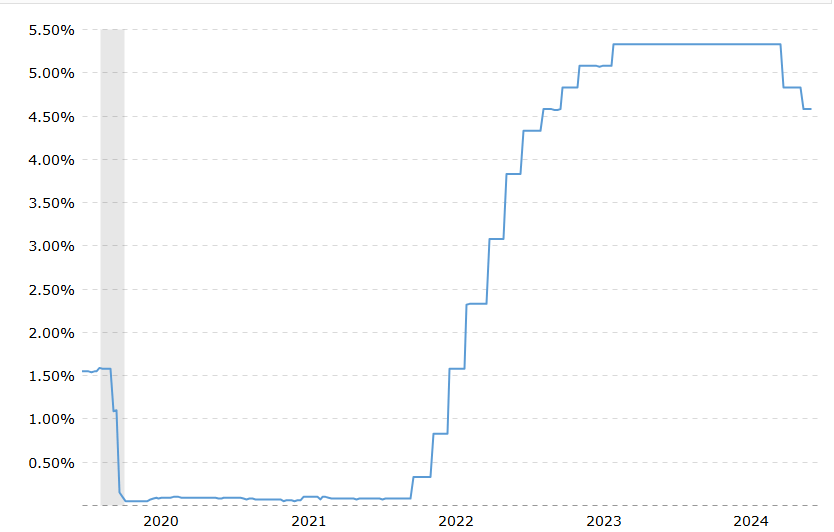

As we all know by now, rates were hiked at the fastest clip in history from near 0 in March 2022 to 5.25 - 5.50% by July 2023. Now, the cycle is reversing and the FED has cut rates 75bps since September 2024 (standing at 4.50 - 4.75% today).

5yr Federal Funds Rate Chart (Source: Macrotrends)

Rate cuts = stimulus for the economy. Everyone knows that.

Today, we will investigate why 500bps of rate hikes from March 2022 → July 2023 didn’t break the economy. Let’s break this down into 3 key reasons:

Consumer balance sheets were phenomenal post-Covid

Companies resized their businesses in preparation for “the most predictable recession in history”

Debt contracts take a long time to renegotiate and lenders amended + extended any underperforming credits

The Consumer:

The consumer drives 66% of the U.S. GDP via their spending. This stat is overused, but it’s so important. If the consumer falls, the U.S. economy falls with them.

Despite the higher rates and elevated inflation experienced from 2022 → 2024, the consumer stood resilient. Low unemployment, great wage growth, large Covid-era savings, and cheap pre-Covid debt all supported the consumer balance sheet throughout the last two years of elevated rates and inflation (see "The Pulse" --#76 / Total Market Factor Index for more).

From 2022 → 2024, the consumer kept spending and they avoided bankruptcy. This oiled the economy to keep moving forward. Rates hovered around 0% in March 2022, but other metrics such as the unemployment rate also sat at historical lows of 3-4%. The same concept applies to consumer savings which sat historically high post-Covid due to government stimulus.

Unemployment Couldn’t Move Any Lower (Source: FRED)

So, over the last two years we experienced a convergence of REALLY GOOD consumer economic metrics coming back towards ‘normalized’ levels. Also, 88% of consumer debt is fixed, so greater short-term rates don’t really affect them ("The Pulse" --#61 / Consumer Debt Mix).

The Enterprise:

In 2023 and 2024, most brainiacs wouldn’t shut the fuck up about the ‘impending recession.’ With everyone saying the same thing, management tends to listen.

Management across industries slashed costs in a proactive attempt to resize operations. Historically, people and businesses have been reactive to bad news and end up taking action too late.

Companies cut variable costs such as: marketing, IT, and other SG&A (aka layoffs). It’s important to note that cost cutting has a fixed upside—after all, costs cannot fall below $0. However, trimming some fat in 2023 and 2024 alongside pass-through inflationary costs to well-balanced consumers supported corporate margins.

Margins Grew Despite Greater Interest Expense (Source: Guru Focus)

Interest expense DID grow over the last two years as corporations have more of a balance of fixed vs. floating rate debt when compared to the consumer. However, proactive managerial decisions largely offset any negative effects of greater interest expense.

The Credit Markets:

My last point angles towards the credit markets over the last two years. I want to hammer home two interconnected concepts here:

Debt contracts take time to renegotiate

Credit investors opted to amend and extend contracts vs. call defaults

Debt contracts can’t be renegotiated overnight. Most corporate bonds are 3-7 years and anything originated pre-2022 carried a very low relative interest rate.

Regarding floating rate debt, loans are priced on SOFR + a spread. So, the interest rate does automatically adjust. However, any troubled corporate will call lenders to the table to adjust the terms. Ever heard of PIK?

When negotiations are underway, there is often great reprieve given to the corporate so tripped covenants will be waived. On that note, lenders opted to amend and extend contracts with poorer credits vs. calling default.

In the low rate environment pre-2022, documents were fairly light in terms of restrictive language to the company (covenants, investment baskets, EBITDA definitions, etc). Any financial troubles caused by greater interest expense allowed lenders to bring management back to the table and negotiate for stronger credit terms vs. immediately calling default. A default would push a company towards bankruptcy.

Example: if interest coverage covenants were tripping due to the 500bps increase in SOFR, a lender may have taken time to renegotiate with the borrower to waive that temporary coverage breach in exchange for something like a tighter leverage covenant or greater restriction on the company’s ability to move collateral outside of a lender’s control.

This action makes the lender a little happier and keeps the underlying company out of bankruptcy.

My single biggest takeaway from the performance of the last two years amidst a higher rate environment is that people jump the gun on forecasting without baking in all relevant information. On paper, a 500bps increase in base rates sounds detrimental to the economy, but if you peeled back the onion you’d see that the economy was poised to withstand rate hikes——at least in the short term.

Up to the FED to determine what ‘higher for longer’ really means.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Timeline Update—-Where you should be in your Interview Prep

Remember this tasteful graphic?

You Need to be Prepping Responses to Interview Questions

This week, I want to quickly debrief the recruiting season thus far and what you should be doing now to be prepared for interviews.

So far 20 firms have opened SA 2026 applications:

9 banks

9 buyside firms (mostly PE)

2 consulting firms

At this point, you should have applied to every single application that you’re interested in. Applying is a skill in itself and the more you apply, the better you get at it (ie navigating painful Workday applications).

Also, by this point you should have networked with 35+ bankers / consultants / investors across the street. Ideally, you have been able to chat with ~3-5 people at any given firm. As we have said in previous newsletters, our advice has been to send 3-5 networking messages each day to ensure you can get enough people on the phone before apps opening.

What you need to be doing now:

Applying Early and Often to all applications

Crushing behaviorals

-Your ‘Tell me about yourself’ response should be perfect by now. Less than 1 minute and clearly walks the interviewer through your resume from the school you attended to why you want to working in banking / consulting / investing

-You should have 5 other stories to parlay into responses for all other behavioral questions such as: ‘tell me about your greatest weakness,’ ‘tell me about a time you had to work on a tight deadline',’ etc

-Follow BLUF and the STAR method. Look those up on Google if you don’t know what they are yet

I’d prioritize behavioral mastery before moving onto technicals given the fact that most interviews won’t take place until February / March. So you don’t need to be a technical nerd until January.

Going Forward:

If you run a club, we want to connect with you to organize FREE Bulk Coaching Sessions. Please shoot us an email @[email protected], would love to make your club the most prepared on campus

Coaching Details:

Pay for 3, get one FREE = $150. (Venmo @ThePulsePrep or Credit Card: (Coaching Bundle $150 for 4 Sessions)

1 hour session = $50. (Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

30-minute session = $30. Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 95% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #79

Gold’s Record Breaking Surge Is Turning Heads — And This Stock Is Up 220% 🤯

Bank of America forecasts gold reaching $3,000 by 2025, catapulting this under-the-radar stock into the spotlight. With smart money pouring into gold and insiders loading up, this hidden gem is just getting started.