Pay for 3 coaching sessions, get 1 FREE! For the next month, we will be offering an exclusive offer to pay $150 to receive 4 coaching sessions with a current or future analyst (Venmo @Hooshelpers). Interviews are right around the corner and we want you to be as prepared as possible. Last year, 85% of those coached received offers! See the “Going Forward” section in the bottom of the newsletter for additional detail.

SA 2025 interview szn is HERE! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Who Should We Interview Next?

In case you missed it, we interviewed @HighYieldHarry (100K+ followers on insta) here: "Interview With High Yield Harry"

Who should we interview?

He provided some fantastic perspectives on recruiting and credit investing. Please answer this poll to let us know who we should interview next!

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Raine Group, Lincoln International, and LionTree Advisors all released summer 2025 apps alongside 6 other banks. So far ~37 banks have opened applications with 20 deadlines in less than 1 month!

You need to be applying today. Applying early and often is incredibly important in the banking recruitment process. The longer you wait, the lower your chances of getting an interview

February will be a HUGE month for interviewing, all aspects of your interview prep should be sharp at this point. Please reach out if you’re looking for mock interviews or any coaching!

Newly Released Applications:

Raine Group: Merchant bank. Underwrite and invest in some of their deals (SA 2025)

Lincoln International: Boutique (SA 2025)

LionTree Advisors: Boutique, tech focus (SA 2025)

Future App Releases:

UBS: BB. Will be released February 1st (SA 2025)

Evercore: The most elite of the elite boutiques lmao. Feb. 1st release (SA 2025)

Bank of America: Strong BB. Will be released February 1st (SA 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: Not much has changed since last week. Three firms have released applications. Be prepared for app releases to heat up around March/April.

FT 2024: Cohorts have been filled and this process is over. Only small firms have applications open.

SA 2025 released apps:

PWC: Management Consulting Intern - Women's Consulting Experience (SA 2025).

Curtis & Co: Boutique firm (SA 2025)

Protiviti: Tech Consulting (SA 2025)

FT Released Apps:

KCIC: Boutique firm (FT)

Lake Partners Strategy Consultants: Boutique firm (FT)

FTI Consulting: Tech Consulting (FT)

Pre Consulting:

Bain: Consulting Kickstart Program (Interactive, virtual series designed to give freshman/first year undergraduate students who identify as Black, Hispanic/Latin American, and/or Indigenous heritage, exposure to business leaders and the exciting world of consulting.)

Apply ASAP if you’re interested!

Also, make sure you're taking advantage of this quiet period of consulting recruiting by perfecting answers to behavioral questions and case-prepping.

Buyside:

Where We’re At:

SA 2025: Roark Capital, Orion Group, and Brinley Partners all released SA 2025 apps this week alongside Citadel and Bain Capital! So far ~29 buyside shops have opened applications

Released apps:

Roark Capital: MM fund, consumer focus. Recently acquired Subway (SA 2025)

Orion Group: MM PE (SA 2025)

Brinley Partners: MM credit fund (SA 2025)

Citadel Securities: Ken Griffin’s hedge fund, highest paying job (SA 2025)

Bain Capital: Venture + PE (SA 2025)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 34th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Compound interest. The 8th wonder of the world?

Relatively slow week in the markets (besides S&P ATH lol) and I couldn’t force myself to discuss rates once again. Therefore, this week’s ‘market update’ is more of a thought piece.

There are many great things in life including: a glizzy on a hot summer’s day, an ice-cold glass of water at 3 am, and compound interest (ie: making money with money).

Compound interest rewards patience and persistence. The best investors in the world such as Warren Buffett have mastered the understanding of buying and holding assets into perpetuity to reap the benefits of compound interest. For example, buying a stock and reinvesting the dividends to increase your hold and accrue more dividends.

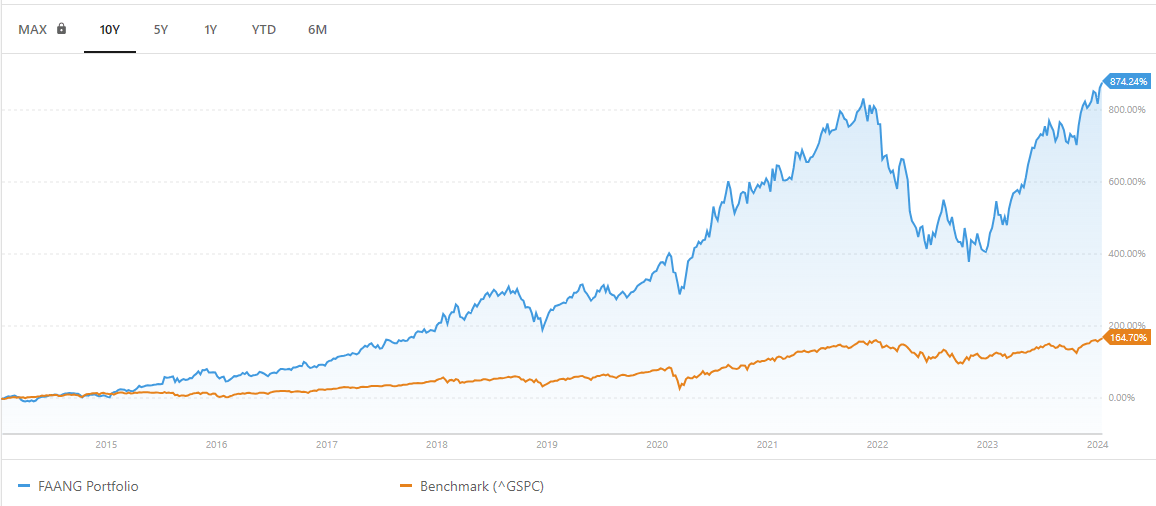

So, why doesn’t everyone just buy and hold? In fact, the best investing strategy over the last 10 years has just been LONG FAANG stocks (MSFT +1,059%, AAPL +992%, etc).

*Sure, there is probably some gritty quant strategy that would have yielded a stronger return, but executing that strategy would have likely been hard, expensive, and uncertain*

FAANG vs. S&P Performance over 10 years (mad bread)

3 reasons why everyone doesn’t just buy and hold GOOD assets forever:

It is a boring strategy (no one wants to pay a hedge fund manager or PE shop to do something they can do themselves)

Structurally, most hedge funds and PE funds are set up to deploy and return capital over a short time frame (~5-7 years which rewards shorter-term thinking)

Ego and speculation are difficult behaviors to counteract

If there is a benchmark to beat, there is always someone who thinks they can beat it

If there is someone selling picks, there are always miners willing to prospect for gold

So, how do we think about all of this and what team do we really want to play for?

Well, most people who enter banking or consulting tend to look to private equity and hedge funds as desired exit opportunities. So, is everyone in this field hard-wired to go prospecting in hopes of striking gold?

Maybe. But we also contribute to our 401K plans.

Do these strategies ignore the beauty of compound interest?

Yes, they usually do.

Is this a bad thing? No.

Not everyone needs to be Warren Buffet and quite frankly, do you even want to be Warren Buffet? The guy lives in a modest house out in Omaha, Nebraska which he purchased for like $30K. That’s not my dream. And unfortunately, compound interest rewards longevity and people don’t live forever.

Something to think about. When you go work for a bank, you’re selling picks to the miners (HF, PE, etc). You need to think along those lines to succeed. When you go work for a hedge fund or PE shop, you’re prospecting for gold. You need to be thinking that you’re better than the benchmark and that you can unlock value no one else can see (or that you’re just really lucky).

Shape your story for the role you’re pursuing, but balance the act with staying true to yourself and maintaining your core values.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Networking 101

Networking is arguably the most overrated, yet necessary aspect of recruiting for entry level roles in banking, consulting, or for the buyside.

At this stage of the recruitment process, especially for banking, networking is going to be extremely difficult due to the fact that analysts are getting swamped with inbound messages requesting time for 15-30 minute chats. DO NOT let networking get in the way of applying for jobs.

Overrated aspects of networking:

Analysts and associates have little incentive to speak with you. Put yourself in their shoes, what do they have to gain from the interaction?

They’re not getting paid to hop on the phone and answer surface-level questions for 15-30mins

On the banking side, many analysts and associates are gunning for buyside positions and aren’t necessarily ‘investing in the team’s talent’

Few calls are a home run. More often than not, a networking call is pretty mid and there is a good chance you’ll never speak to the person ever again

15-30 minutes of a faceless interaction makes it difficult to really connect with a person (especially when the entire discussion is centered around work)

Coincides with point #2, but very few people you network with have the ability or desire to actually help you land a role

Some firms are moving away from referral systems because they don’t want the entire analyst class to be full of referral hires who all think and act similarly

Bad referrals have a negative impact on the employee who made the referral + you barely know each other after a 15 minute call!

So, how can we make networking less brutal?

Try to really learn about who the person is vs. just learning about what they do (you probably already know what they do lmao)

Talk a little bit about work, but more about what they like to do outside of work (helps to get to know someone and maybe you share a mutual interest)

Come prepared with targeted questions about aspects you truthfully don’t have the answer to (ie. skip the bullshit. This is less relevant to entry level networking and much more applicable later in life)

As apps are opening, remember to apply as early and often as possible! This is seriously our simplest and best piece of advice to all candidates. Your chance of getting the job drops dramatically if you’re applying closer to the deadline than the open date.

Going Forward:

Pay for 3 sessions, get 1 FREE! We will pair you with a current or future analyst to help with everything from:

Resume Review

Mock Interviews

Developing Recruiting Preparation Plans

Last year, 85% of those coached received offers! Venmo: @Hooshelpers $150 to claim this offer; sessions are ~1 hour long and we are fully flexible to your schedule

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #34