SA 2025 interview szn is only ~1 month away! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+ banks/consulting/buyside firms. Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>HH Database Preview--Video

Due to popular demand, we added a bunch of Sophomore Summer Programs offered at banks like BofA, Rothschild, and UBS. Find them on the database!

Recruiting Timeline:

Banking:

Where We’re At:

SA 2025: Besides RBC, many banks are expected to open applications on January 1st! That is only ~1 month away

SA 2024: This is officially our last post discussing SA 2024. At this time, we recommend exploring alternative industries and saddling up for FT 2025 recruiting which will kick off around June.

FT 2024: ~85% over. The job market has been tough for FT recruiting, so take what you can and get scrappy. Follow-up with recruiters and those you’ve networked with to grease the wheel and get yourself an opportunity.

Gameplan:

SA 2025: January 1st is ~1 month away. By now, you should be full-swing into networking and starting to prepare answers to behavioral interview questions. Reference our Premium Database for a suite of all the resources necessary to prepare for an interview.

SA 2024: If you’re dying for an IB role, take a job wherever you can for the summer. You can always re-recruit for FT 2025.

FT 2024: Reconnect with your network and explain why you’re the perfect fit for X firm. Be clear and concise to let the listener know why IB is your goal and what skills make you qualified for the job.

Interview Questions of the Week:

-Behavioral: Tell me about a time where you worked alongside a really bad teammate. How did you overcome this hurdle?

-Technical: If I have $100 of debt, $50 of cash, an enterprise value of $70, and my stock price is $20, how many shares are outstanding?

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Want access to an updated database of 200+ banks/consulting/buyside firms? Venmo @HoosHelpers $50 and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

SA 2025: We are at the very beginning of SA 2025 recruiting. Only one firm has released an application and others won’t be released until around May.

SA 2024: SA 2024 has wrapped up. Random firms may decide they need an extra associate consultant and post an application, but your typical consulting firms have filled their incoming classes.

FT 2024: FT is wrapped up as well. You may see some one-off applications posted on Handshake. These are just firms deciding that they need to fill a single position.

Gameplan:

SA 2025: Network. Network. Network. You should have a list of firms of interest and be researching them to ask insightful questions during informational calls. When you do research, genuinely ask yourself, “What is unique about this firm and how does that align with my goals and interests?”

SA 2024: We are at the end of the road here. You must be a pro at cases. Additionally, it might be time to consider taking a strategy, research, or finance role and re-recruit for consulting next year.

FT 2024: There are very few opportunities left and those that are still available are one-off openings in which firms are hiring a single candidate. Time is of the essence and you should be able to answer behaviorals and do cases in your sleep.

Interview Questions of the Week:

-How many streetlights are there in New York City?

This is a brain teaser and is a very typical question in consulting interviews

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Buyside:

Where We’re At:

SA 2025: GTCR, Insight Partners, and Harris Associates have all opened up apps for SA 2025. Buyside recruiting is more sporadic than banking and consulting, but expect more apps to open in January/February.

SA 2024: Once again, this is the last post referencing SA 2024. SA 2024 is ~75% complete for buyside recruiting as this cycle tends to be more sporadic than banking or consulting.

Gameplan:

SA 2025: Once again, apps will open around January/February. Speak with professionals to narrow your focus on the area of investing (pe/vc/credit/hf) that you’re looking to explore. Do not enter the process blind.

SA 2024: Not interested in jumping directly into an investing seat? Are you thinking about recruiting for investing roles after a few years in banking/consulting? Check out High Yield Harry’s site for the BEST guidance + resources for navigating a post-grad search for an investing seat (focus on credit & pe) High Yield Harry

Interview Questions of the Week:

-Behavioral: What are some key characteristics of deals done in low-rate environments (2020 & 2021 vintages) vs. deals done today?

-Technical: Why is a ‘take-private’ an attractive opportunity? What are the pros and cons of this type of transaction?

Feel free to write us your responses and we can provide feedback on the quality of your answers!

Premium Database:

The database is updated bi-weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every two weeks with the latest banking and consulting job postings. We released our 22nd update last week.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the bi-weekly updates, you pay a one-time fee of $50 (Venmo @Hooshelpers) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>HH Database Preview--Video

Market Update:

Why aren’t people paying-off their credit cards?

We have discussed the weakening of the consumer balance sheet since: "The Pulse" -- #16 (posted way back in September). Today, we focus strictly on the increase of consumer credit card delinquencies.

Key Factors Influencing Rising Credit Card Delinquencies:

Savings rate erosion (detail found here: "The Pulse" -- #20)

Reduction in government stimulus + forbearance

Super easy access to credit cards with ~80+ issuers today

Now, let’s take a look at credit card delinquencies:

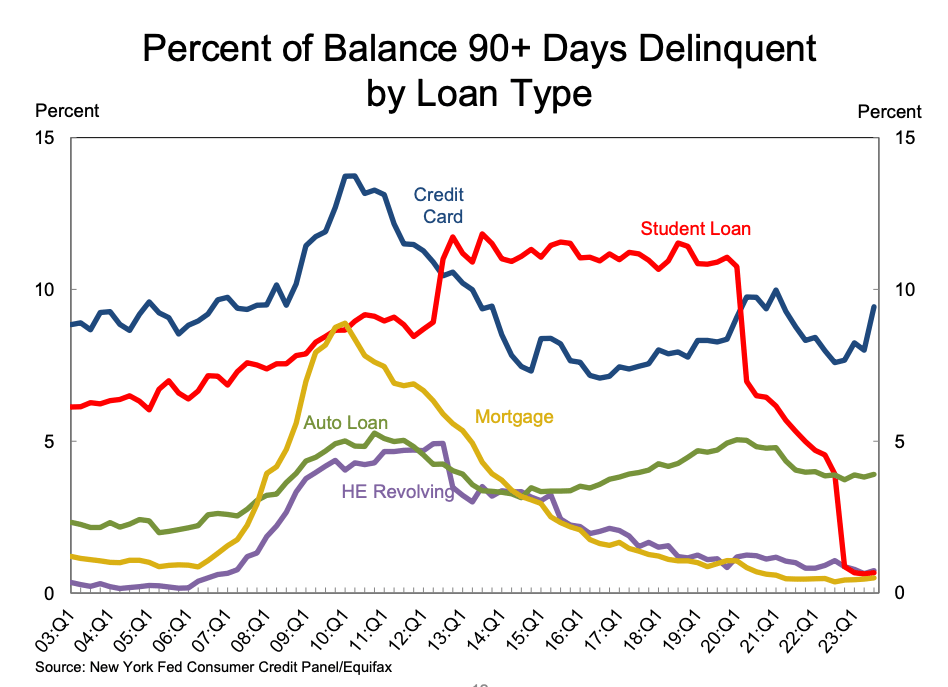

Credit Card Delinquency Rate in 2023 = Credit Card Delinquency Rate in 2008

As you can see, credit card delinquencies have risen much quicker than other obligations such as mortgages & auto loans. Since the repayment of student loans has only recently been reinstated, ignore that data point for now (but expect student loan delinquencies to shoot up in the near future).

High inflation and the lack of government stimulus has supported the use of credit cards to purchase goods and services. As savings erode, consumers tend to turn to the plastic to maintain their spending appetite. At least, in the short-term.

However, credit cards are floating-rate products with huge interest rates (20%+). Racking up credit card debt is never a wise decision and is not a long-term solution to maintain spending appetite.

As consumers become delinquent, interest expenses add up and credit scores fall; disincentivizing the exuberant use of these cards. What happens next? Consumer spending falls too!

As we have noted many times before, consumer spending is the backbone of the economy driving ~2/3 of GDP. When consumer spending dries up, everyone is hurt. With delinquencies rising on credit cards, it will be interesting to see how consumer spending shakes out for the holiday season; ultimately impacting Q4 earnings.

Ok, so we have explained the economic rationale driving the increase in credit card delinquencies, now let’s dive into some behavioral rationale.

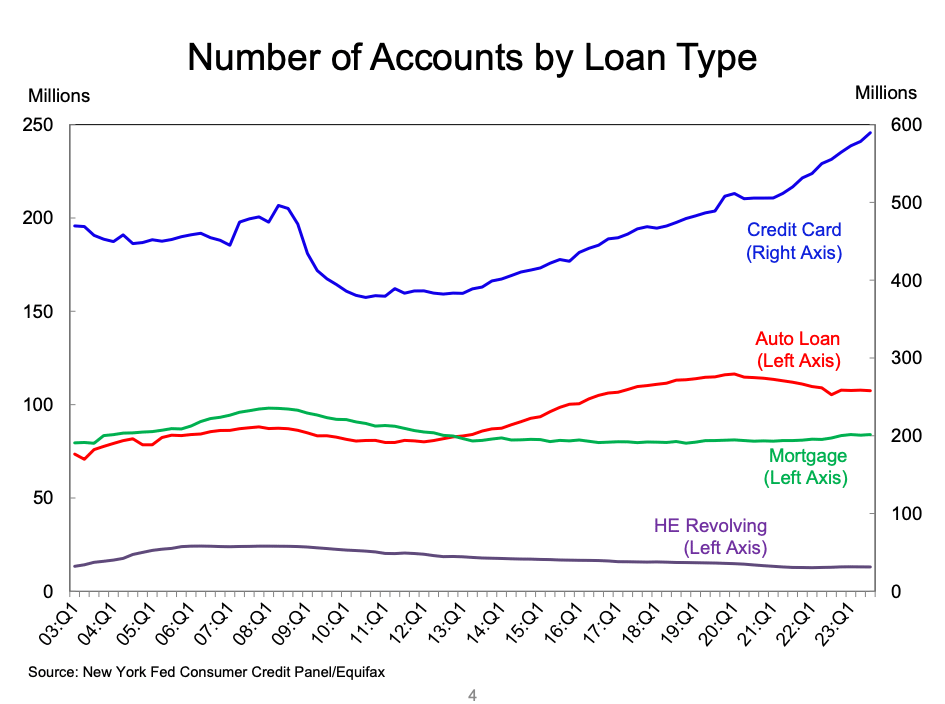

Namely, the tremendous increase in access to consumer credit. Check out the graph below:

A Credit Card for Everyone

Since the GFC, lending standards have tightened across many consumer debt products (mostly home-related; mortgages & HELOCS).

However, as you can see from the graph above, access to credit cards has risen exponentially. With ~330mm people in the U.S., there are about 1.8 credit cards for every person! At the start of the GFC, there were only ~1.5 credit cards for every person.

This difference may seem incremental, but it generally tells us that there is easier access to credit cards today vs. 2008. Does this shift stem from a greater technological movement pulling people to credit cards instead of cash? Or does it stem from an abundance of credit card issuers? The answer: a blend of both.

Today, there are over 80 credit card issuers in the United States. Over the last 5 years, a plethora of new entrants in the name of FinTech have entered the space to overthrow the old regime and provide better consumer credit solutions (I can now pay rent, fee-free, with a credit card thanks to FinTech). Certainly, this has aided the issuance of credit cards.

We can’t write-off the possibility that the abundance of credit cards has supported the rise in credit card delinquencies as people favor repayment of some cards, mistrack repayment when using multiple cards, and place less importance of credit card repayment when there are plenty of institutions begging to provide them with a card.

In an interview, form a view on how credit card delinquencies flow through the economy to ultimately impact the bottom-lines of corporations.

Learning Point of the Week:

EBITDA. Arguably the most well-known and controversial acronym in finance.

First, what is EBITDA? EBITDA stands for ‘earnings before interest, taxes, depreciation, and amortization.’ EBITDA is often referenced as “a proxy for cash flow” and is not a GAAP defined measurement.

More or less, EBITDA is a rough measurement of a company’s operating performance. EBITDA is often used within various ratios such as EV(enterprise value)/EBITDA as a measure of a company’s comparative value, EBITDA/sales as a measure of profitability, and Debt/EBITDA as a measure of a company’s ability to repay debt.

How to calculate EBITDA:

Net Income + Tax Expense + Interest Expense + Depreciation Expense + Amortization Expense

Revenue - COGS - other operating expenses (make sure D&A is not included)

*There are many different ways to calculate EBITDA, but the two methods referenced above are the most common*

Why is EBITDA controversial? Some people, such as Warren Buffett, think EBITDA is a bunch of bullshit that excludes REAL cash outflows that impact a company’s profitability. For example, an industrials company with high, regular capex has a much different EBITDA vs. FCF profile because capex is not included within EBITDA. In the case of industrials, EBIT may be a better measurement to quickly assess the performance of a business.

Everyone loves talking about EBITDA. Make sure you know what it is and how it’s used. At the end of the day, EBITDA is just one step on the path to Free Cash Flow (FCF). FCF is the true holy grail of all non-GAAP measurements and is a hill investors will die on. We will be covering FCF in next week’s update.

Going Forward:

We will be adding a tracker of when each firm released applications last year so that you can get a better idea of when specific firms will release applications this year. THIS WILL ONLY BE AVAILABLE ON THE PREMIUM DATABASE

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Check us out on LinkedIn too! The Pulse

Proudly Produced,

The Pulse

“The Pulse” #26