Our coaching program is killing it. Multiple summer 2027 offers already secured by our sophomores. Moelis, BofA, MS, PWP, and more.

We have a 95%+ placement rate and provide the best value in the industry: Investment Banking Interview Coaching | The Pulse.

Last chance to lock in today’s rates. Coaching prices increasing February 1st.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Harris Williams, MTS Health Partners, Huntington Bank and more opened their applications this week. 81 banks are actively recruiting for SA 2027. If you’re not actively involved in multiple interview processes right now, then you’re behind. Focus on the new apps we feature and apply immediately to put yourself in the best position of receiving an interview

If you need some interview support or just need a place to vent, check out our Coaching Program: Investment Banking Interview Coaching | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Harris Williams: Very strong Richmond-based boutique (SA 2027)

MTS Health Partners: Healthcare boutique (SA 2027)

Croft & Bender: MM advisory (SA 2027)

Campbell Lutyens: Secondaries IB (SA 2027)

Huntington Bank: Regional (SA 2027)

Hennepin Partners: Boutique (SA 2027)

JLL: Energy IB

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

This process is 90% complete. Boutiques will continue to post applications into March.

SA 2026 released apps:

None

SA 2027 released apps:

None

FT 2026 released apps:

The Hackett Group - Associate Consultant (FT 2026)

Strategy& - Deals Strategy Associate (FT 2026)

Buyside:

Where We’re At:

SA 2027: Ampfield Management, Chicago Fundamental Investments, and more opened their apps this week. There are currently 63 buyside firms actively recruiting for SA 2027.

Buyside Associate Recruiting: We are officially headed into ‘offcycle.’ Don’t know the difference between oncycle and offcycle? Check out our explanation here: The Pulse Buyside Recruiting | The Pulse. Hill Path, Searchlight, Carlyle, and more are all actively recruiting. This is a section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

Ampfield Management: L/S HF (SA 2027)

Chicago Fundamental Investments: L/S HF (SA 2027)

Rotheasy: U.K. pension & insurance manager (SA 2027)

New Buyside Associate released apps:

Hill Path: Opportunistic PE (summer 2027)

Carlyle: Mega Fund PE (summer 2027)

Searchlight Capital: Financial services PE (summer 2027)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 140th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for investment banking, consulting and buyside roles | The Pulse

Market Update:

Gold & Silver Sky High

The commodities are having a killer moment.

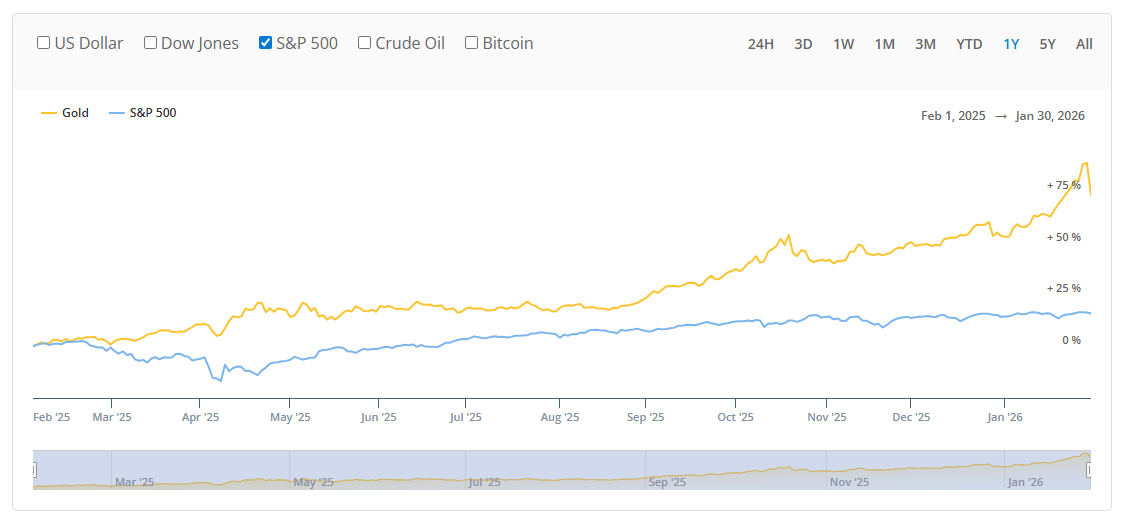

Gold vs. S&P 1-yr Return (Source: APMEX)

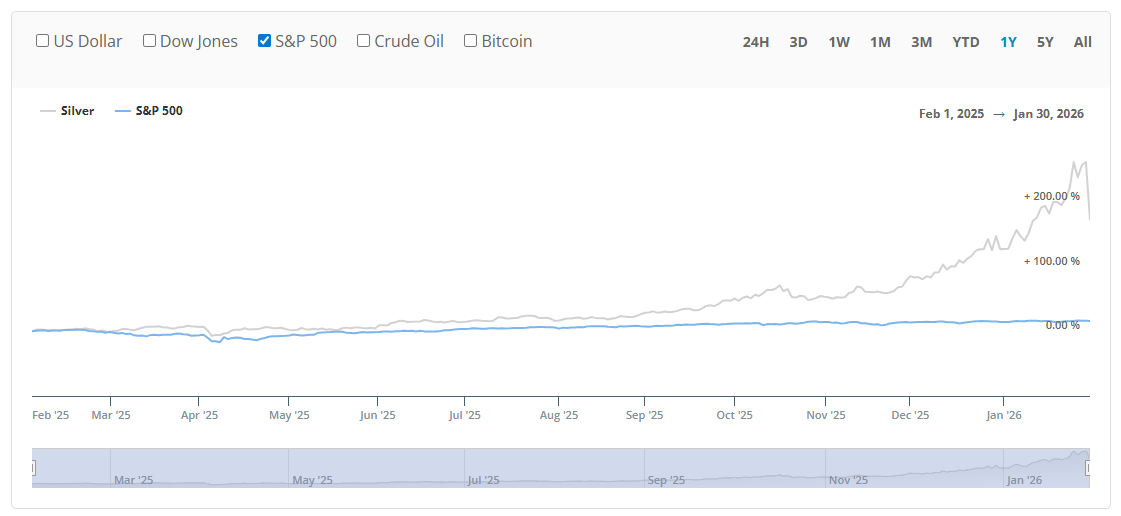

Silver vs. S&P 1-yr Return (Source: APMEX)

The single largest factor driving the spike here is the flight to safety amidst global uncertainty. There are 3 globally recognized ‘safe’ stores of value:

Gold (been this way since Mesopotamia)

USD

US Treasuries

For obvious reasons, USD and US Treasury prices have fallen since the new administration was put in place last year. The charts above explain the immediate flight to the creme de la creme safe haven asset, gold. Also, notice how silver is not included in this list. That was intentional and I’ll discuss more on that later.

Now, Liberation Day was crazy enough and caused a huge push into gold. However, tripling down with attacks on the FED, seizure of Venezuela, and demands to seize Greenland have really pushed investors away from the USD and UST.

It’s harder to trust the safety of U.S. assets when the head of command is just looking to stir the pot—for better or for worse.

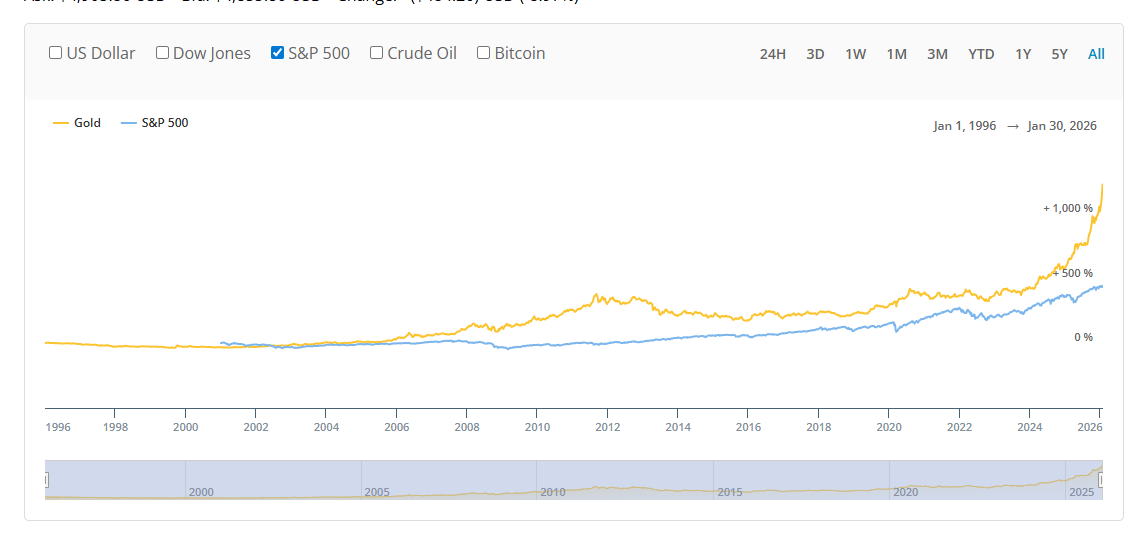

Now a question that needs to be raised, can gold really be deemed a safe haven asset or a globally recognized store of value when its price has 2.5x’d in just 2 years?

This Ain’t Healthy (Source: APMEX)

A store of value must retain value at a reasonable level and shouldn’t really experience dramatic, short-term swings in prices. This has been a table stakes argument for why Bitcoin is not actually ‘digital gold.’

Plus, unlike silver, gold does not have any significant application. It’s really just a currency with a finite supply and its value solely lies in the price people prescribe it.

Immense fluctuations in value for something like gold is really scary tbh. Many governments, banks, and central banks sit on gold as a backstop for any broader uncertainty facing their economies. However, buying any asset at 2.5x its value from only two years ago is a tough pill to swallow and becomes financially reckless. Ironically, the spike in value will turn many of these institutional buyers into sellers or at least into shoppers looking for a different asset to store value (probs back to U.S. assets).

At the end of the day, there are no cash flows, management team, or forecasts to buy into for gold vs. an actual company. So, it becomes difficult for investors to even try lying to themselves about why purchasing more gold today makes sense. Very different backdrop vs. something like the S&P 500 where you can say, “You know what, this AI shit might be the real deal. Buying at 30x P/E might not be that fucked if businesses do become more efficient.”

-Silver, The Younger, More Useful Cousin of Gold-

For the wrong reasons ONLY, silver has received plenty of attention in the news. Silver has never been and will never have the same store of value as gold.

Consider this: there are 1.7 million metric tons of silver vs. only 216K metric tons of gold in Earth. I’m not exactly sure how to picture those numbers, but what I can tell you is that there is ~8x more silver in the world than gold.

However, unlike gold, silver has incredibly strong ductility and conductivity. Nerd words for silver = useful. You can make silver into useful shit.

SILVER IS LOWKEY SIGMA

EVs, AI, you name it. New age tech companies like using silver to enhance their products. So, is the ramp in price more justifiable than gold? Probably not, but maybe! Maybe you can convince yourself that there will only be more use cases of silver with the newer technology of today and tomorrow.

However, silver is now 4x more valuable than what it was 2 years ago. FYI, AI was already a big thing back then.

-The Wandering Commodity: Diamonds-

All of this commodity talk may lead your mind to wander to the 3rd most popular rock: the diamond.

“Why aren’t diamonds being discussed?” Diamonds are infinitely more useless than gold. The entire value of a diamond rides on SUCKERS buying engagement rings and other overpriced jewelry.

A question for the ladies:

Do you care about real or fake diamonds?

I’m sure everyone knows about the infamous fake diamond. Long story short, fake diamond supply and inflation are KILLING the demand for real diamonds.

^no one can tell the difference unless you have those goofy ahh diamond examiner goggles on.

Hold your ground fellas! Real diamonds don’t even have a legitimate case for being a store of value anymore! Bad investment!!

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Case Prepping

If you’re seeking a role in consulting, case studies will be used to test your analytical abilities and business acumen. Below are a few helpful pointers.

Practice with a friend. There are so many case prep materials out there that anyone can access, so you cannot really gain an edge by having unique material. However, I think students underweight the importance of running case prep with their peers. Practicing with others forces you to verbalize your ideas and allows you to see how other students approach a problem. Sharing your ideas will make you better at case studies and give you a substantial leg up.

Practice a lot. When I interview, I am at least a little bit nervous and I don’t think that’s just me. By practicing over and over, you will be able to enter the interview with confidence and attack any case they give you. Additionally, the way you approach each case will be based on the assumptions they give you and the ones you make yourself. Lots of practice will help you learn how to quickly make and apply assumptions.

Your interviewer can help you. Interviewing is stressful, but your interviewer is your friend when it comes to case studies. Allow them to guide you and don’t be afraid to admit when you’ve made a mistake. If the interviewer provides a suggestion that might help you with the case or questions your logic say, “Thank you” and incorporate their suggestion. They want you to succeed and are a resource for you.

Don’t make your life hard, dial up a friend or shoot us an email @[email protected] if you’re looking to set up a mock interview.

Going Forward:

Heavy Push on Our Buyside Associate Prep

On the Buyside, models + jobs = offer. We bring everything you need under one roof: Buyside Recruiting & Interview Prep Platform | The Pulse. High quality is what we deliver.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #140

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions