Coaching + Database Bundle

For the first time ever, we are bundling our coaching program and Premium Database into a single bundle.

For an $80 investment, you can receive access to our Premium Database + unlock a one-hour coaching session to crush your interviews: Premium Database + Coaching Bundle.

You’re effectively locking in a full hour of coaching for only $15. On a standalone basis, this bundle would be priced at over $115; huge value here.

Got an Offer?

Give us a shout out on LinkedIn and we will pay you $50. All we need is your venmo and a tag in your post.

We Will Pay You $50 To Make This Post & Tag Us @ThePulse

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: Greenhill, Macquarie, TD Securities and more opened their applications this week. 64 banks are actively recruiting for SA 2027. You should be getting interviews right now. Firms across the Street are interviewing and some are already giving out offers. The entire SA 2027 process should be pretty wrapped up by the end of February

If you need some interview support or just need a place to vent, check out our Coaching Program: Investment Banking Interview Coaching | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

Greenhill: Restructuring, part of Mizuho now (SA 2027)

Cantor Fitzgerald: Middle market (SA 2027)

Macquarie: Australian bank (SA 2027)

Aeris Partners: Boutique M&A (SA 2027)

Guggenheim: EB (SA 2027)

TD Securities: Canadian middle market (SA 2027)

Tidal Partners: Tech M&A boutique, pays top of Street—$130K base (SA 2027)

Pharus: Boutique (SA 2027)

DC Advisory: D.C.-based middle market (SA 2027)

Cascadia Capital: Boutique M&A (SA 2027)

Q Advisors: Tech M&A boutique (SA 2027)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

This process is mostly complete. Boutiques are continuing to release applications.

SA 2026 released apps:

None

SA 2027 released apps:

None

FT 2026 released apps:

Aimpoint Digital - New Consultant Development Program (FT 2026)

Metaformers - Technology Consultant (FT 2026)

Reference Point - Associate Consultant (FT 2026)

Buyside:

Where We’re At:

SA 2027: DE Shaw, Balyasny, General Atlantic and more opened their apps this week. There are currently 48 buyside firms actively recruiting for SA 2027. Many of these apps are Handshake-only

FT 2027: Warburg Pincus opened their FT 2027 app. There is 1 firm actively recruiting for FT 2027. I’m likely going to remove this section until more volume comes for the FT process (around May / June)

Buyside Associate Recruiting: Oncycle offers have been given, congrats to all who killed it. Mana Ventures, Ares, and RJF Capital Advisors all actively recruiting. This is a section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

DE Shaw: Multi-strat HF (SA 2027)

Balyasny: Multi-strat HF (SA 2027)

Access Holdings: LMM PE (SA 2027)

Radian: Growth equity (SA 2027)

Brown Brothers Harriman: PE (SA 2027)

Stellex: Tech PE (SA 2027)

Evergreen Services Group: Long-term capital (SA 2027)

Banneker Partners: LMM PE (SA 2027)

Capital Southwest Corporation: PC (SA 2027)

General Atlantic: VC (SA 2027)

Kline Hill Partners: PE secondaries (SA 2027)

Trinity Hunt Partners: PE (SA 2027)

New Buyside Associate released apps:

Ares: Large, credit-focused asset manager (immediate)

RJF Capital: LMM PE (immediate)

Mana Ventures: VC (immediate)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 137th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for investment banking, consulting and buyside roles | The Pulse

Market Update:

Depreciation & AI Chips

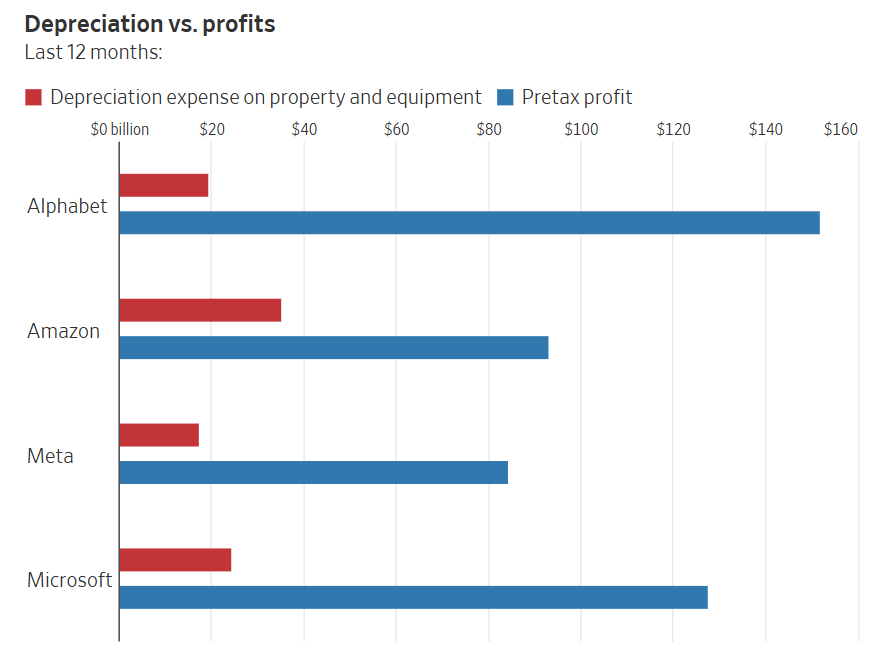

The topic of AI chips and depreciation initially came up a few weeks ago when Michael Burry called out accounting practices for the depreciation of Nvidia chips and other expensive tech equipment.

Depreciation is not usually the part of a financial statement that grabs attention, but in the AI chip world, it has become one of the most important levers shaping reported profits.

As companies spend ludicrous sums on GPUs, servers, and data-center infrastructure, depreciation determines how those costs are recognized over time. It doesn’t change cash flow, but it meaningfully affects earnings, margins, and how investors judge performance. In a sector defined by rapid innovation and massive capital spending, those accounting assumptions matter a lot.

Source: MUFG

What has pushed depreciation into the spotlight is the widening gap between how fast AI hardware evolves and how slowly companies are choosing to write it off. Many large technology firms have extended the useful lives of AI-related assets.

Meta now depreciates most servers and networking equipment over about 5.5 years, up from roughly four to five years previously. Alphabet and Microsoft use around six years for similar assets, compared with closer to three years earlier in the decade. Amazon has also used longer timelines for parts of its infrastructure.

Source: WSJ

These changes have had a noticeable effect on reported profits. Meta’s adjustment alone reduced depreciation expense by roughly $2.3 billion over nine months, boosting earnings without changing the underlying economics of the business.

That kind of accounting shift has drawn skepticism, particularly from investors who argue that AI chips do not remain economically valuable for anywhere near that long. In my opinion, the concern is warranted.

AI hardware improves fast, and new chip generations can make older ones less competitive within a few years. Secondary market data supports this view, showing that used GPUs often lose a large share of their value within three years. If a chip’s economic usefulness drops sharply after that point, spreading its cost over six years understates depreciation and overstates current profits.

This criticism gained traction when Michael Burry publicly questioned whether long depreciation schedules were inflating earnings across the tech sector. His argument was not about accounting rules being broken, but about earnings quality. If companies assume long asset lives that do not reflect reality, profits look better today at the expense of future periods.

Some estimates suggest that if AI chips are closer to three-year assets, depreciation across hyperscalers could be understated by tens of billions over the next several years. Pretty insane amount of cash.

At the same time, there is a semi-valid counterargument. Older GPUs do not stop working when a new model launches. Instead, they tend to move down the workload stack, shifting from training cutting-edge models to running inference or handling less demanding tasks.

For example, Nvidia’s A100 chips from 2019 are still widely used and continue to generate revenue. In many cases, older hardware remains fully utilized even if it is no longer state-of-the-art. From that perspective, five or six-year depreciation schedules can be defended as reflecting ongoing economic use, not just peak relevance.

The push and pull come from the difference between “still usable” and “still valuable.” We can see in secondary markets that older chips may remain operational, but their pricing power declines quickly as newer generations arrive.

Rental rates fall, resale values drop, and returns compress. Straight-line depreciation smooths this decline, even though real economic value tends to fall unevenly. That mismatch is what makes depreciation such a sensitive issue in AI.

For investors, the takeaway is that depreciation assumptions matter a shit ton for reported profitability. Longer schedules inflate near-term earnings and margins, while shorter schedules create pressure but may better match cost with value.

The risk of aggressive assumptions is not immediate cash strain, but future write-downs or earnings volatility if assets fail to earn what their book values imply.

When an industry is moving this fast and spending this much, depreciation assumptions, capital risk, and durability of investments deserve almost as much attention as the revenue numbers themselves.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

Competitive Tension

Do you have multiple interviews slotted for next week? First of all, congrats! You’re almost there!

You should leverage your success by telling firms about your processes, this carries more weight than telling them you have an offer from somewhere else (more on this below).

This is competitive tension, one of the best tools to enhance your success while interviewing. Competitive tension helps you advance your interviews. For example, if you interviewed with MS on Monday and have a HL interview scheduled for Wednesday, you should immediately tell the MS recruiter that you have another process moving very quickly. The idea is that this will urge the MS recruiter to move up your Superday.

Why do I want my Superday to happen earlier?

There are a finite amount of offers and a seemingly infinite number of super qualified applicants. Most firms review apps, process interviews, and give offers on a rolling basis. The more offers given = the lower chances you have of receiving one. It’s easier for a firm to give out offers to good candidates when they have a lot to give. As the offers roll out and the firm starts to archetype the summer analyst class, they start looking for more specific qualities and backgrounds.

Follow after me:

“Hey! Hope all is well. Really enjoyed my conversation with [X] on [X], excited for any next steps of the process. Just writing to inform you that I am involved in another fast-moving process with an interview slotted for [X]. Would love to continue the conversation here, please let me know if there is any additional material I can provide. Thank you”

NEVER say the names of the other firms you’re interviewing with.

Ok, now I want to discuss why competitive tension during the interview phase is 10x more effective than trying to leverage a separate offer (for summer analyst recruiting).

Once you notify a firm that you’ve received an offer elsewhere, they are likely to categorize you as “sold.” Summer analyst recruiting is a cost for a firm because summer analysts don’t really do anything meaningful on the job + time needs to be dedicated by working professionals to interview candidates. Therefore, firms are not in the business of begging you to accept their offer over another firm.

Going Forward:

Got an Offer?

Give us a shout out on LinkedIn and we will pay you $50. All we need is your venmo and a tag in your post.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #137

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions