SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 or pay with credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” section below for more details.

Last year, 85% of students coached received offers.

No bread? No problem! Check out our referral program to unlock resume reviews, the Premium Database, and coaching sessions—for FREE! (see details in the “Going Forward” section)

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Most apps are rolling off, no new updates here. This cycle is over. A few processes may be conducted for firms looking to boost headcount or replace those who re-negged their offers.

FT 2025: Needham & Company opened its application this week. There are currently 14 firms actively recruiting for FT 2025. Please reach out if you are looking for coaching!

New FT 2025 Applications:

Needham & Company: Middle-market boutique (FT 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: 16 SA 2025 applications have been released so far. We're still early in the process, but make sure to apply early and often!

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025 - Closed)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025 - Closed)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025 - Closed)

Berkeley Research Group: Associate Consultant Intern (SA 2025)

Oliver Wyman: Summer 2025 Intern (SA 2025 - Closed)

Bain: Associate Consultant Intern (SA 2025)

Cavi Consulting: Consulting Associate Internship (SA 2025)

McKinsey: Summer Business Analyst (SA 2025)

BCG: Associate Consultant Intern (SA 2025)

Redstone Strategy Group: Consulting Intern (SA 2025 - Closed)

KPMG: All Practices including management consulting (SA 2025)

Alpha FMC: Consulting Intern (SA 2025)

DSP Strategy: Consulting Analyst Intern (SA 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Next Haven opened its SA 2025 apps this week. So far ~103 buyside shops have opened applications

SA 2025 released apps:

Next Haven: PE Search Fund (SA 2025)

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 57th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com)) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Financial Markets During Election Years

This seems timely given that Biden and Trump had a debate Friday night (and it was uglyyy).

Today we are going to concentrate on what typically happens to financial markets during election years. Understanding the impact of politics on your job as a banker, PE analyst, or asset manager is extremely important because clients are deeply concerned about how elections impact the sale of their businesses, the performance of their portfolios, and any policy changes that might affect how they conduct business.

Policy changes tend to occur when one party controls the White House and Congress. This seems unlikely this election cycle which is good because financial markets do not like change.

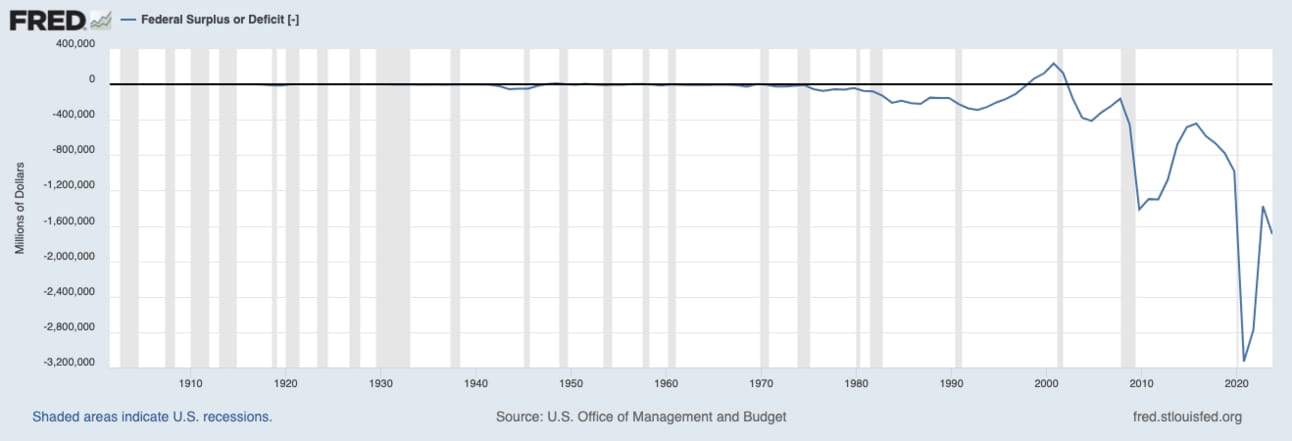

Investors and individuals alike are focused on what will happen to the Tax Cut and Jobs Act (TCJA) which is set to expire in 2025. This Act was one of the Trump Administration's core platforms which considerably lowered tax rates. Should Trump win and the provisions of the TCJA be extended, the government budget deficit would continue to grow (an issue that everyone is already well aware of).

Federal Surplus or Deficit (Source: FED)

For reference, if the TCJA is not extended, corporate tax rates could move from 21% back up to 35%. That is money that is coming directly out of the pockets of businesses.

Corporate Tax Rates Over the Years (Source: Peter G. Peterson Foundation)

However, if Trump wins it is possible that the effects of lower taxes would be offset by additional tariffs on imported goods to increase government revenue. Trump has suggested that he might impose a 10% baseline tariff on all imports to the US as well as a 60% tariff on imports from China. But Tariffs do more than just increase government revenue, they can often increase the price of goods if companies decide to “pass on” the cost of tariffs to consumers by raising prices. Tariffs can also increase the strength of the US dollar relative to other currencies (as it did in 2016 when the US dollar increased 5% compared to other currencies).

See "The Pulse"--#55 / Rate Cut Imbalances (beehiiv.com) for other commentary on currency swings.

On the other hand, Biden has proposed raising corporate tax rates, incorporating a global minimum tax, and getting rid of provisions that benefit those making $400k or more annually.

While increased corporate taxes do affect how much businesses take home at the end of the day, presidential elections themselves have minimal effects on financial markets and investment returns in the long run. There might be short-term volatility but elections do not have a meaningful effect on portfolio returns over time. A much more important factor in the performance of financial markets has to do with what inflation will do over the coming months and how that affects the FED’s decision on rate cuts.

As you can see, there is not a meaningful difference in returns between election years and non-election years.

Returns Don’t Tend to Differ Much in Election Years (Source: JPMorgan)

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Case Prepping

If you’re applying for consulting roles case studies will be used to test your analytical abilities and business acumen. Given that consulting recruiting is in full swing I figured it would be helpful to give a few pointers.

Practice with a friend. There are so many case prep materials out there that anyone can access so you cannot really gain an edge by having unique material. However, I think students underweight the importance of running case prep with their peers. Practicing with others forces you to verbalize your ideas and allows you to see how other students approach a problem. Sharing your ideas will make you better at case studies and give you a substantial leg up.

Practice a lot. When I interview I am at least a little bit nervous and I don’t think that’s just me. By practicing over and over you will be able to enter the interview with confidence and attack any case they give you. Additionally, the way you approach each case will be based on the assumptions they give you and the ones you make yourself. Lots of practice will help you learn how to quickly make and apply assumptions.

Your interviewer can help you. Interviewing is stressful but your interviewer is your friend when it comes to case studies. Allow them to guide you and don’t be afraid to admit when you’ve made a mistake. If the interviewer provides a suggestion that might help you with the case or questions your logic say, “Thank you” and incorporate their suggestion. They want you to succeed and are a resource for you.

Going Forward:

Building a great PE tool (targeting summer 2025 release). Please let us know what you want to see!

Coaching Details:

1 hour session = $50. (Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

30-minute session = $30. Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #57