The Pulse Part 2: Buyside Associate Recruiting

In one week, we will be launching our Buyside Associate Recruiting Platform.

Private equity, hedge funds, private credit, venture capital, and growth equity. We will cover it all! This platform will be tailored to fresh graduates and analysts who are thinking about jumping from banking / consulting over to the Buyside.

Little Sneak Peek of What We Are Cooking

There will be three legs to the stool:

Jobs. Full access to ALL Buyside jobs. Headhunters currently control who sees which jobs, we are changing that. No more searching, no more guessing. We have everything

Models + Case Studies. 15+ real case studies with answers across PE, PC, HF, and VC/GE from firms like Apollo, Oaktree, Blackstone and more. Elite practice to ace your interviews (yes, you need to do models / cases for Buyside associate recruiting)

Organization. Everything you’ll need to navigate the Buyside associate recruiting process will be found on our platform

Fill this out for elite access: Buyside Associate Interest

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Provident Healthcare Partners and Mesirow opened their applications. 103 firms are recruiting for SA 2026.

FT 2026: No new updates. 2 firms are actively recruiting for FT 2026

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

Provident Healthcare Partners: Boutique healthcare shop (SA 2026)

Mesirow Financial: MM IB based in Chicago (SA 2026)

New FT 2026 Applications:

None

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

McKinsey and Bain released their full-time and summer analyst roles 3 weeks ago. As applications start opening, make sure to apply early and often.

SA 2026 released apps:

None

FT 2026 released apps:

ZS Associates - Decision Analytics Associate Consultant (FT 2026)

Buyside:

Where We’re At:

SA 2026: GCM Grosvenor and Chicago Fundamental Investment Partners opened their apps this week. Currently 99 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

GCM Grosvenor: $76bn multi-strat asset manager, PE secondaries intern (SA 2026)

CFI Partners: Multi-strat credit fund (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 103rd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

Snapshot of the Macro

Today, we are covering a snapshot of the positive and negative macroeconomic factors impacting markets today. (Mostly focused on the U.S.)

Pros:

Rates cut 100bps. Federal Funds rate now stands at 4.25-4.50%

Source: NY FED

10-year and 2-year not inverted

Source: FRED

Possibly lower corporate taxes

Source: Trading Economics

Inflation down to 2.3%

Haven’t Seen Tariff Effect Yet (Source: FRED)

Wage growth outpacing inflation

~200bps of Real Income (Source: Statista)

Market rebounded from lows caused by tariff announcements

Hopefully You Didn’t Miss the Generational Buying Opportunity (Source: Google Finance)

Cons:

Earnings forecasts are inconsistent, no one is able to predict current policy shifts

M&A and IPO activity slower due to tariffs

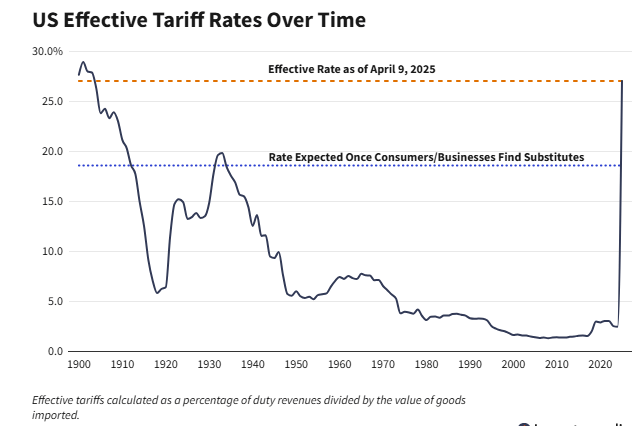

Higher tariffs are being placed globally, will cause an increase in prices

Source: Investopedia

Valuations back to highs

S&P 500 PE Ratio at 30.7x (Source: multipl.com)

Homes are too expensive

Peep the Price 5 Years Ago (Source: FRED)

Bankruptcies rising

Source: U.S. Courts

FICO Scores Yet to be Re-Rated from Resumption of Student Loan DQ Reports

(Source: Experian)

Consumer savings rate is trending lower

Savings Rate at 3.9% (Source: FRED)

Wars between Ukraine / Russia and Israel / Palestine

U.S. national debt is still high

Middle-Ground Items:

Potential nearshoring and onshoring of manufacturing

Spreads trending closer to median levels

Source: FRED

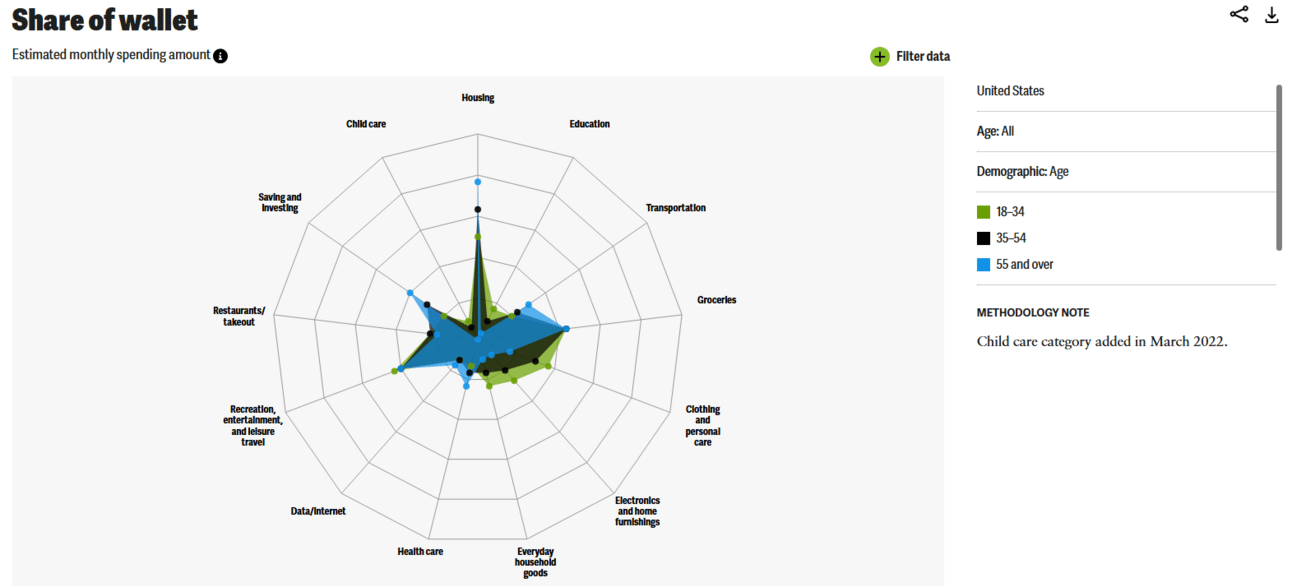

Spending remains focused on necessities, but is stable

Source: Deloitte

Unemployment rate at 4.2%

Source: FRED

DTI normalizing at 11.3%, supported by the wealth affect

Source: FRED

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

How to Answer “Tell me about yourself?”

Without fail, in every job interview, you will get a question along the lines of “Tell me about yourself?” or “Walk me through your resume”. These questions are extremely important.

They offer the interviewer a chance to look at your resume and also for you to tell your story.

Your answer should ideally contain the following:

Where your from

School, major, perhaps how you ended up at each

What sparked your interest in the field you are interviewing in

Extracurriculars/interests and how the experiences contributed to your interest

Prior internship experience

That is a lot to cover in 90 seconds, so be concise and choose what you bring up wisely. The worst thing you can do is take 5 minutes to answer this question and fail to sell yourself to the interviewer.

Make sure the interests/internships you discuss are relevant and recent. Discussing how you were a busboy in 10th grade does not provide much relevant information when you are interviewing for a consulting role as a Sophomore in college.

Try to humanize yourself as much as possible. These interviewers speak with dozens of candidates, so make yourself memorable by being likeable and interesting. At the end of the day, everyone wants to work with people they like.

Practicing answers to these questions is really important, but don’t sound like a robot. There’s no reason you should need to memorize information about yourself. It should flow pretty naturally.

Going Forward:

You Got a Job?

Congrats! Please share our newsletter with your younger peers looking to recruit for banking / consulting / the buyside.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #103

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions