Biggest Sale of the Season! From now until April 1st, we will be running a 30% sale for the purchase of our Premium Database. This is our biggest sale of the SA 2025 recruiting season and can be captured by venmoing @ThePulsePrep $35

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @ThePulsePrep $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: AQ Tech Partners, Northborne Partners, and Greenwich Capital Group all opened applications this week. So far ~81 banks have opened applications. Please reach out if you’re looking for mock interviews or any coaching!

Interviews are taking place across the Street, your apps need to be submitted ASAP to have a chance at getting an interview

Newly Released Applications:

Greenwich Capital Group: Small boutique (SA 2025)

TM Capital Corp: Small boutique (SA 2025)

Reagan Consulting: Boutique, Atlanta-based (SA 2025)

Northborne Partners: Minneapolis-based (SA 2025)

CapM: Small boutique (SA 2025)

AQ Technology Partners: Tech-focused boutique (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: SIX applications have been released so far. Beginning in late March and April, recruiting will pick up. Our logic for late March/April? Last year MBB (McKinsey, Bain, and BCG) released their round 1 applications in April. Given the trends of top firms hiring earlier, we believe recruiting will start on a slightly earlier timeframe this year. As always, we will keep you informed when apps roll out. Read the below interview with an Associate Consultant at Bain & Company for insider advice/perspective!

SA 2025 released apps:

KPMG: Advisory Intern, Deal Advisory - Financial Due Diligence (SA 2025)

PWC: Business Processes Intern (SA 2025).

Curtis & Co: Boutique firm (SA 2025 - Closed)

Protiviti: Tech Consulting (SA 2025)

RSM: Tech, Risk, and Business Improvement Intern (SA 2025)

Deloitte: Business Technology Solutions Summer Scholar (SA 2025)

Bain: Pre-consulting Women's Leadership Summit (Spring 2024)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2025: Spectrum Equity, Bessemer Venture Partners, and Long Ridge Partners all opened SA 2025 apps this week. So far ~59 buyside shops have opened applications, with interviews taking place already at many funds

Released apps:

Bessemer Venture Partners: Large VC fund (SA 2025)

Long Ridge Partners: PE and hedge fund, looking for PE intern (SA 2025)

Spectrum Equity: Cali-based growth equity fund focused on tech (SA 2025)

Alpine Investors: Cali-based growth equity & pe (SA 2025)

Chicago Fundamental Investment Partners: Looking for Credit intern (SA 2025)

Five Rings: Pay $23,000/month lmao—apparently- Quant Trading (SA 2025)

University of Utah, Sorenson Impact Fund: VC Intern (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 41st update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $35 (Venmo @ThePulsePrep) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $35.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Interview with a Consultant at Bain:

Below is an interview with an Associate Consultant at Bain & Company, one of the most elite management consulting firms. We primarily focus on landing the job, life on the job, and exit opportunities.

The Associate Consultant (who would like to remain anonymous) was a Summer Associate Consultant at a Big 4 firm before landing a full-time role at Bain.

Getting the Job:

What drew you to management consulting?

-I wasn't entirely sure what I wanted to do with my career (and still am not), but I knew I liked problem solving. Management consulting, especially at an MBB, provides an unmatched breadth of experience and exposure to many different industries. The development opportunities and exposure to different industries sets you up for a career virtually anywhere. I think that versatility is what draws so many to management consulting.

What do you think Bain/McKinsey/BCG look for in an applicant & how can one stand out?

-First and foremost, they want to see very strong academic performance and involvement (and leadership) in extracurricular pursuits. Relevant internships or academic projects are also a big factor, and these don't even have to be consulting-related. You need to show that you can, and have, approached difficult problems with a creative, thoughtful, and analytical framework. They test these skills through case studies during the interview process.

As for specific qualities they look for in applicants, it really comes down to being coachable, having intellectual curiosity, and a strong work ethic.

How important is networking when recruiting for consulting?

-In my opinion, networking is helpful but not as important as a lot of people make it out to be. It is encouraged but not vital. In other words, a strong applicant is still a strong applicant with or without networking. At non-target schools it may play a more vital role, I just don't have as much insight into that given that Bain recruits pretty heavily at my alma mater. Networking can cure a cold, but it won't bring back the dead.

Do you have any interview advice?

-Repetition. Do a bunch of cases. You'll get much more comfortable and build confidence so you're less nervous during the actual interview. Also, it is okay and a good thing to thank an interviewer for catching a mistake when doing a case study. This shows humility and the ability to adjust quickly–two valuable skills in management consulting.

On the Job:

How does fulltime differ from interning?

-As an intern, you're really not expected to know anything. When you become a full-time consultant there is way less handholding and higher expectations, especially after the first few months. You need to be able to manage your time well and meet deadlines–people will notice quickly if you lack in these areas.

How do you get put on projects and at what point do you specialize?

-One way that Bain differs from McKinsey and BCG is that we have staffing managers. At McKinsey and BCG you tend to network your way onto a project. I really enjoy having a staffing manager and they do a pretty great job. You can tell them if you have particular interests and they will try to get you on cases in those specific areas. For example, I am interested in working with financial institutions and private equity firms so I get put on cases in that specific industry. At Bain when you're not working on a case you are said to be on "the beach". Other firms call it "the bench". This just means you are in between projects while your staffing manager assigns you to a new one. During this time you focus on internal development and learning new skills.

Did anything surprise you when you first started?

-I was surprised at the amount of freedom I have. Deadlines are well-communicated and you can allocate your time as you see fit as long as you get your work done. For example, I can go to the gym in the middle of the day if I want to as long as the deliverable or assignment I am working on is done within the given timeframe. I've found this freedom to be huge in maintaining work-life balance.

How rigorous do you find the hours to be?

-The hours aren't too bad. Typically, I work 60-hour weeks and our weekends tend to be protected. Also, they do a pretty good job of getting us out of the office around 5 on Fridays. This does mean that your week is front-loaded. Working 12-15 hour days Monday-Thursday is pretty common.

After the Job:

What are some common exit ops from management consulting? What have you seen from your coworkers?

-As we briefly touched on at the beginning, the benefit of consulting is the wide range of exit ops. I've seen a lot of Bain consultants leave to work at PE shops or move to large companies, and work in corporate strategy roles. If you're a higher-up, you might also get recruited to be an executive/serve in a management role at a company you've worked with. It's also not uncommon to stick around for more than two years, especially given that Bain will pay for you to get a graduate degree. Overall, the exit ops are all super appealing a big reason I chose management consulting and Bain.

To the interviewee, we could not thank you enough! To our readers, we hope this was helpful! Consulting recruiting is right around the corner and it never hurts to get insider insight.

If you like these interviews, please reach out with suggestions @[email protected]

Learning Point of the Week:

Application timelines

On the banking side, many application deadlines are coming to a close. As we mentioned in previous editions, February and March were predicted to be huge interview months.

First a quick update:

We are 65% complete with the entire SA 2025 process

Most processes are complete at the elite boutiques (intern classes completely picked)

Offers extended at firms like Rothschild, Morgan Stanley, and Moelis

Processes at most EBs and BBs will conclude by the end of March

So, when should you hear back after submitting? When is it too late to apply?

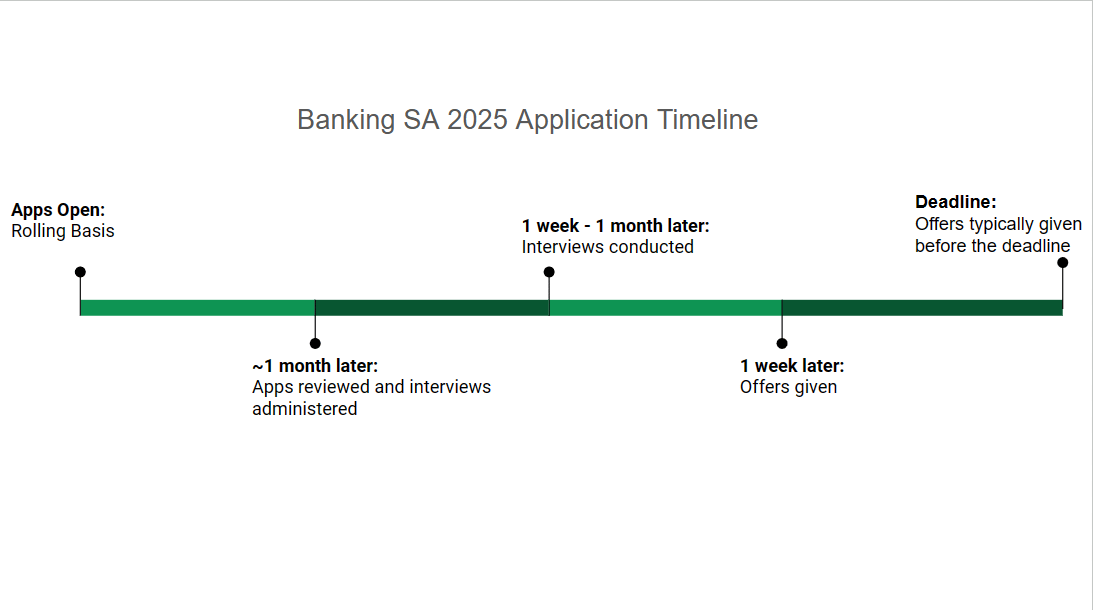

Applies to ~90% of firms

That up there^ is the application timeline.

The opening:

Generally speaking, most firms operate on a rolling basis where apps are reviewed as the timeline rolls off vs. reviewing all applications after the stated deadline.

Mathematically speaking, your odds of getting an interview are substantially higher when an application first opens up. If a reviewer has a stack of 50,000 applications and 500 internship spots, it is much easier to slide “good” candidates reviewed early on into the “yes” pile. However, as the “yes” pile grows, the interviewer becomes more selective and may only shove “excellent” candidates when sifting through the remainder of the stack. Hence our greatest piece of advice: “Apply early and often.”

The review period:

Within 3 weeks after the app opening, apps will be reviewed and early interviews will be administered (add another 1-2 week lagging effect for giant institutions like JPM and BofA).

The interview period:

Interviews at boutiques tend to start and end in a condensed timeline before the stated application deadline with entire analyst classes getting picking very quickly.

Interviews at bulge brackets and other larger institutions also start and end before the stated application deadline, albeit the interview period may span an entire month or so before the analyst class is completely full (margining a few spots in reserve for exceptional talent that may come through the pipeline).

The offer:

Offers will be handed out within a week of the interview. Usually an exploding deadline (~2 weeks).

The rejection:

Unfortunately, formal rejections are not delivered until much later in the timeline. Maybe 1-3 months after applying (long in other cases).

A general rule of thumb, if you haven’t heard back within a month you’re probably in the rejected pile. If you haven’t heard back in 1.5 months, you’re definitely toast (once again add a 1-2 week lagging effect for the larger firms).

For example, if you haven’t heard back about your JPM app which opened January 1st, you’re probably in the rejection pile.

Important to note that these statements apply to most firms, however, there are certainly some outliers

Going Forward:

The “Pay for 3, get 1 FREE” coaching deal has ended. However, coaching will continue. Check out the details below to set up a session:

1 hour session = $50. Venmo @ThePulsePrep

30-minute session = $30. Venmo @ThePulsePrep

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached have received offers at Goldman, JP Morgan, Blackstone, and many other firms. Roughly 85% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #41