Major Premium Database Upgrade!

For Premium Database users only, we are now offering finance job opportunities that:

A). Pay $50 / hour (covers the entire cost of the Premium Database)

B). Offer relevant finance experience to boost your resume

For the next month, we will be running a 25% sale for the purchase of our Premium Database. Details of our Premium Database can be found in the ‘Premium Database’ section below.

Purchase with credit / debit card via Stripe: (ThePulsePrep 25% SALE—Stripe.com)

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Wells Fargo, Barclays, Solomon Partners and more opened their applications this week. 23 banks are actively recruiting for SA 2027. This was our largest update for the Summer 2027 recruiting season; word on the street is that interviews will begin in January

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Wells Fargo: Large, full-service bank (SA 2027)

Barclays: UK-based bulge bracket (SA 2027)

William Blair: Middle market advisory bank (SA 2027)

Ardea Partners: UK-based boutique (SA 2027)

Santander: Spanish middle market bank (SA 2027)

Solomon Partners: Boutique (SA 2027)

Texas Capital Bank: Regional bank (SA 2027)

Union Square Advisors: Tech boutique (SA 2027)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

Some small/boutique firms have yet to release apps, but this process will be completely done by early February, and we will stop tracking at the beginning of March.

SA 2026 released apps:

None

SA 2027 released apps:

None

FT 2026 released apps:

Dayblink Consulting - Analyst (FT 2025)

Buyside:

Where We’re At:

SA 2027: Citadel (shitadel), Point72, and Bessemer Venture Partners opened their apps this week. There are currently 17 buyside firms actively recruiting for SA 2027

Buyside Associate Recruiting: Blackrock, Blue Owl, and GDA Luma Partners are seeking associates for immediate and summer 2026 start dates. This is a new section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

Citadel: Large, multi-strat HF (SA 2027)

Point72: Large, multi-strat HF (SA 2027)

Bessemer Venture Partners: Large VC fund (SA 2027)

Sculptor Capital Management: RE acquisitions intern (SA 2027)

Eldridge Associates: Investments intern, dynamic fund (SA 2027)

Dodge & Cox: Investments intern (SA 2027)

New Buyside Associate released apps:

Blackrock: Largest asset manager (PE TMT associate; summer 2026 start)

Blue Owl: UMM credit fund (Infrastructure credit associate; immediate start)

GDA Luma: Distressed investing shop (Distressed associate; immediate start)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 132nd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $50 Credit Card / Debit Card: (ThePulsePrep 25% SALE—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

Seasonality in Business

For many businesses, Q2 is very different from Q4. Some small businesses or entities make their entire year in only a few months. Think about snow plowing or Mariah Carey every time December rolls around.

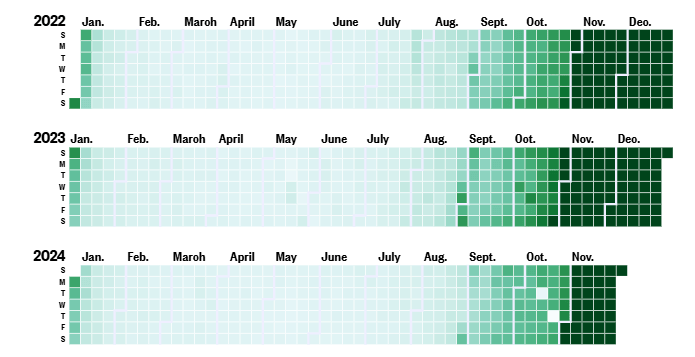

“All I Want for Christmas is You” Total Listens Heatmap (Source: last.fm)

Mariah Carey is estimated to earn a disgusting $2.6 million per year from royalties generated by this song alone. The song was released in 1994….long before many of us were even born.

I bet she has no idea how to even spend all of that money. Talk about passive income.

Anyways, seasonality is a very real factor that influences businesses of all sizes worldwide. As an investor or analyst, you want to make sure that seasonality is not clouding your vision of the underlying business.

For these seasonal enterprises, it’s critical to analyze LTM (last twelve months) metrics when comparing historical performance or when spreading comps. Let’s look at Amazon together to visualize seasonality, what you should compare, and what you shouldn’t.

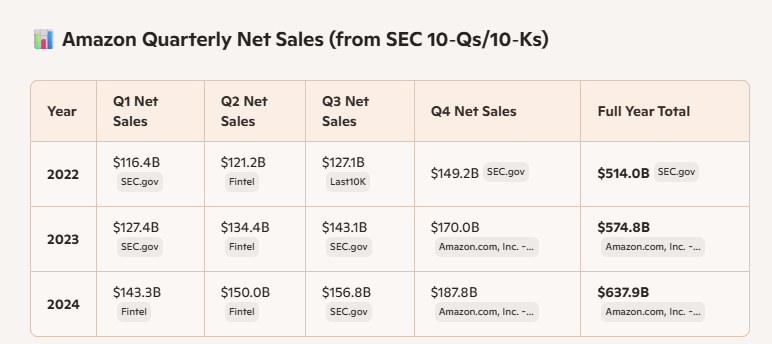

Amazon Net Sales (Source: My Quant, CoPilot—doesn’t need to sleep)

I’ll say it again. ILAI. I LOVE AI.

Copilot whipped this shit up in 3 seconds. Even an old head like me who is nice in the sheets would need a good 5-10 mins to spread these by hand. A human intern would probably take 6 fucking hours to put something like this together.

I digress. Amazon is a very seasonal business. They over-perform in Q4 as the entire world buys gifts for the holidays.

Here is what you should compare:

Quarters year to year (ex: Q1 2022 vs. Q1 2023)

Full year numbers or LTM stats (ex: 2023 vs. 2024 or LTM 1Q22 vs. LTM 1Q23)

Here is what you shouldn’t compare:

Quarter to quarter metrics (ex: Q4 2023 vs. Q1 2024)

It’s all about smoothing the numbers to get a complete view of business performance. You’d be an idiot to compare a company like Amazon quarter to quarter because it’s a seasonal business. It makes substantially more money from people October through December when holiday shopping is in full force vs. January through March when everyone is skiing or depressed.

Now, LTM comparisons work because you’re capturing a full years’ performance (every single season). However, I’d still urge you to just compare something like LTM 1Q22 with LTM 1Q23 vs. LTM 1Q22 with LTM 2Q22. The reason being is that you’re now playing with the concept of annual variance—a business may only expect to grow 5% YoY from Q1-Q1, but 7% from Q2-Q2.

^plus, nobody else does that. Oddball metrics don’t go very far in finance. Alpha is found by analyzing standardized metrics in a different way.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Merger Math

Problem:

Company A (21x PE multiple) buys Company B (15x PE multiple). Is this transaction accretive or dilutive?

^PE is Price / Earnings for the slow folks.

Before jumping into an answer, I first need to ask how this transaction is financed. What is the mix of cash, debt, and equity to fuel the purchase?

In this case, let’s say it’s an all-stock transaction. Great, I immediately know that this is an accretive transaction.

If the acquiror’s equity is “more expensive” than the target’s equity (ex: 21x PE > 15x PE), than this is accretive for the acquiror when financing the transaction with 100% equity since Company A is effectively buying earnings at a discount to what its own earnings trade at.

Imagine if you could buy a dollar for only 50 cents. That’s essentially what’s happening here.

Don’t get it twisted, this absolutely does not apply if there is a true financing mix (ex: 50% debt, 50% equity). I’ll review this nuance next week.

For now, if BIG PE buys SMALL PE, the transaction is accretive. If SMALL PE buys BIG PE, it’s dilutive.

Going Forward:

Our Referral Program

3 Referrals = Free Resume Review

5 Referrals = Free Premium Database

10 Referrals = Free Coaching Session

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #132

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions