Our coaching program is killing it. Multiple summer 2027 offers already secured by our sophomores. Moelis, BofA, MS, PWP, and more.

We have a 95%+ placement rate and provide the best value in the industry: Investment Banking Interview Coaching | The Pulse.

Last chance to lock in today’s rates. Coaching prices increasing February 1st.

Got an Offer?

Give us a shout out on LinkedIn and we will pay you $50. All we need is your venmo and a tag in your post.

We Will Pay You $50 To Make This Post & Tag Us @ThePulse

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Canaccord Genuity, Howden, Greenwich Capital Group, and more opened their applications this week. 74 banks are actively recruiting for SA 2027. If you’re not actively involved in multiple interview processes right now, then you’re behind. Focus on the new apps we feature and apply immediately to put yourself in the best position of receiving an interview

If you need some interview support or just need a place to vent, check out our Coaching Program: Investment Banking Interview Coaching | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Rockefeller Capital Management: Boutique advisory (SA 2027)

Canaccord Genuity: Canadian boutique, highest paying on the Street (SA 2027)

AQ Technology: Tech boutique (SA 2027)

Howden: Insurance advisory, hot sector (SA 2027)

Greenwich Capital Group: Boutique M&A (SA 2027)

Shea & Company: Boutique (SA 2027)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

A few more releases this week, including some EYP roles. Apply ASAP!

SA 2026 released apps:

EY Parthenon: Associate Consultant Intern (SA 2026)

CIL Strategy Consultants: Associate Intern (SA 2026)

HKA: Business Consulting Intern (SA 2026)

SA 2027 released apps:

None

FT 2026 released apps:

EY Parthenon: Associate Consultant (FT 2026)

Buyside:

Where We’re At:

SA 2027: Bracebridge Capital, UVIMCO, Brio, and more opened their apps this week. There are currently 60 buyside firms actively recruiting for SA 2027.

Buyside Associate Recruiting: We are officially headed into ‘offcycle.’ Don’t know the difference between oncycle and offcycle? Check out our explanation here: The Pulse Buyside Recruiting | The Pulse. Norwest, Future Standard, and Egis Capital Partners are all actively recruiting. This is a section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

Bracebridge Capital: Structured Credit HF (SA 2027)

UVIMCO: UVA endowment (SA 2027)

Atlas Holdings: Industrials and business services holdco (SA 2027)

Global Endowment Management: Investments intern (SA 2027)

Brio: Blackstone portco focused on RE Credit (SA 2027)

Koch: VC (SA 2027)

New Buyside Associate released apps:

Norwest: GE (summer 2027)

Future Standard: Private Credit (immediate)

Egis Capital Partners: Private Equity (immediate)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 139th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for investment banking, consulting and buyside roles | The Pulse

Market Update:

Recent Public Market Developments

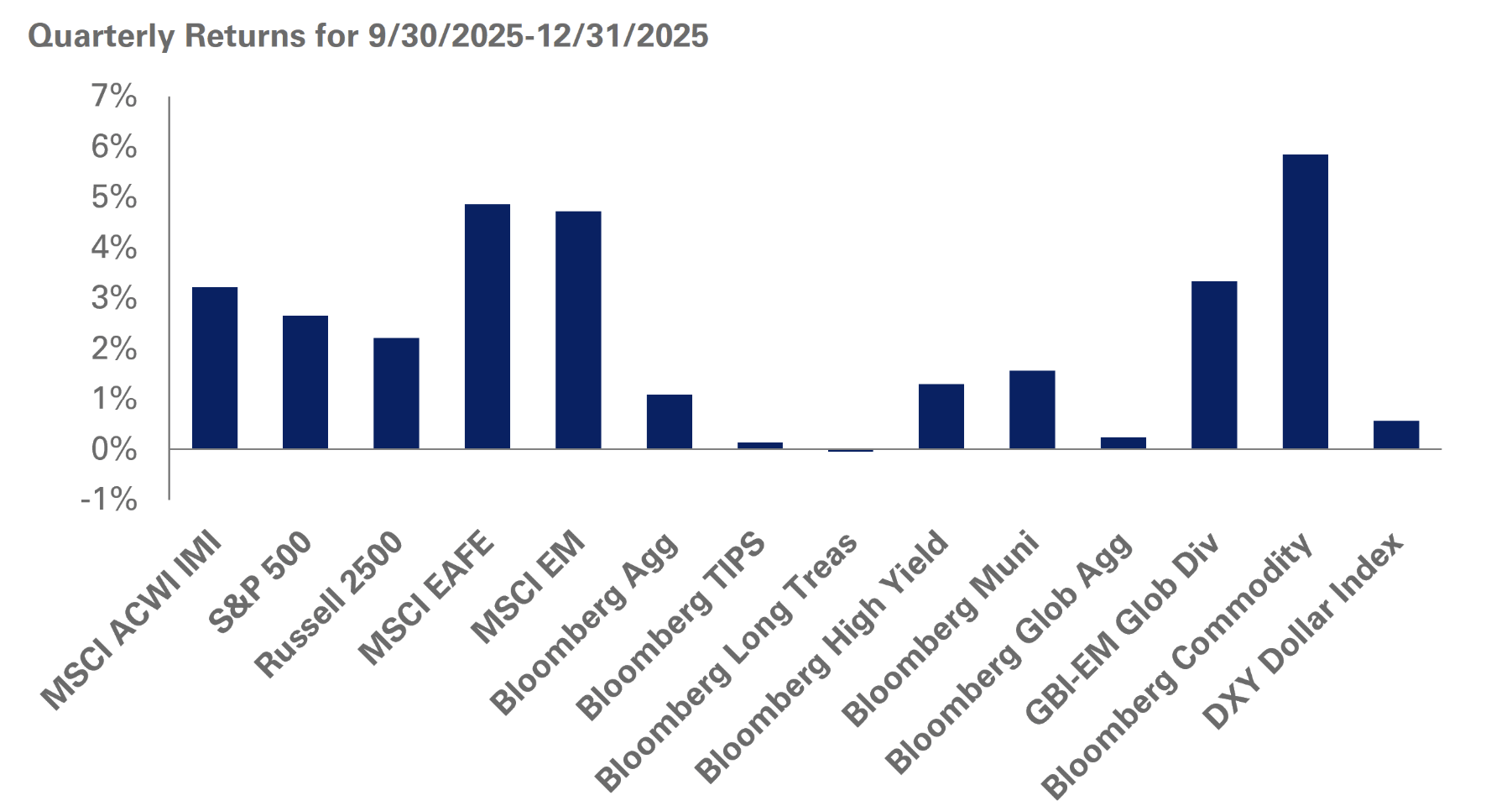

Lots has been going down in public equity markets. Over the last few months, U.S. equities have looked steady in the headline indexes, but the leadership dynamics underneath have shifted. The S&P 500 continued to lean heavily on mega-cap strength into year-end, yet the market has started acting less like a one-trade environment and more like a place where different segments respond to different catalysts.

Source: NEPC

You could feel that in the way investors rotated between “duration-sensitive” growth, cyclical exposures, and smaller companies depending on the day’s mix of rate expectations, policy headlines, and earnings revisions.

For anyone watching market structure, the key theme has been a slow move away from extreme concentration and toward broader participation, even if the biggest names still dominate index-level behavior.

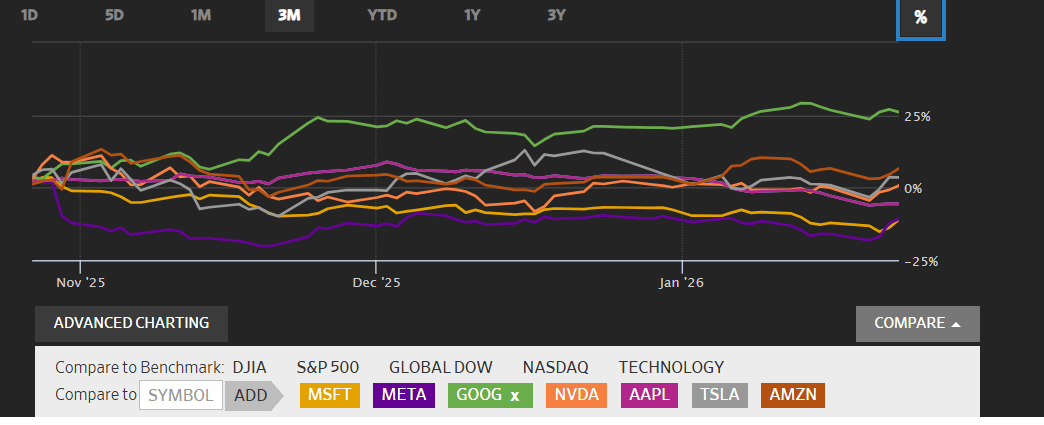

The Magnificent Seven are still central, but they have not been moving as tightly together as they did when the AI mega-cap trade was at peak consensus. In 2023 and parts of 2024, these stocks often traded as a single factor, with flows driving them up or down in sync.

Over the last few months, correlations within the group have loosened because the market has become more selective about business-specific fundamentals and about who is likely to capture actual AI-related cash flow versus who is mainly increasing costs.

The underwriting differences are pretty real. Nvidia and the hyperscalers are tied directly to AI infrastructure demand, while other names are being priced more around consumer cycles, advertising momentum, hardware replacement timing, margin durability, and regulatory risk. That said, the MAG 7 still move together when macro risk spikes. They are liquid, widely owned, and heavily represented in index products, which makes them the first place investors reduce exposure when sentiment turns.

Source: WSJ

The other major development has been improving breadth, particularly as small and mid-caps started to participate more. Early January 2026 featured a rotation in which the Russell 2000 and other smaller-cap benchmarks outperformed while mega-caps stalled or traded choppily. Some of that is fundamental. Smaller companies are generally more sensitive to financing conditions, so even modest changes in rate expectations can matter more for their valuations and earnings outlooks.

Some of it is positioning and mean reversion. After an extended period where capital clustered in the same large-cap names, it does not take much for investors to look elsewhere when the risk-reward in mega-caps feels less asymmetric.

At the same time, it is worth being disciplined about what small-cap “strength” actually means. Valuation metrics can be misleading because a meaningful share of small-cap indices is unprofitable, and broad index-level statistics can look cheap mainly because of how the denominator is constructed. The more defensible takeaway is that participation broadened and the market became less narrowly dependent on a handful of mega-cap winners.

Mid-caps have also benefited from this shift because they sit in an interesting middle ground. They tend to have more established business models than many small caps but still carry higher sensitivity to the domestic cycle than the global mega-caps.

When the market starts pricing in stable growth and easier financial conditions, mid-caps often look like the less shitty way to express that view without the balance-sheet risk embedded in the smallest names.

More broadly, the rebound in breadth has practical implications for portfolio construction. In the most concentrated periods, being underweight a few mega-caps can dominate relative performance even if your broader stock selection is right. When breadth improves, idiosyncratic alpha has more room to show up, and market returns rely less on a single cluster of companies.

International equities have been part of the story as well, especially coming out of Q4 2025. Developed international markets and emerging markets both outperformed broad U.S. benchmarks in the fourth quarter, helped by more attractive starting valuations relative to the U.S., currency effects, and a shift in risk appetite that favored diversification away from the most crowded U.S. trades.

Another subtle driver is that when U.S. mega-cap leadership becomes expensive and heavily owned, it does not take much for incremental flows to look more compelling overseas, particularly in markets where earnings expectations are easier to beat and policy settings look less restrictive.

Generally, the Mag 7 still behave as a cohort during macro stress, and they still drive the index because of their weight and liquidity. But the last three months have shown more dispersion inside the group and more competition for leadership from the rest of the market. The market has been reintroducing differentiation, both among mega-caps and across size segments, which is another way of saying that stock selection and portfolio balance have started to matter more again.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

The Beauty of a Mock Interview

Outside of networking, mock interviews are the most useful tool you can use while recruiting.

Think about it, a company only has maybe 3 total hours of conversations with you before handing you an offer letter. That means you only have 3 hours to impress them with your polished interviewing. You also have a limited buffer to be weird and fuck up the entire interview.

3 reasons why mock interviewing will make your life 10x easier:

There is nothing like being in front of another person. The more someone is a stranger, the harder it is to be calm, cool, and collected…especially when you’re unfamiliar with the topics you’re speaking about. The good thing? Lot’s of practice in front of others can suppress some of those nerves!

Feedback on your body language. Another person can let you know if there is something off about your body language in an interview setting. Looking around the room, having a shaky voice, or moving your hands too much or little, are all BAD body language. You’ll never know unless someone else tells you

Curveball questions. You can only prepare so much. Some answers will have to be unscripted as there are hundreds of thousands of potential questions that can be asked. The more questions you’re given, the better prepared you’ll be

In the past, I made things really difficult for myself by not asking others for help. Mock interviews are the best way of prepping for an actual interview. You’d be surprised at how you sound when speaking in front of another person!

Don’t make your life hard, dial up a friend or shoot us an email @[email protected] if you’re looking to set up a mock interview.

Going Forward:

Got an Offer?

Give us a shout out on LinkedIn and we will pay you $50. All we need is your venmo and a tag in your post.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #139

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions