Secured an offer for Summer 2027? Looking for experience to boost your resume?

Immediate finance jobs that pay $50/hr here: Finance Experience

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Regions Bank and Brentwood Capital Advisors opened their applications this week. 83 banks are actively recruiting for SA 2027. Summer 2027 IB recruiting is wrapping up, we are 85% complete with this process

If you need some interview support or just need a place to vent, check out our Coaching Program: Investment Banking Interview Coaching | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Regions Bank: Regional (SA 2027)

Brentwood Capital Advisors: Nashville-based boutique (SA 2027)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

This process is mostly complete. Boutiques will continue to post applications into March and April.

SA 2026 released apps:

MW Jones & Company - Business Analyst Intern (SA 2026)

SA 2027 released apps:

None

FT 2026 released apps:

ECG Management Consultants - Analyst (FT 2026)

Buyside:

Where We’re At:

SA 2027: Orion Group, Spectrum Equity, GCM Grosvenor, and more opened their apps this week. There are currently 71 buyside firms actively recruiting for SA 2027.

Buyside Associate Recruiting: Blackstone, Ares, and Cerity Partners are all actively recruiting. This is a section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

Orion Group: MM PE (SA 2027)

GCM Grosvenor: MM PE (SA 2027)

CF Private Equity: PE Secondaries (SA 2027)

Barings: Investment Management (SA 2027)

Spectrum Equity: Growth Equity (SA 2027)

PeakSpan Capital: Growth Equity (SA 2027)

Starwood: Large REIT, RE Acquisitions (SA 2027)

Ardian: PE Secondaries (SA 2027)

New Buyside Associate released apps:

Blackstone: Liquid Credit (immediate)

Ares: Alternative Credit (immediate)

Cerity Partners: VC (immediate)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 141st update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for investment banking, consulting and buyside roles | The Pulse

Market Update:

Software Selloff

Last week we saw a huge software selloff which was basically a fast reset in expectations around AI and software valuations. The headline number was big; roughly $1 trillion in market value was wiped from software and related names over a short stretch, as investors started to price in the risk that AI agents could pressure traditional SaaS business models way sooner than expected.

The selloff reflected a real shift in how the market is thinking about future revenue durability, pricing power, and competitive moats in software, which was previously the darling of private and public market investors alike.

The S&P North American Technology Software Index was down 8.62% month-to-date as of February 6, even after a strong single-day rebound of +3.63%. At the same time, money rotated into other parts of the market. Small caps outperformed on that rebound day, with the Russell 2000 up around 3.5% to 3.6%.

Source: Yahoo Finance

That kind of relative move usually means investors are reducing exposure to expensive growth and reallocating into segments where valuations are lower and near-term earnings assumptions feel less fragile.

From an investing perspective, this is mostly about multiples and confidence in long-term cash flows. Software stocks tend to trade at premium valuations because investors expect recurring revenue, high margins, and long compounding runways. AI creates tons of upside, but it also introduces uncertainty. If customers can just replace seat-based subscriptions with cheaper AI workflows, then revenue growth and retention assumptions need to be revisited. When those assumptions get shakier, valuation multiples compress quickly.

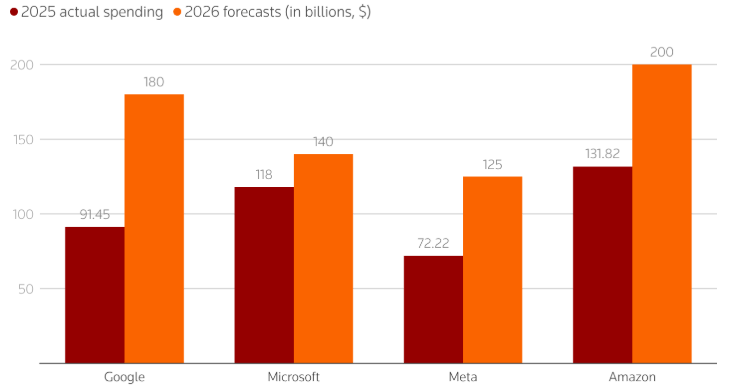

There is also a second layer being capital intensity across the AI stack. Market narratives are now discussing $600+ billion in aggregate AI-related spending plans across major tech players. Whether that number is perfectly precise matters less than what it signals: the scale of investment required is huge, and returns may take time to show up clearly in earnings. So investors are balancing potential long-term productivity gains from AI and near-term uncertainty about who actually captures the economics.

Source: Reuters

For the broader market, this probably means higher dispersion rather than one clean directional call. You can have a decent overall index while software remains under pressure. You can also see software names rally sharply on strong guidance, then drop again if management commentary on AI monetization feels vague.

Essentially, this environment really rewards specificity. Companies that can point to measurable adoption, clear pricing models, and defensible data advantages should hold up better than companies relying on broad AI strategy language. Investors have learned to see through that BS.

The private equity implications are important. PE firms have spent years buying software businesses because the model usually supports stable growth and leverage (think Thoma Bravo). AI uncertainty challenges that playbook in a few ways. First, if public software multiples reset lower, private exit multiples usually follow. That can extend hold periods and reduce realized returns on deals underwritten at peak valuations. Second, leverage becomes less forgiving when growth visibility drops. A capital structure that looked fine under steady expansion can feel tight if net retention weakens. Third, value creation becomes more operational and less financial. It is not enough to improve sales efficiency, firms may need to reposition product roadmaps quickly around AI capabilities.

That said, this is not automatically negative for PE. Dislocations create entry opportunities, especially in vertical software businesses with sticky workflows and proprietary data. If those assets can integrate AI in a way that improves customer outcomes without collapsing pricing, they can still be attractive at more reasonable purchase multiples. The bar is just way higher now, and diligence has to go deeper on product defensibility and AI execution risk.

So the practical takeaway is straightforward. The selloff was less about software being fucking over and more about showing the economics. Investors are no longer paying top-tier multiples for AI exposure alone. They want evidence that AI can improve growth or margins without eroding the core business. That is a healthier setup long term, even if it is more painful short term.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

No Offer Yet, Now What?

We are 85% complete with summer 2027 investment banking recruiting. The peak season was January where we saw the bulk of interviews and offers get released. Congrats to all who secured an offer!

Do you have an offer for summer 2027? Where at?

Below is our advice for all of those without an offer:

1. Embrace the fact that we are now entering the back half of the Summer 2027 IB recruiting season. As you know, there are 3 core components to a successful recruiting process: a) hard work, b) proper timing, and c) a bit of luck. If you've done a and b, do not be hard on yourself. There are plenty of fantastic opportunities available-- you need to stay motivated

2. Stay vigilant for ad-hoc openings at firms you're already familiar with. For example, let's say it's April and you see an app open for Houlihan Lokey. This is likely a single open spot which was created because someone re-negged their offer or HL realized there is additional capacity for another intern. These ad-hoc openings are almost never given to cold applicants. If you networked with 3-5 people at Houlihan Lokey, but never heard back after submitting your initial app be sure to immediately reach back out to those contacts and say "hey I see that [X] app just opened, is there someone you can connect me with who is on that team / running that process?"

3. Have an open mind about what firm you spend your summer at. At The Pulse, our single best piece of advice is to 'Apply Early & Often' to maximize your odds at sticking interviews. You do not need to work at JPM or Evercore to have an incredible investment banking experience. Working at a smaller, lesser known firm that specializes in the lower middle market or within a certain sector can provide you with unique insight, responsibility, and experience that you would not gain at a more structured firm. Also, you can always re-recruit for FT

4. Be extremely proud of all that you have learned throughout the process thus far. I can guarantee you that your finance knowledge, recruiting knowledge, and direction of what you want to do post grad have improved tremendously since the summer.

Going Forward:

Heavy Push on Our Buyside Associate Prep

On the Buyside, models + jobs = offer. We bring everything you need under one roof: Buyside Recruiting & Interview Prep Platform | The Pulse. High quality is what we deliver.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #141

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions