The Pulse Part 2: Buyside Associate Recruiting

We officially launched our Buyside Associate Recruiting Platform.

15+ Real Models / Case Studies with solutions + a database of jobs directly from headhunters. The Pulse gives IB analysts the access plus the modeling prep needed to stand out.

Private equity, hedge funds, private credit, venture capital, and growth equity. This platform is tailored to fresh graduates and analysts who are thinking about jumping from banking / consulting over to the Buyside.

This 40% discount won’t last forever, sign up here: https://thepulseprep.com

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Houlihan Lokey kicked off Summer 2027 coffee chats. Check Handshake

SA 2026: No updates here. 103 firms are recruiting for SA 2026

FT 2026: No new updates. 2 firms are actively recruiting for FT 2026

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

None

New FT 2026 Applications:

None

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

BCG released their application two weeks ago. No new firms have opened apps this week, though we expect more volume as we get later into the summer.

SA 2026 released apps:

BCG - Summer Associate (SA 2026)

FT 2026 released apps:

BCG - Full-time Associate (FT 2026)

Buyside:

Where We’re At:

SA 2026: Bridge Investment Group, Walton Street Capital, and Walleye Capital opened their apps this week. Currently 105 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Bridge Investment Group: RE investing shop (SA 2026)

Walton Street Capital: REPE (SA 2026)

Walleye Capital: $32bn AUM HF, Fundamental L/S (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 106th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

Soft Data vs. Hard Data Gap

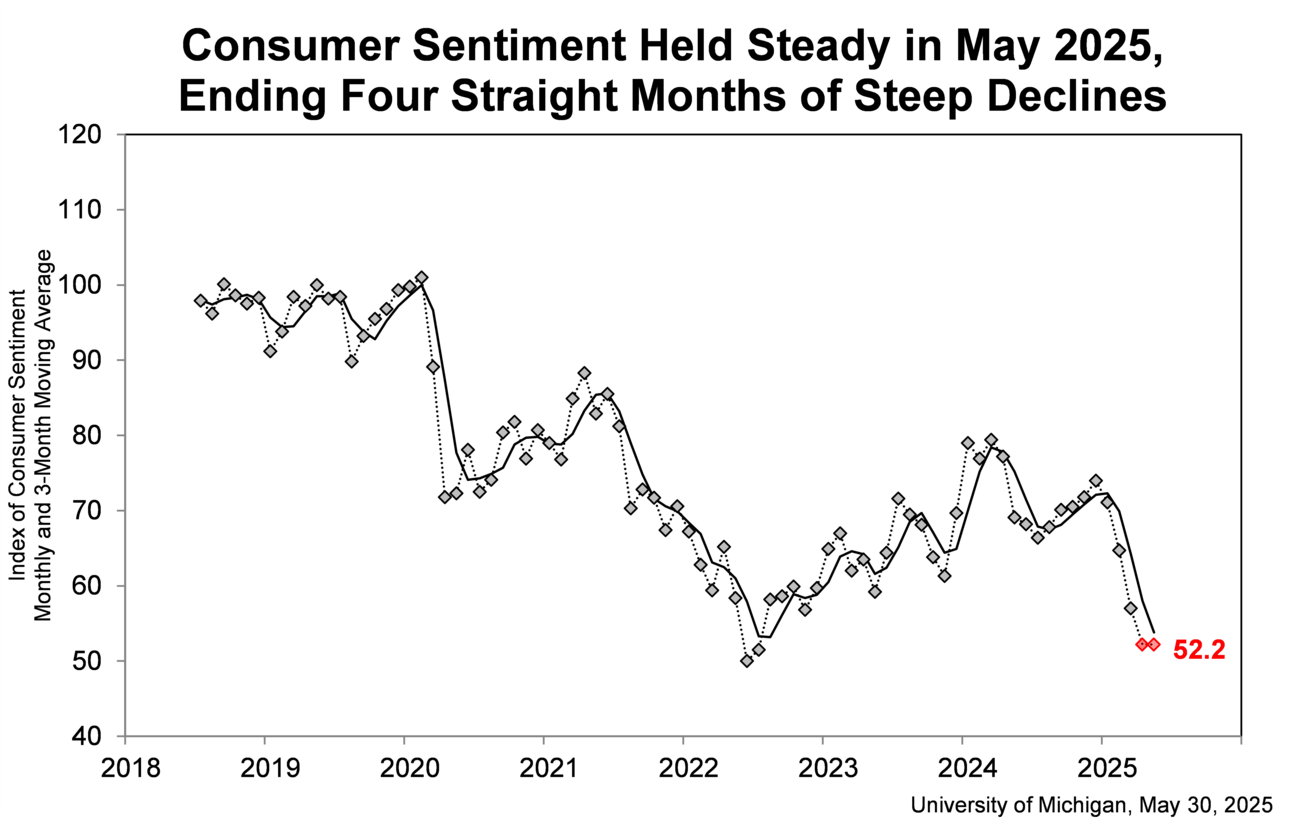

All I read about is how consumer sentiment is low and everyone thinks we are heading into a recession. People usually quote the University of Michigan Consumer Sentiment survey when relaying this ‘soft data.’

However, the real numbers are telling a much different story.

Wage growth is outpacing inflation, people are spending money, and unemployment is still pretty low— ‘the hard data.’ So, what is everyone complaining about?

Consumer Sentiment is Low (UMich)

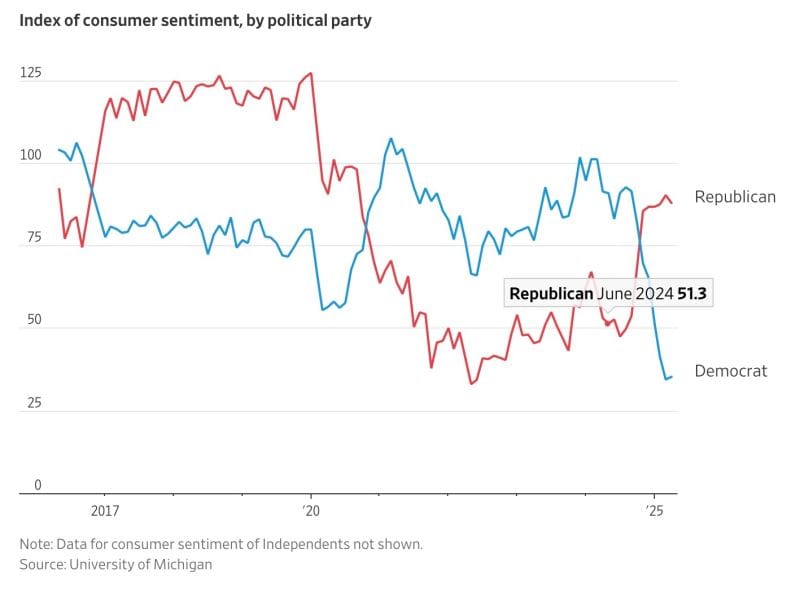

Democrats are Happier with a Democratic President. Vice Versa for Republicans (Source: University of Michigan)

Actually, there is no logical complaining. People surveyed are just clearly left-leaning. Also, only 500-600 people are ever surveyed. This is ridiculous.

The next time you see someone quote the UMich Consumer Sentiment survey, just remember that it’s total bullshit.

I don’t understand how or why this survey became so popular, but it’s statistically unreliable data. I am a huge proponent of behavioral investing, but behavioral data has to be calculated correctly to be properly leveraged.

So, what are some better ways to gauge consumer sentiment?

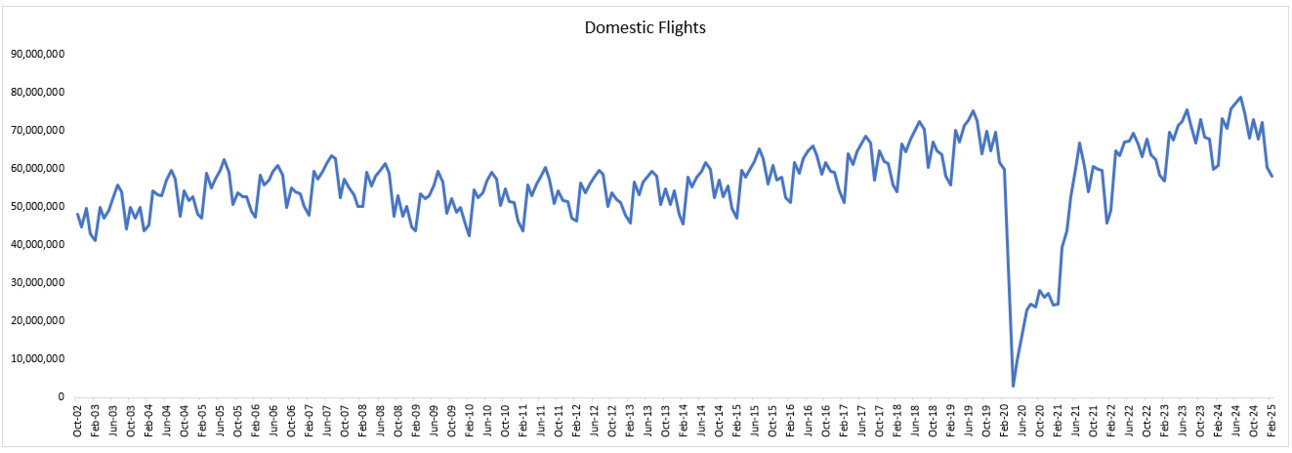

Air traffic

Retail foot traffic

Communication about stocks, money, and investing

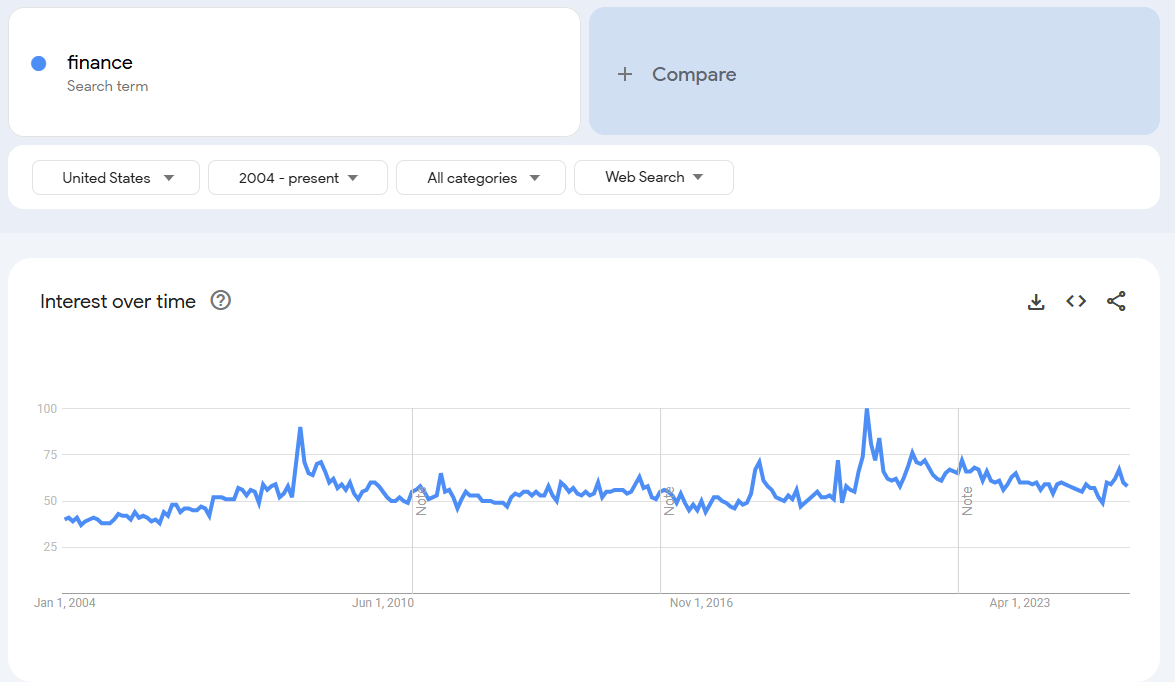

Search ‘Finance’ in Google Trends

Let’s start with air traffic. This is a hard data point; however, it is not truly economic data. Regardless, we can look at air traffic trends as a proxy for assessing consumer sentiment because people typically fly more when they feel financially healthy.

Slight Drop in Air Traffic (Source: FAA)

The seasonality of air traffic is shockingly consistent. Crazy tbh. People generally fly less in the winter than they do the summer. People also fly less during periods of economic stress. There is a small, yet noticeable decrease in flights around 2008 and a huge drop during Covid. Right now, we are in the midst of what looks to be a larger than average decrease in flights.

Moving onto retail foot traffic, people often shop less when they’re feeling financial stress. Placer.Ai does a great job of laying out patterns in retail foot traffic. 2024 Retail Foot Traffic Recap – Placer.ai Blog. Some major limitations here are that a). our population has steadily increased over time and b). people are migrating more to online shopping.

Discussion around investments, money, stocks, etc is ‘soft data’ and can be really difficult to pin down. However, people usually engage in these discussions when they’re happy and the market is ripping. All of a sudden, everyone feels like a genius and wants to let the world know about all of the money they’re making. When the tides turn and the market drops, money talk dries up.

Go to your local bar and lmk what people are discussing. I just heard one of my buddies talk about some AI shitco that ripped 700%. He was as quiet as a mouse two months ago when tariffs rocked the world.

Lastly, Google Trends. If you don’t have any friends to listen to about their investments, then try searching the word ‘finance’ on Google Trends.

Spikes During Downturns (Source: Google Trends)

When people are unhappy and feeling some financial pressure, they turn to Google for answers on how to better manage their finances. Noticeable upticks during downturns here.

This is by no means a conclusive list. However, pairing these ‘softer’ data points alongside more traditional ‘hard’ economic data points can help paint a better picture of unbiased Consumer Sentiment. The hard data and soft data should align.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Oncycle vs. Offcycle Private Equity Recruiting

The next step up the prestige ladder after banking or consulting is ‘Buyside’ associate recruiting. The majority of folks are shooting for roles within private equity.

However, Buyside associate recruiting is wildly different from undergraduate banking or consulting recruiting. The process a). starts earlier, b). is 10x harder, c). requires modeling skills, and d). is controlled by headhunters ‘the gatekeepers.’

I wrote extensively about Buyside Associate Recruiting here: How The Process Works | The Pulse Part 2: Buyside Associate Recruiting. Today, I’ll walk through a primer on ‘oncycle’ vs. ‘offcycle’ recruiting.

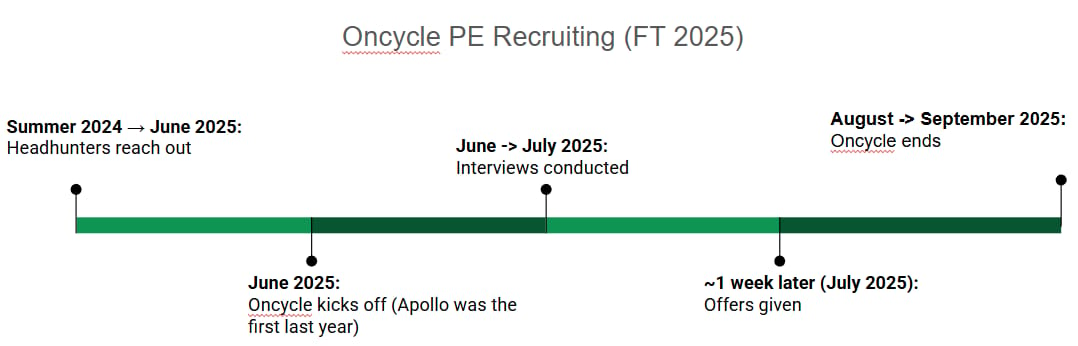

‘Oncycle’ recruiting is an abbreviated recruiting process that starts as soon as first years start their analyst training programs. It’s primarily geared towards large cap private equity recruiting and allows people to lock in a job 2 years before the start date. So, 2025 fresh graduates will recruit for Summer 2027 Private Equity Associate roles in just a few weeks.

Oncycle only lasts a few weeks and typically wraps up before September. Headhunters hired by the PE funds will reach out to the strongest candidates about their interest and quickly rush them into an interview at the fund. Sometimes in the same day. The candidate can sit there interviewing for 2-6 hours. Many of the interviews happen in the middle of the night.

As a candidate, you’ll likely only see ~10% of available Buyside jobs due to headhunter selection…huge reason why: The Pulse Part 2: Buyside Associate Recruiting is an incredible resource. We show you 100% of all available Buyside jobs so that you don’t have a headhunter dictating your career.

You will be required to do some form of LBO modeling. They’ll either stick you in front of excel or tell you to pull out a piece of paper to crank through a paper LBO. If you model the case correctly and nail the interview, then you’ll get the job. This can all happen in the same night.

‘Offcycle’ recruiting is much more similar to your standard interview process. It typically starts right after ‘oncycle’ and lasts throughout your analyst years. You’ll be recruiting for jobs within that same start date… so Summer 2027 starts for 2025 graduates.

These are more drawn-out processes and opportunities come in waves (more volume in 1Q and 4Q after compensation and budgets are determined). Once again, the headhunters control the process and will reach out to qualified candidates about certain opportunities.

Interview processes can last 3-6 weeks. You’re on the fund’s time. Generally, you’ll have an interview every week. You’ll also definitely see some form of LBO modeling. Unlike ‘oncycle,’ it’s very unlikely that you’ll only receive a paper LBO. Instead, you’ll typically be forced to complete a timed LBO model with complex scenarios or build a model from scratch based on a case provided by the fund.

Unlike oncycle, offcycle also includes private credit, hedge fund, and venture capital / growth equity recruiting instead of just private equity.

Fun times!

Going Forward:

You Got a Job?

Congrats! Please share our newsletter with your younger peers looking to recruit for banking / consulting / the buyside.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #106

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions