SA 2026 interview szn is fast approaching! Don’t fall behind your competition by wasting time tracking applications.

Instead, use our Premium Database to gain access to 200+banks/consulting/buyside firms. Venmo @ThePulsePrep $50 or pay with credit card (ThePulsePrep—Stripe.com) and shoot us an e-mail @[email protected]. Additional details of the database can be found below. Gain an edge over everyone by accessing a wealth of recruiting resources and detailed explanations of the interview processes of each firm.

Video of Premium Database——>The Pulse Database Video

Looking for interview prep or a coach to help you navigate the process? Check the “Going Forward” below.

Last year, 95% of students coached received offers.

Pay for 3 coaching sessions, get one FREE! For the next month, we will be offering an exclusive offer to pay $150 to receive 4 coaching sessions with a current or future analyst (Venmo @ThePulsePrep or pay with credit card: (Coaching Bundle $150 for 4 Sessions). Interviews are right around the corner and we want you to be as prepared as possible. Last year, 95% of those coached received offers!

Recruiting Timeline:

Banking:

Where We’re At:

SA 2026: No updates this week. RBC is the only bank to have opened. HL is now expected to open its application in late November. Our projections tell us that December and January will be BIG months for app openings, so get your networking in now before the entire world is begging for “a quick 15 mins.”

FT 2025: 3Wires Partners opened its application. There are currently 53 firms actively recruiting for FT 2025. Please reach out if you are looking for coaching!

New SA 2026 Applications:

None

New FT 2025 Applications:

3Wires Partners: Aerospance, defense, and government banking (FT 2025)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 200+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

46 SA 2025 applications have been released along with 52 FT 2025 apps. If you haven’t received an offer or any invitations to interview you should direct your focus to boutique firms because the larger firms will have filled their analyst class soon.

*We updated the networking contacts in the premium database so take advantage of that resource.

SA 2025 released apps:

Harbor - Global Consulting Intern (SA 2025)

FT 2025 released apps:

Advancy - Junior Consultant (FT 2025)

Council Advisors - Business Analyst (FT 2025)

Apply ASAP if you’re interested!

Buyside:

Where We’re At:

SA 2026: Riverside announced its application. Currently 4 buyside firms recruiting for SA 2026 seats.

New SA 2026 released apps:

Riverside Partners: PE, micro cap (SA 2026)

Premium Database:

The database is updated weekly and contains 200+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 71st update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you pay a one-time fee of $50 (Venmo: ThePulsePrep / Credit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (You can enable purchase protection if concerned). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $50.

This is a small investment for a huge payout when you secure your dream offer!

Video of Premium Database——>The Pulse Database Video

Market Update:

Banking vs. Private Credit

Before diving in, some current events:

Greater turmoil around Israel vs. Iran: Iran Attack on Israel

Longshoremen on strike: East Coast Longshoremen Strike

Over the last 2ish years, the narrative has been that private credit is going to eat banks’ lunch. Today, we assess two things: does this make sense? Who benefits and who gets hurt?

—Our previous write-up on the shift to private credit: "The Pulse" -- #24 (beehiiv.com)

The above post from last year dug more into the fundamentals of a). what private credit is, b). why the transition, and c). further opportunities for PC. So, we will not be visiting those topics today.

-Does the migration to Private Credit make sense?-

It depends on your perspective.

If you’re a depositor at a bank, your top priority is that the bank has enough money in the vault to fulfill your withdrawal requests. You’d rather have the bank physically store your money vs. reinvesting your funds into riskier projects (lend your money). However, your money is still FDIC-insured below $250K and you get paid a little (APY on checkings and savings accounts) to leave your money with the bank—-so it’s relatively risk free.

Comically Bad APY at Large Banks lmaoo

Now, if you’re an investor in a private credit fund, you want that fund to deploy your capital to generate a return. You want them to lend your money and you pay them management fees to execute on your behalf. There is no insurance on your investment in the fund, but if performance is solid you do demand a 12-13% return.

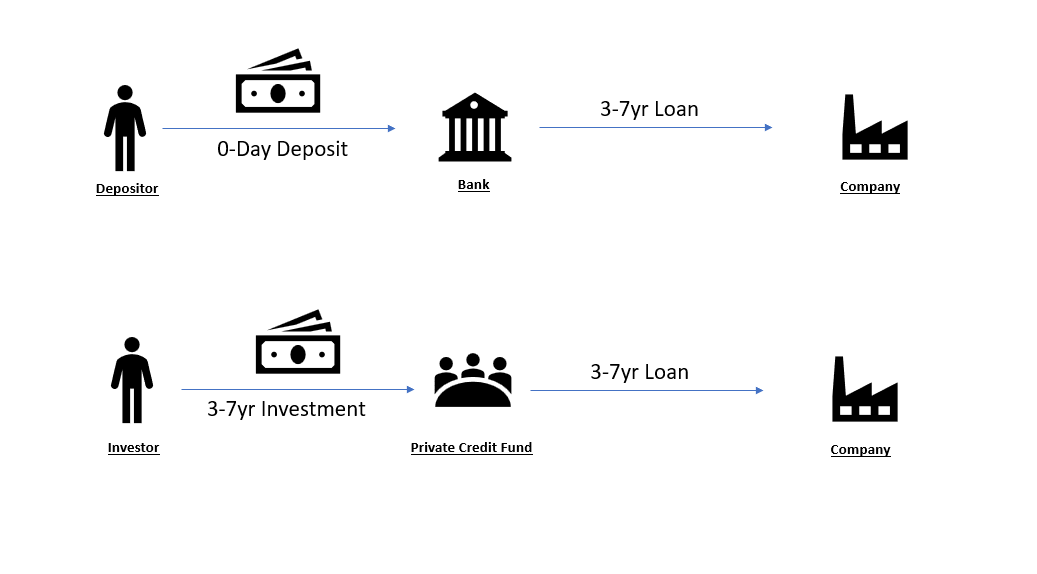

What I described are a few foundational differences between the banking and private credit business models from the perspective of the capital contributors (depositors at banks and LPs at PC funds). Boil it down further and you realize that banks have an asset-liability mismatch.

Banks make loans for 3-7 years, but are on the hook to fulfill withdrawal requests in seconds. On the other hand, LPs in PC funds sign paper to lock up their capital for the duration of the fund, about 3-7 years. Excluding leverage used by PC funds, they have an asset liability match.

It makes more sense for loans to be made from those who have an asset-liability match (PC funds). Also, doesn’t it make sense for loans to be made by those who can afford to the risk? LPs are willing to take the risk and they’re diversified across a range of funds vs. the average person with 100% of savings tied to one bank.

Banking Model vs. PC Model—Similar Dynamics, Different Incentives

“If a bank fails, it is a tsunami of negative effects. If some random private credit shop blows up, there will only be a small ripple of negative effects.” (The Pulse 12/24/23)

Outside of the asset-liability concern, banks are facilitators of liquidity. Funds not so much (yet).

Banks do everything it takes to originate loans because they can a). sell the loan or b). generate fees from other lines of business to compensate for making a “bad loan.”

Regulatory agencies force banks to be in the moving business, so they developed the BSL (broadly syndicated loan) markets to sell their risk. This dynamic creates an agency cost because banks aren’t incentivized to structure the tightest documents as they’re not holding the loans. It’s a balancing act, but the balance often tips in favor to offer loose terms to the issuer in order to win the mandate. Then, they deal with selling the paper to investors on the back end.

In some cases, banks do hold the loans they originate. These are often senior revolvers. However, banks can still originate and hold bad loans (negative ROE). They can do this because they have so many other lines of business to generate fees such as payments or M&A. So, taking a hit on a loan to build a relationship with a company could be a financially successful solution for the firm as a whole.

Today, funds don’t have the infrastructure to be the same liquidity providers as banks. The private credit fund business model is to lend money to generate returns. That’s it. As private debt markets evolve, there will be a greater emphasis on private credit stepping into the bank role as a primary liquidity provider.

-Who benefits and who gets hurt?-

Besides banks and PC funds, other counterparties are bound to feel the shift of lending activity moving into the hands of PC funds.

Beneficiaries: private credit fund managers, riskier businesses, and private equity funds

Losers: consumers, banks (kind of), and private credit returns

-Beneficiaries-

Fund Managers: More lending activity sent to the private markets = more fundraising needed = more AUM for fund managers = more $. Credit favors scale. Every single credit investor we interviewed has matched that idea. The credit game is a game of scaling your fund to the largest size to have the most investment opportunities and to collect more fees from AUM. That equation leads to bigger bonuses for fund managers.

Riskier Businesses: Unbanked businesses can receive funding from the private markets as private credit funds have more discretion to lend to riskier companies. This funding opportunity can help smaller, riskier businesses to grow and prove to equity investors that the business model isn’t so risky after all.

Private Equity Funds: More lending activity sent to private debt markets = the establishment of more private credit funds = greater competition to be a part of the lending club to finance sponsor-backed transactions (LBOs). PE funds will continue to force lenders to compete with one another as capital is a commodity and PE funds just care about getting the loosest possible docs at the cheapest rate.

-Losers-

Consumers: Private credit loans include an illiquidity premium and are more expensive than BSLs. Who the fuck is going to foot the bill? It won’t be the businesses borrowing these loans. It’ll be you! Companies borrowing from the private credit markets will look to pass the costs of greater interest expense downstream to you and me.

Banks: Syndicating debt makes banks a lot of money. As debt goes private, banks will lose business if they don’t evolve. However, they can also capitalize on the trend of capital going private by expanding lending activity to private credit funds and nonbanks (more on this in a different release). After all, how does a non-deposit taking institution make loans?

Private Credit Returns: This piggybacks off of the same idea of why PE funds will benefit. Private credit is going to become more competitive. Funds will compete on costs and offer cheaper loans or loans with less protection. This will impair private credit returns as managers stretch their mandates to continue deploying capital.

The dynamic is shifting. Debt and equity are moving private. The public markets won’t vanish, but for large alternative asset managers, the world is their oyster.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

The Yellow Brick Road (Banking → Private Equity → MBA / Hedge Fund / PE round 2)

It’s a common myth that the most successful professionals in finance need to follow the path of 2 years banking, 2 years private equity, and then a trip down MBA lane / pivot to a hedge fund / take greater responsibility in PE.

Rather than a yellow brick road, I think this is a quick path towards regret for most people. Sure, following this road allows you to earn >$500K / year and attend a lot of client dinners but it comes at the cost of sacrificing your 20s.

My World If I Could Tell People I Work 100 Hours at Apollo

Banking is a grind. PE is known as banking 2.0 especially at the mega funds. An MBA is chill, but why do banking / PE to then go get an MBA? A hedge fund provides 0 certainty of employment and is extremely stressful during market hours. Nothing is perfect.

I know so many people heading down this route with no true end goal. It’s always a ladder of prestige and getting paid more which is their top priority. Unless they really live and breathe this shit, they’re going to find themselves in a position of regret when they realized they blew through their 20s doing things they don’t truly love.

There isn’t a yellow brick road.

No single path is the best for every single person. For some people, banking → private equity → the big 3 exit opps makes sense. They’re passionate about gaining that experience to be industry veterans. For many others, there is an entire world of possibilities out there which often lie under a stone left unturned. They just need some time to discover what they really love to do in life.

Never take a path you think you might regret.

Going Forward:

If you run a club, we want to connect with you to partner. Please shoot us an email @[email protected], would love to make your club the most prepared on campus.

Coaching Details:

Pay for 3, get one FREE = $150. (Venmo @ThePulsePrep or Credit Card: (Coaching Bundle $150 for 4 Sessions)

1 hour session = $50. (Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

30-minute session = $30. Venmo @ThePulsePrep or Credit Card: ThePulsePrep—Stripe.com

Email us with your availability and we will be happy to schedule a session @[email protected]

Students we coached for SA 2025 have received offers at Goldman, JP Morgan, Evercore, and many other firms. Roughly 95% of those coached received offers last year!

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session

Proudly Produced,

The Pulse

“The Pulse” #71