Pay $65 via debit / credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. This provides you with a full year of access and the database will be sent to you every Sunday.

Additional details of the database can be found below. Gain an edge over everyone else.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Stifel and Houlihan Lokey opened their applications this week. 10 banks are actively recruiting for SA 2027

FT 2026: Spartan Group and Ascend Capital Group opened their apps. 69 firms are actively recruiting for FT 2026.

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Stifel: Middle market bank (SA 2027)

Houlihan: Elite boutique, great Rx team (SA 2027)

New FT 2026 Applications:

None

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

This process is 85% complete. Smaller firms will continue to release applications into early 2026.

SA 2026 released apps:

None

SA 2027 released apps:

Protiviti - Technology Consulting Intern (SA 2027)

FT 2026 released apps:

Lake Partners Strategy Consultants - Analyst (FT 2026)

Buyside:

Where We’re At:

SA 2027: No updates here. There are currently 11 buyside firms actively recruiting for SA 2027

New SA 2027 released apps:

None

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 130th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

50 Year Mortgage

The 50-year mortgage has been the recent obsession of the finance world. Today, we dive into a primer of how mortgage markets work + the pros / cons of the proposed 50-year mortgage.

First, a primer of how mortgages work.

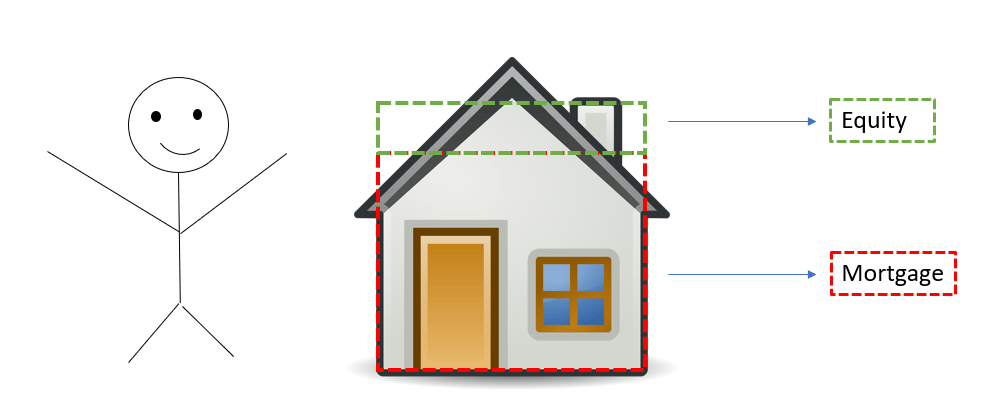

A mortgage is a loan used to buy a house. Conceptually, it works similarly to an LBO where the sponsor (you) contributes a little bit of equity and borrows a lot of debt from the lender (the bank / non-bank mortgage company) to buy an asset (a house). Many people live in their homes for many years and therefore mortgages are long-dated loans with terms typically ranging between 15 and 30 years in the United States.

20% Equity, 80% Mortgage (Source: The Pulse)

The average person is not sitting on $500K -$2.5mm liquid, nor is it wise to plow all of that money into a single investment if you don’t have to. The primary purpose of a mortgage has always been to make homeownership more affordable by allowing people to effectively spread home payments over a long period while still providing the seller with the full value of their house upon the close of the transaction.

The longer the term of your mortgage, the lower the monthly payment. However, the interest rate charged by the bank will also be greater because the bank is assuming duration risk by lending you a lump sum of money for a longer period of time. That’s lending 101.

In the United States, the most common mortgage is the 30-year fixed mortgage. These fuel the ~$21tn U.S. mortgage market. One of the largest markets in the world, larger than the entire Chinese stock market.

How I Feel Locked In On The MBS Market

Two questions:

a). why is the U.S. mortgage market so large?

b). why are mortgage lenders comfortable with providing long-duration, fixed rate paper?

Both questions are answered by the invention of the mortgage-backed security (“MBS”). An MBS is a bundle of hundreds or thousands of mortgages packaged into a tradeable security which is typically offered via a securitization. The fixed-rate nature, large volume, and strong credit characteristics of these securitizations allow for tight pricing and ample liquidity. This competitive MBS market backdrop provides lenders with execution certainty and constant funding to offer fixed rates, low rates, long terms, and large loan amounts.

^In other words, for a lender to be aptly compensated for assuming the risk of providing a mortgage and holding it on balance sheet with no secondary market, they should be getting rates of 10-20% with maximum terms of maybe 10 years. After all, their protection lies in your ability to continue receiving income to make timely payments (you can be fired at any second) and the house retaining value greater than the total loan size.

So, be thankful for the United States mortgage market and mortgage-backed securities. Otherwise, your cash-poor ass would never be able to afford a decent home.

Now that we covered all of that shit, let’s dig into the newly proposed 50-year mortgage. Structurally, this would look exactly like a 30-year mortgage…except it will have a 50-year term and a slightly more expensive rate (likely 50-80bps). For all the squids out there, that’s like 0.5-0.8%.

Every jackass has been saying: “You’ll owe X times more interest with the 50-year vs. the 30-year!!! It’s not a good trade!”

Well guess what, those same bastards were probably saying the same thing when the 30-year mortgage was created in 1948. The math is simple, you get a lower monthly payment in exchange for a longer term and a higher rate. No other combination of that equation will ever work.

Sample Mortgage (Source: Yours Truly)

^a little moment of appreciation for me still being nice with it in the sheets. Thanks, take notes.

The bastards are correct, you will pay more interest throughout the life of the 50-year mortgage. In fact, you’ll pay 2.2x more interest vs. the 30-year mortgage. However, you already pay 2.5x more interest with the 30-year mortgage vs. the 15-year mortgage. Maybe the $93 of monthly savings isn’t worth the extra interest for you.

But if the lower monthly payment allows you to afford a house, then go for it! The cost savings are not gigantic, but if it’s enough to make you comfortable then you should be happy. Home equity is an invisible concept anyways, making a meaningful return on your house is incredibly difficult when you factor in all of the ancillary cash outflows such as maintenance, taxes, insurance, etc that eat away at your IRR throughout the life of the investment. Run this simple scenario in excel: spread cash outflows every month over 30 years and you’ll see how hard it is to make money on such a long-term, negative cash flow investment.

This isn’t 1948, it’s hard to imagine that your $1mm house will be worth $33mm in 50 years. Keep pounding the S&P.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

LBO

The leveraged buyout (“LBO”) is private equity’s favorite tool.

I commit a little bit of equity and borrow a bunch of debt to buy a company. This can ultimately enhance my return as I pay down debt using cash flow from the business throughout the life of the investment. Btw, you can check out our free LBO template with answer key here on our Buyside Associate site: Free LBO

The KKR founders created this transaction structure to lever TF out of “boring” cash-flowing businesses. Their disciples quickly set up 19,000 other PE firms to buy nearly every single type of company across all sizes, industries, and geographies. PE influences your life whether you like it or not and that influence is financed with the LBO.

When I was interviewing for the Buyside, I memorized 6 core pillars of LBO candidates:

LBO Pillars (Source: The Pulse)

Tbh, these pillars are great for practically any type of investment.

How the LBO process works:

Significant diligence and assessment of comparative valuations to determine the relative value of the business in question

Draft assumptions of the purchase price by applying an LTM EBITDA multiple or adding a premium to the stock price (if the company is public)

Create a Sources & Uses to assess the amount of financing needed for the transaction (want as much leverage as possible to boost your return)

Project out cash flows over the hold period using all excess cash to pay down debt

Apply an exit multiple to the last year’s EBITDA and then pay off all remaining debt. Your end value is your exit equity value

Calculate the IRR from year 0 (equity check written) to the final year (equity check expected to be received). Compare the calculated IRR with your fund’s hurdle rate to determine the viability of the investment

Now, an LBO isn’t all financial engineering. Oftentimes a PE firm will execute some level of operational improvement (firing people, growing revenue streams, etc) to add value to the transaction. However, adding a shit ton of leverage and assessing capacity for multiple expansion are certainly large drivers of the transaction’s value.

For an interview, be sure to understand what an LBO is, what a good LBO candidate looks like, and the basics of how an LBO process works.

Going Forward:

Our Referral Program

3 Referrals = Free Resume Review

5 Referrals = Free Premium Database

10 Referrals = Free Coaching Session

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #130

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions