Biggest Sale of the Season! From now until April 1st, we will be running a 30% sale for the purchase of our Premium Database. This is our biggest sale of the SA 2025 recruiting season and can be captured by venmoing @ThePulsePrep $35

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Check out this week’s market update for a quick overview of the coverage at Five Finance!

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Q Advisors and Janney Montgomery Scott opened applications this week. So far ~87 banks have opened applications. Please reach out if you’re looking for mock interviews or any coaching!

Interviewing: Many people are receiving offers, if you haven’t been receiving any interviews, then your resume in garbage. Please send our way and we will help you fine tune your resume!

Newly Released Applications:

Q Advisors: TMT-focused boutique (SA 2025)

Janney Montgomery Scott: Boutique (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: SIX SA 2025 applications have been released so far along with a few sophomore programs. Last year MBB (McKinsey, Bain, and BCG) released their round 1 applications in April. We expect other top firms such as EY Parthenon, Strategy&, LEK, and others to release applications shortly thereafter.

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025)

Bain: Pre-consulting Women's Leadership Summit (Spring 2024 - Closed)

Cornerstone Research: Sophomore Summit (Spring 2024)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Volition, PIMCO, and Fox Capital Partners all opened SA 2025 apps this week. So far ~69 buyside shops have opened applications

Released apps:

Fox Capital Partners: REPE (SA 2025)

PIMCO: Large asset manager, looking for distressed debt/special sits intern (SA 2025)

Hanwha Asset Management: Korean investment manager (SA 2025)

Volition Capital Partners: Small growth equity shop (SA 2025)

UVIMCO: UVA’s endowment (SA 2025)

Renovus Capital Partners: Small PE shop (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 43rd update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $35 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $35.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

FIVE FINANCE

Little bit different from our traditional market write-up. This week we are writing about a great platform to gain insights on all deal-related activity, Five Finance.

Check out some of their coverage below:

Ever been asked the dreaded “Tell me about a recent deal?” question during an interview?

Well, Five Finance has you covered. Think of them like a more informative version of Exec Sum broadcasting deals and market activity that matters.

I personally follow their coverage to stay up to date on everything deal-related.

Please give them a follow on Instagram here: Five Finance

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Stock-Based Compensation

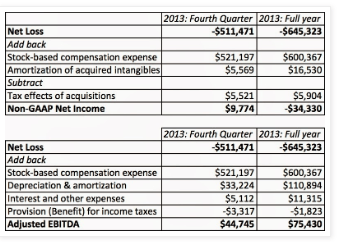

Reasonable add-back to EBITDA? Or a disgusting way to overvalue a business? Let’s learn:

Stock-based compensation is compensation paid to employees of a business in the form of shares, options, warrants, restricted stock units, etc. Essentially, SBC is a way for a business to pay people without paying them in cash.

It also aligns employees closer to the mission of the business because their financial success is directly linked to the success of the business. Oh, and most SBC is granted on a vesting schedule, so an employee has to work an X number of years before being able to cash out.

Ok, aside from the definition, SBC is a contentious item. It is frequently added back to EBITDA although it is not truly a non-cash expense and certainly has a dilutive effect for shareholders. It is more of a delayed cash expense (I’ll explain more on this below).

Valuation gurus like Aswath Damodaran frequently debate how SBC should be treated: Aswath on SBC

Here is how it is often seen in a company’s financial statements:

SBC Often Added Back (Source: Damodaran)

Unlike true non-cash items like D&A, SBC can be a realizable cash expense. In more of a tangential effect.

You see, SBC dilutes shareholders because the Company is directly issuing more shares to pay employees. In an attempt to counteract this dilution, companies that issue SBC often engage in greater share repurchase activity. Share repurchases are a true cash outflow for a business.

The big problem with SBC is analysts often add it back to EBITDA, but don’t do shit about adjusting for the share dilution effects when arriving at a final stock price. Therefore, the ultimate valuation is inflated.

Is it a problem if everyone does it? Kind of, but not really.

Value is just a number that people believe in. If everyone believes something is valued at X, then it is worth X. The only problem is when a few people think something is actually worth Y, and then other people start to change their minds.

What do I think?

I think it makes sense for some companies to add it back. Businesses that sit on huge cash piles and don’t issue a gross amounts of SBC annually (think industrials, some financial firms, some mature tech companies like Apple). These companies have the resources to pay out SBC with relatively minimal impact to liquidity or share dilution.

However, some high-flying tech stocks like Netflix, Uber, etc issue a shit ton of SBC. This can be problematic for the aforementioned reasons. When the market is doing well, fuck it, add it back. When shit hits the fan and companies needs to maintain SBC spend, there can be dramatic share dilution.

Then again, SBC is not the most exciting aspect of these businesses lmao. They can cover up their SBC problems. Wild growth projections or AI stories tend to dominate the headlines instead and may support the elevated valuations.

I get asked about SBC all the time in interviews. People love chatting about it and forming their own opinions on how it should be handled. You need to form your own and decide how to deal with it.

Going Forward:

The “Pay for 3, get 1 FREE” coaching deal has ended. However, coaching will continue. Check out the details below to set up a session:

1 hour session = $50. Venmo @ThePulsePrep

30-minute session = $30. Venmo @ThePulsePrep

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached have received offers at Goldman, JP Morgan, Blackstone, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #43