SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 or pay with credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” section below for more details.

Last year, 85% of students coached received offers.

No bread? No problem! Check out our referral program to unlock resume reviews, the Premium Database, and coaching sessions—for FREE! (see details in the “Going Forward” section)

Subscribe to Short Squeeze! https://www.shortsqueez.co/subscribe?_bhba=77836b9d-058f-422a-b31d-93428fb81513

Free newsletter covering the financial markets in 5 minutes. Every day.

Are you a summer 2024 intern?

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: No updates. ~111 banks have opened applications. We will conclude our tracking of summer 2025 roles within the next 1-2 months. Please reach out if you’re looking for mock interviews or any coaching!

FT 2025: No updates. So far, 12 firms are actively recruiting.

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: 16 SA 2025 applications have been released so far. We're still early in the process, but make sure to apply early and often!

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025 - Closed)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025 - Closed)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025 - Closed)

Berkeley Research Group: Associate Consultant Intern (SA 2025)

Oliver Wyman: Summer 2025 Intern (SA 2025 - Closed)

Bain: Associate Consultant Intern (SA 2025)

Cavi Consulting: Consulting Associate Internship (SA 2025)

McKinsey: Summer Business Analyst (SA 2025)

BCG: Associate Consultant Intern (SA 2025)

Redstone Strategy Group: Consulting Intern (SA 2025 - Closed)

KPMG: All Practices including management consulting (SA 2025)

Alpha FMC: Consulting Intern (SA 2025)

DSP Strategy: Consulting Analyst Intern (SA 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: I-Squared Capital opened SA 2025 apps this week. So far ~97 buyside shops have opened applications

SA 2025 released apps:

I-Squared Capital: International Infrastructure PE (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 55th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com)) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Rate Cut Imbalances

As we all know, the FED maintained rates at 5.25-5.50% with the latest CPI measured at 3.4%, PCE at 2.7%, and unemployment at 4%. Measures of inflation (CPI and PCE) need to get closer to 2% or unemployment needs to blow out above 4.5-5.0% for the FED to begin cutting rates.

So, we hold firm in the U.S. But what about the rest of the world?

If you have your ear to the ground, you’d know that some central banks are beginning to cut rates: ECB and Canada both just made a cut.

Other Central Banks Cutting (Source: Financial Times)

On the surface, this may not seem like a huge deal and tbh one cut for 25bps isn’t a huge deal. However, an item worth noting is the derailment of the synchrony of global central bank policy which came together in 2020 ("The Pulse" --#38 (beehiiv.com)).

As central bank policies diverge, the synchrony of the global financial markets will also diverge.

Also, other central banks need to be mindful of the inflationary effects that rate cuts will have on their economies. Not only will people borrow and spend more (direct effect of cuts), but local currencies will also depreciate relative to countries where cuts have not been made (indirect effect of cuts).

A change in relative value between currencies can have a tremendous effect on the importing and exporting of goods/services between the different currency holders. For example, if the USD rises in value relative to the Euro, then the U.S. will be in a better position to import goods from Europe because the USD can effectively buy more goods/services there than it previously could. The opposite trade happens for Europe. Europeans become less likely to buy goods/services from the U.S. because they’re more expensive.

So, when the ECB cut rates on June 6th take a guess at what happened to the relative value of the Euro compared to the USD.

USD has risen in value compared to the Euro (Source: TradingView)

The area highlighted is between June 6th and 9th. The ECB cut rates on June 6th leading to an immediate increase in relative value of the USD when matched with the Euro.

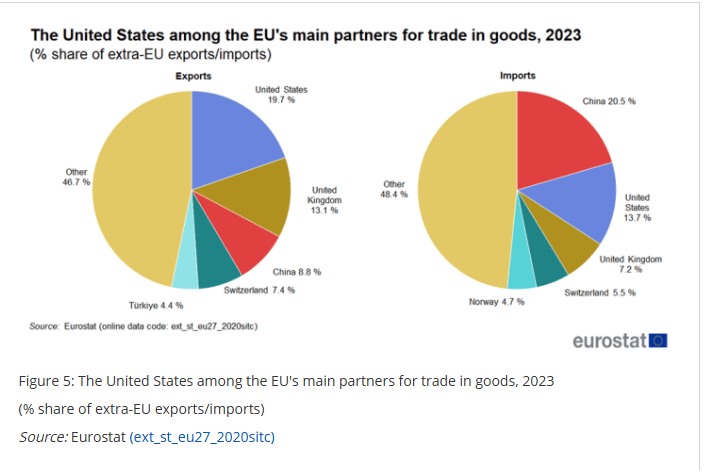

The U.S. is also the EU’s greatest trading partner.

Roughly 19% of exports to the US and 14% of imports from the US (Source: Eurostat)

And the goods imported from the U.S. tend to be more essential goods.

Energy and medicinal products NEED to be bought (Source: Eurostat)

So, the picture being painted here is that the Euro is now worth less compared to the dollar and Europeans are pretty reliant on the U.S. for essential goods like oil, pharmaceuticals, and natural gas. They will now need to spend more to receive the same imported goods/services from the U.S. and there really isn’t a great partner to substitute (there is still a ban on the import of oil and natural gas from Russia until the war with Ukraine subsides).

Therefore, the ECB diverging from the actions of the FED can be a tremendous inflationary threat for the Eurozone.

Maybe “follow the leader (the U.S.)” isn’t such a bad approach. After all, Eurozone inflation is still hovering around 2.4% and by no means ‘in the clear’ of the coveted 2% hurdle.

Once again, 25bps and some slight currency devaluation really isn’t that big of a deal. However, if central banks continue to diverge in their policy actions, there could be unwanted surprises like greater inflation.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

On-Cycle Private Equity Recruiting

As we mentioned in a previous LinkedIn post, it has been confirmed that on-cycle PE recruiting for summer 2026 start dates will begin within a month. Last year, the process kicked off in mid-late July.

‘On-cycle’ recruiting is typically carried out by the largest funds (Blackstone, Apollo, etc). What they’re doing is poaching talent (primarily from banks, although sometimes from the MBB) to lock-in an associate class 2 YEARS IN ADVANCE.

So, if you’re interested in PE and want to work at a Mega-Fund, on-cycle is your best shot at getting placed.

How the process works:

You will be contacted by headhunters and some associates at the respective firms to schedule coffee chats

If things go well, you move onto a modeling test / case study round (sometimes take-home, timed assessments, sometimes in-person)

You get called in (typically between 9pm and 4am) to meet with the team in-person and interview for 2-5 hours straight

You get an offer you need to accept in 24 hours - 1 week

This is the fastest route to a PE job and is MUCH faster than the off-cycle process.

To succeed, you need to know for sure:

a). PE is what you want to do with your life

b). Know what fund size you want to work at

c). Know what strategy you want to execute (easiest to go from your current banking group to the same group on PE side; ex: tech coverage IB → tech investing PE)

d). Know how to model or assess an investment to pass that technical round

We are looking to build a new tool to help everyone with navigating the competitive PE associate recruiting processes. If you’re currently interning at a bank or consulting firm, we’d love to hear from ya about topics/items you’d find most helpful!

Going Forward:

Building a great PE tool (targeting summer 2025 release). Please let us know what you want to see!

Coaching Details:

1 hour session = $50. (Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

30-minute session = $30. Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #55