The Pulse Part 2: Buyside Associate Recruiting

On May 25th, we will be launching our Buyside Associate Recruiting Platform.

Private equity, hedge funds, private credit, venture capital, and growth equity. We will cover it all! This platform will be tailored to fresh graduates and analysts who are thinking about jumping from banking / consulting over to the Buyside.

Little Sneak Peek of What We Are Cooking

There will be three legs to the stool:

Jobs. Full access to ALL Buyside jobs. Headhunters currently control who sees which jobs, we are changing that. No more searching, no more guessing. We have everything

Models + Case Studies. 15+ real case studies with answers across PE, PC, HF, and VC/GE from firms like Apollo, Oaktree, Blackstone and more. Elite practice to ace your interviews (yes, you need to do models / cases for Buyside associate recruiting)

Organization. Everything you’ll need to navigate the Buyside associate recruiting process will be found on our platform

Fill this out for elite access: Buyside Associate Interest

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: Ziegler and Calder Capital opened their applications. 101 firms are recruiting for SA 2026. This process is mostly dead. There are ~20 boutiques left to open. Any name-brand openings are just re-openings of apps due to renegged offers / groups expanding (seeing good action here this year due to the compressed cycle and people receiving multiple offers). We don’t track these because they don’t stay open very long and are mostly just filling 1-2 spots

FT 2026: No new updates. 2 firms are actively recruiting for FT 2026

If you need some interview support or just need a place to vent, check out our Coaching Program: Coaching for banking, consulting, and buyside recruiting | The Pulse. 95%+ of those coached for the summer 2025 recruiting season received offers!

New SA 2026 Applications:

Ziegler & Company: Healthcare-focused boutique (SA 2026)

Calder Capital: Boutique M&A (SA 2026)

New FT 2026 Applications:

None

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

McKinsey and Bain released their full-time and summer analyst roles last week. The process is in the very early stages but heats up in the summer. Interviews can be expected to take place in mid to late July for MBB.

SA 2026 released apps:

McKinsey - Summer Business Analyst (SA 2026)

Bain - Associate Consultant Intern (SA 2026)

FT 2026 released apps:

McKinsey - Business Analyst (FT 2026)

Bain - Associate Consultant (FT 2026)

Buyside:

Where We’re At:

SA 2026: Aquiline Capital Partners and Night Owl Capital opened their apps this week. Currently 96 buyside firms are recruiting for SA 2026 seats

New SA 2026 released apps:

Aquiline Capital Partners: MM PE (SA 2026)

Night Owl Capital: L/S HF (SA 2026)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 101st update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for banking, consulting and buyside roles | The Pulse

Market Update:

Market Uncertainty

The word of the year is “uncertainty”. Decision making is hard during normal times, but the current market uncertainty related to tariffs, DOGE, and the current political climate makes it nearly impossible. So what happens when a company is considering capital expenditures/deals when they’re not sure if their business will exist tomorrow? Nothing.

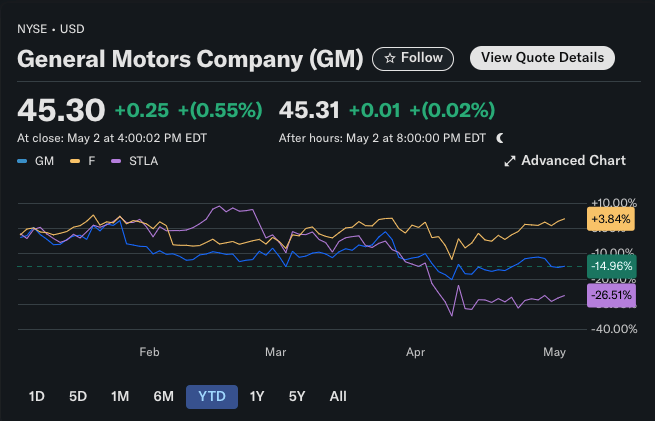

Take the automotive industry for example, where 25% tariffs were announced back in March. Large car manufacturers such as GM, Stellantis, and Ford have supply chains that are heavily reliant on Canada and Mexico. Therefore, these tariffs are extremely damaging to the cost of their products, the consumer, and their bottom line.

At the same time that Trump has been putting tariffs in place, he has also been flip-flopping back and forth, adding and then removing. So, if you’re GM, are you going to completely disrupt your supply chain and invest heavily in American manufacturing when the tariffs could disappear in a month? Probably not, and if you do, you won’t bet the mortgage.

(Source: Yahoo Finance)

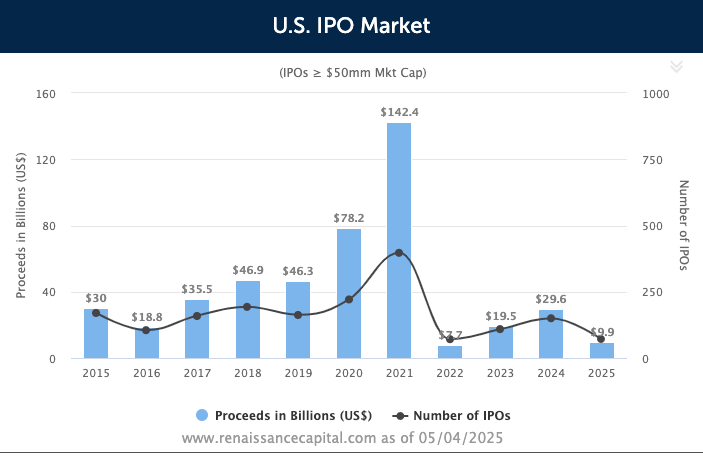

The automotive industry is not the only one faced with the aforementioned challenges. Every firm is going through the same experience. Tomorrow is so uncertain that they are delaying investment, deals, IPOs, etc. For firms to make business decisions, they need some sort of certainty and timeframe.

IPOs we’re expected to be hot this year. That has not been the case so far (largely due to tariffs). Firms such as Klarna (Buy now pay later, which allows you to finance your burrito purchases) and Stada (German healthcare) delayed their IPO investor events.

These are not isolated incidents but rather calculated decisions by management to hold off on a very big decision until they have more certainty.

Going public means there are increased reporting requirements, and most importantly, the company’s value is marked-to-market and subject to daily market swings.

U.S. IPO Market (Source: Renaissance Capital)

Just as companies have been delaying IPOs, M&A has also slowed. It’s tough to put a price tag on a company that may be worth much less tomorrow than it is today.

Firms are waiting for calmer seas before making big decisions. It is likely to remain that way until there is more clarity on tariff policy.

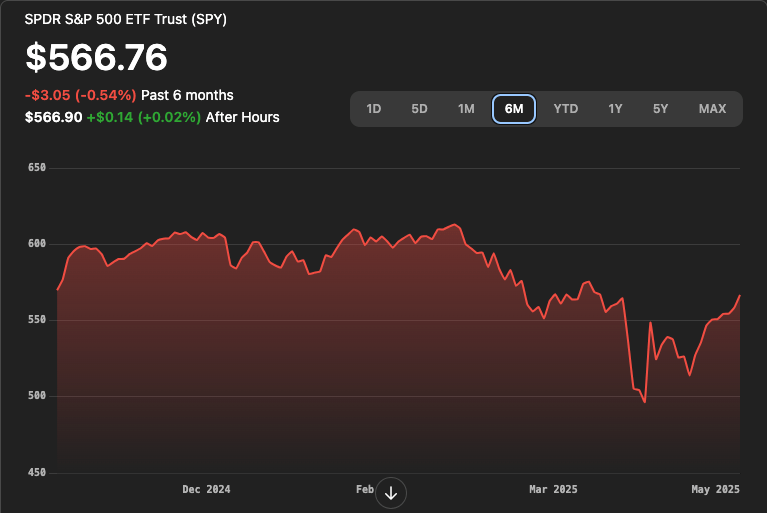

On a more positive note, the S&P 500 is on a nine-day winning streak–the longest stretch of consecutive gains in 20 years. It has even recovered its losses since the Liberation Day tariff announcements on April 2nd.

S&P futures are down ~0.70% at the time of writing this, but maybe we will end up getting a 10th green day.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

The Consulting Industry - AI & DOGE

As prospective consultants, it’s important to understand the industry’s ever-changing landscape. Over the past few years and months, the industry has evolved in a few ways.

AI is (and will continue) to play a larger role in consulting. Firms are investing tons of time and money in internal AI tools to make their employees more efficient.

Most recently, I read an article about BCG’s gen AI tool, Deckster. It’s a slideshow editor they developed internally. Among other features, Deckster will grade the slides produced by junior consultants based on the firm's best practices.

The article cited data that about 40% of Associate Consultants use the tool weekly. This has made some associates jumpy about the future of their roles. Certainly, firms will continue to develop tools to make employees more efficient. As for the effect on hiring, time will tell.

DOGE’s attack on government consulting contracts has also been in the news quite a bit over the last few weeks. As they’ve been poring through government spending, they’ve asked consulting firms such as Deloitte, Booz Allen, PWC, EY, and KPMG to reassess the pricing of their contracts or just cutting the contracts altogether.

This doesn’t come as a surprise because when looking for places to cut costs, consulting spending is a pretty good place to start. Unfortunately, I do think there will be some government consulting jobs lost related to DOGE’s cost-cutting.

While AI gaining traction in consulting and fewer government contracts are slightly scary for those entering the industry, the best thing to do is to learn to use AI early and work hard to be the best (and most curious) you can for those first few years outside of college.

Going Forward:

Will You Be in NYC This Summer?

We want to host a happy hour and you’re invited.

Will You Be in NYC this Summer?

Free drinks on us (lets blow the fucking budget).

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #101

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions