Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions

Major Premium Database Upgrade!

For Premium Database users only, we are now offering finance job opportunities that:

A). Pay $50 / hour (covers the entire cost of the Premium Database)

B). Offer relevant finance experience to boost your resume

For the next month, we will be running a 25% sale for the purchase of our Premium Database. Details of our Premium Database can be found in the ‘Premium Database’ section below.

Purchase with credit / debit card via Stripe: (ThePulsePrep 25% SALE—Stripe.com)

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Piper Sandler and Deloitte opened their applications this week. 25 banks are actively recruiting for SA 2027. You need to be crushing advanced technicals right now to compete in this cycle, check out the following bullet if you need some help

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Piper Sandler: Boutique advisory (SA 2027)

Deloitte: IB arm of Deloitte (SA 2027)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

This process will be completely done by early February, and we will stop tracking at the beginning of March.

SA 2026 released apps:

Alvarez & Marsal - Analyst Public Sector Services (SA 2026)

SA 2027 released apps:

None

FT 2026 released apps:

None

Buyside:

Where We’re At:

SA 2027: Bridgewater, Atlas SP, and LLR Partners opened their apps this week. There are currently 20 buyside firms actively recruiting for SA 2027

Buyside Associate Recruiting: Betram Capital, Leon Capital Group, LS Power and more are seeking associates for immediate and summer 2027 start dates. This is a new section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

Bridgewater Associates: Large, multi-strat HF (SA 2027)

Atlas SP: Structured credit arm of Apollo (SA 2027)

LLR Partners: LMM PE (SA 2027)

New Buyside Associate released apps:

Betram Capital: LMM PE (summer 2027 start)

LS Power: LMM PE power & energy fund (immediate start)

Leon Capital Group: Healthcare PE (immediate start)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 133rd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $50 Credit Card / Debit Card: (ThePulsePrep 25% SALE—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

2025 Wrap-Up

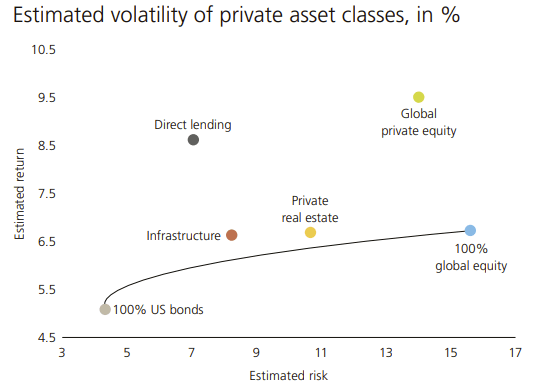

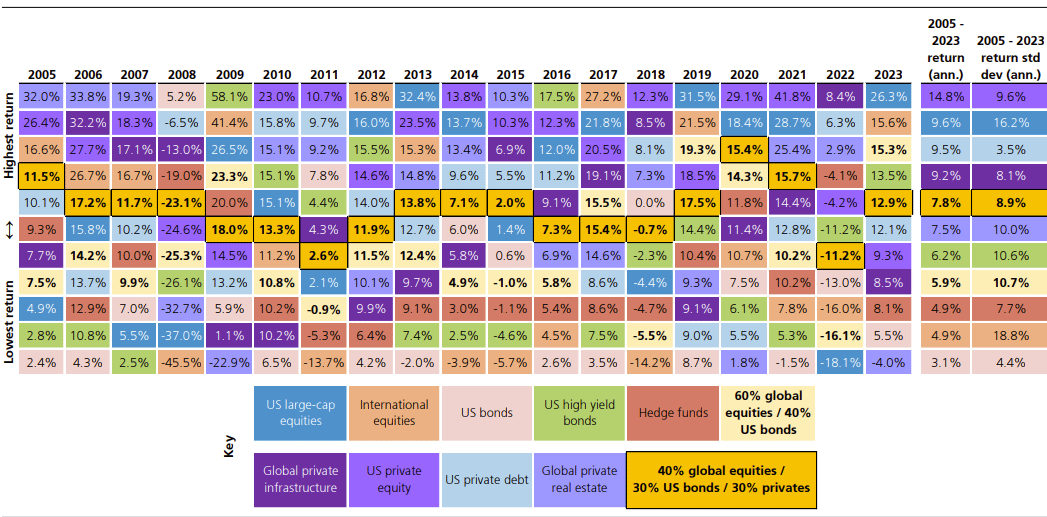

Private vs. Public Markets

When people talk about investing, they usually mean public markets. Stocks, ETFs, indexes like the S&P 500. You open an app, buy a ticker, and you are in.

Private markets, meaning private equity and venture capital, are talked about more as an alternative asset class rather than something most individuals interact with day to day. Public and private market returns can look very different, especially during specific time periods, because of PE time horizons and the fact that their investments are not marked-to-market.

In good times, public and private markets do not look that different. Public equities have returned around 9 to 10 percent per year over long periods. Private equity funds like to advertise returns in mid to high teens. That sounds meaningfully better, but those numbers usually reflect top-performing funds, are reported before fees, and are smoothed over time. The differences become much more obvious during periods of stress.

Look at the 2008 financial crisis. Public markets got absolutely wrecked. The S&P 500 fell about 57 percent from peak to trough, and valuations collapsed fast. The forward P/E ratio dropped from roughly 16 or 17x in 2007 to around 10x in early 2009. Every bad headline showed up immediately in stock prices, so if you owned public equities, you felt it daily.

Source: GWM Investment Research

Private equity looked way calmer at the time. PE funds reported smaller drawdowns and less volatility, not because their companies were holding up better but mainly because of accounting. Private assets are valued way less frequently using models, not live prices, so losses showed up slowly. Many PE funds eventually marked assets down in the years after 2008.

The same pattern showed up during COVID. In March 2020, public markets dropped around 34 percent in a few weeks. Valuations moved fast again with the S&P 500 going from about 19x earnings before COVID to briefly lower, then shot above 22x by the end of 2020 once rates went to zero.

Private markets barely moved at first. Early COVID valuations in PE and VC looked solid then exits disappeared, fundraising slowed, and reality set in. By 2022 and 2023, many venture-backed companies saw effective valuation cuts of 30 to 70 percent, even if they avoided officially calling them down rounds.

Source: Pitchbook

The 2022 rate shock made the contrast even clearer. Public markets repriced immediately. The S&P 500 P/E fell from around 22x at the end of 2021 to about 16x by late 2022. Tech stocks were hit very hard and PE valuations stayed high on paper, but deal activity collapsed. Eventually, prices adjusted, but only after liquidity dried up.

Bottom line, public markets are brutally transparent. You see losses instantly, but prices also reset and recover faster. Private markets feel smoother, but that smoothness comes from delayed pricing and illiquidity. Over a full cycle, the economic reality is often similar. The difference is when and how you are forced to confront it.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Comps & Precedent Transactions Analysis

Just covering the Big 3 of Valuation today.

-Comparable Companies Analysis-

Matching apples to apples.

At its core, comps analysis involves spreading financial metrics of very similar companies to determine how they match up against one another.

You're trying to value Company A: a U.S.-based cybersecurity, SAAS business with a $20bn enterprise value

To find good comps, you want to find as many SIMILAR businesses as possible (3-5) usually works. They should be similar in:

-Industry

-Business Model

-Size

-Geography

If you check those boxes, you'll spread some multiples such as EV / EBITDA, EV / Sales, and Debt / EBITDA to assess where Company A sits amongst peers

To arrive at a valuation, you'll take your median EV / EBITDA and apply it to Company A. This is your comps valuation!

-Precedent Transactions Analysis-

Easy one and similar to comps.

Let's revert back to valuing Company A. You want to see if there were any RECENT deals that involved the acquisition of a SIMILAR business by either:

a). a strategic buyer (typical operating company--usually a competitor)

or

b). a financial sponsor (PE firm)

The deal must be recent. Think the last 2-3 years to account for current market conditions

So, with precedent transactions you can arrive at a proxy for Company A's value by analyzing recent transactions of similar companies.

At the end of the day, valuation boils down to the number someone else is willing to pay for something.

Going Forward:

Our Referral Program

3 Referrals = Free Resume Review

5 Referrals = Free Premium Database

10 Referrals = Free Coaching Session

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #133