Wow, RBC opens up its SA 2026 application: RBC SA 2026 App

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” section below for more details.

Last year, 85% of students coached received offers.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: TAP Advisors and Ziegler opened applications this week. So far ~89 banks have opened applications. Please reach out if you’re looking for mock interviews or any coaching!

The process is 75-80% complete for SA 2025. We expect most offers at BBs and EBs to be fully released before May 1st. If you’re still interviewing, you NEED to really capitalize on your opportunities as the pipeline will only look more sparse going forward

Newly Released Applications:

TAP Advisors: Small boutique (SA 2025)

Ziegler: Small, Minneapolis-based boutique specializing in healthcare (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Seven SA 2025 applications have been released so far along with a few sophomore programs. We are still at the beginning of this process, but you want to apply ASAP when applications are released. So don't wait to network and case prep until the applications come out!

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Business Processes Intern (SA 2025 - Closed).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025 - Closed)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025 - Closed)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025)

Bain: Pre-consulting Women's Leadership Summit (Spring 2024 - Closed)

Cornerstone Research: Sophomore Summit (Spring 2024)

Berkeley Research Group: Associate Consultant Intern (SA 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Bridge Investment Group, Kline Hill Partners, and UGE International all opened SA 2025 apps this week. So far ~72 buyside shops have opened applications

Newly Released apps:

Bridge Investment Group: Real Estate debt (SA 2025)

Kline Hill Partners: PE Secondaries investing (SA 2025)

UGE International: Clean energy developed and investor (Summer 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 44th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

U.S. Population Growth

We previously discussed the importance of wage growth in: "The Pulse" --#39 (beehiiv.com). Wage growth serves to be a powerful economic tailwind pushing spending further, earnings higher, and GDP larger.

Today, we will discuss another critical, often over-looked, and sometimes very political topic—population growth.

(Please note, nothing written here serves to take any political stance, strictly an objective assessment of population growth in the U.S.)

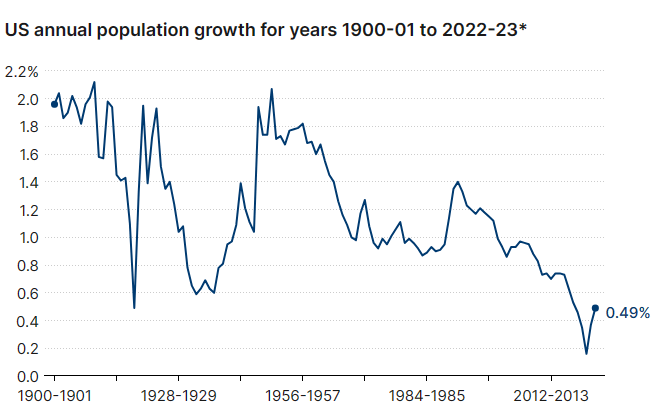

Population Growth is Slowing (Source: Brookings)

If we were to smooth out this graph, we can clearly tell that U.S. population growth is decelerating. This is a natural phenomena for a maturing country in the 21st century.

Now, when breaking out the numbers we can see where the remaining growth stems from:

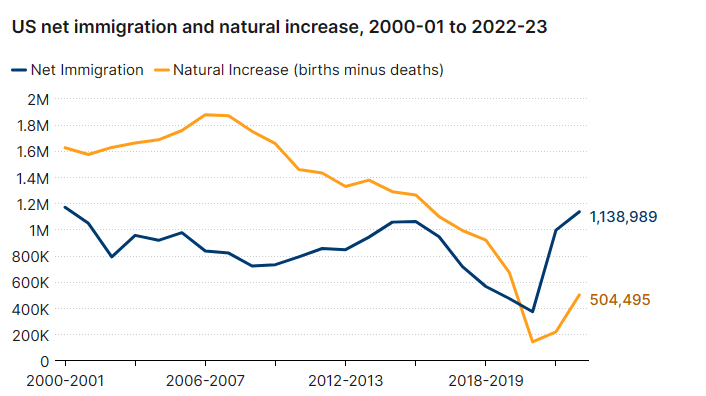

Immigration is Driving Growth (Source: Brookings)

What do we see? Population growth due to immigration is ~2x stronger than population growth from current citizens.

Why is this happening?

People are having kids later (average age of a first-time parent is 26 vs. 21 in 1972)

People are having fewer kids (1.79 children per woman today vs. 2.1 in 1972)

Child care costs are extreme (14.2% of disposable income)

Homes are unaffordable ("The Pulse" --#27 (beehiiv.com))

Social reconstruction of gender parity

Behavioral: Cutting costs (i.e. having less kids) is an easy way to climb up the socioeconomic ladder

Immigration has been a major tailwind for the United States since the end of the pandemic. While everyone else struggled to get back on their feet, the United States continued to blaze forward.

In 2022, when a recession was the expected economic outcome, the United States held firm. Immigration coupled with excess savings from Covid fueled a spending rampage that continues to this day ("The Pulse" --#16).

Sure, there are complexities with immigration (especially political ones), but we won’t dive into that at this time. What we really want to emphasize is that in the wake of an aging country, with a natural population having fewer children, strong immigration has maintained the population growth necessary to see economic resilience.

At the baseline, what does population growth do for our country and economy?

Generally, more people = more spending = larger GDP. No booming economy has a stagnant or decreasing population.

However, the benefits of a growing population may be better understood by looking at the hardship faced by countries with a declining population (Italy, for example).

A declining population leads to less economic growth, loss of global influence, and greater strain on government budgets to support the current, aging population. Ultimately, this cycle continues and investable dollars end up being eaten away by maintaining the current standard of life.

Am I willing to work 2x as hard in my life to not only partially support the aging population BUT ALSO create a deep safety net to fully support myself when I retire? Fuck no. However, that is a major problem created by a declining population. You end up chipping away at your current resources to avoid diminishing your quality of life, which diminishes investment capacity.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Due Diligence Simplified

Due diligence is the process of evaluating all of the components of a business to determine if it is worth investing in or working with.

Today, I’ll compare due diligence to buying a car:

Step 1: What type of car do you want? Do you already have 3 lambos and don’t need a fourth? How long do you plan to drive your car? Does it need to be new? Can it be foreign?

Similar to buying a car, an investor needs to decide what type of company or security they want to invest in or need exposure to before moving forward with the DD process.

Step 2: Is the price right? Are rates too high? Are too many people trying to buy the same car? Is it insurable? Will someone want to buy the car from me in the future?

After deciding what type of car you want, the next step is determining if the car’s value is fair. No matter how perfect the car is, it will be a bad purchase if you pay the wrong price. As an investor, paying too much will kill your return, no matter how good the business is.

At Step 2, you are likely reviewing the financials and business model of a business to ensure it is a good fit.

Step 3: Talk to a salesman and take the car for a test drive. A car salesman has a biased opinion, but their deep insight into the local market and nature of the vehicle you’re looking to purchase still provides the buyer with valuable information. If the salesman seems untrustworthy, you will likely move to the next dealer.

At this stage of the investment process, you are meeting with the company to ask detailed questions about their business to form a better perspective of value and fit. Maybe you’re asking questions about funky accounting mechanics, maybe you’re digging into their customer concentration and geographic influence, and maybe you’re trying to vet the management team.

Step 4: Great, you like the car and you think the price is right. Now it is time to hash out the terms of the purchase. Does the car payment match my expectations? Do I get a warranty? Can I get favorable financing? How much do I need to pay the salesman?

You might be thinking, “why wouldn’t these questions be considered in Step 1 or 2?” Well, the blunt answer is that nobody wants to help you answer these questions until they know you’re serious about buying the car. Step 4 is where a ton of DD processes fall apart.

Communication is really hard and sometimes people need to see terms on paper to fully understand what they’re stepping into. This can be just as tough for the buyer as it is for the seller.

Step 5: The paperwork penciled and you will execute the purchase.

The execution stage is also easier said than done. In an investment process, there can be technical errors with the wiring of funds, legal sign offs on all of the docs, or random last minute regulatory concerns. All of these hurdles can significantly delay an investment process and may also lead to the termination of a deal.

Morale of the story: A DD process if fragile. All you can do is ask the right questions to avoid surprises. The last thing you want is to wire the funds and get completely fucked over with a lemon.

Going Forward:

Want to make some bread selling the database or being a coach? Shoot us an email and we would love to work with you.

Last year, we paid $ thousands to our members who helped sell the database.

Coaching Details:

1 hour session = $50. Venmo @ThePulsePrep

30-minute session = $30. Venmo @ThePulsePrep

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #44