Coaching + Database Bundle

For the first time ever, we are bundling our coaching program and Premium Database into a single bundle.

For an $80 investment, you can receive access to our Premium Database + unlock a one-hour coaching session to crush your interviews: Premium Database + Coaching Bundle.

You’re effectively locking in a full hour of coaching for only $15. On a standalone basis, this bundle would be priced at over $115; huge value here.

Recruiting Timeline:

Banking:

Where We’re At:

SA 2027: JPM, GS, Evercore, PJT, and more opened their applications this week. 53 banks are actively recruiting for SA 2027. As predicted, January 1st was a huge date for app openings. Remember to apply EARLY & OFTEN to maximize your odds of landing an interview. All apps tracked within our Premium Database; these users are spending their time prepping for interviews instead of searching for app links

If you need some interview support or just need a place to vent, check out our Coaching Program: Investment Banking Interview Coaching | The Pulse. 95%+ of those coached for the summer 2026 recruiting season received offers!

New SA 2027 Applications:

JPM: Largest BB (SA 2027)

GS: Elite BB (SA 2027)

MS: Global BB (SA 2027)

UBS: Strong BB (SA 2027)

PJT: EB, RSSG (SA 2027)

Evercore: Strong EB (SA 2027)

Brown, Gibbons, & Lang: Strong boutique (SA 2027)

Ducera: Rx-focused boutique (SA 2027)

SMBC: Japanese MM (SA 2027)

CIBC: Large Canadian bank (SA 2027)

Nomura: Japanese MM (SA 2027)

Wells Fargo: Large US bank (SA 2027)

Societe Generale: French bank (SA 2027)

MUFG: Large Japanese bank (SA 2027)

Scotiabank: Canadian MM (SA 2027)

CVP: Elite boutique, strong tech advisory (SA 2027)

Moelis: EB (SA 2027)

See below to gain access to our premium database, updated weekly, which houses the application processes for over 300+ banks/consulting/buyside firms! Gain an edge over everyone else by not having to spend countless hours tracking applications and deadlines.

Consulting:

Where We’re At:

We will stop tracking these opportunities at the beginning of March. Boutiques will continue posting applications through the early spring.

SA 2026 released apps:

None

SA 2027 released apps:

None

FT 2026 released apps:

Grayce - Graduate Consultant (FT 2026)

Buyside:

Where We’re At:

SA 2027: Ares, Blackstone, KKR, and more opened their apps this week. There are currently 36 buyside firms actively recruiting for SA 2027

Buyside Associate Recruiting: Oncycle recruiting officially kicked off with firms such as Oaktree, AKKR, and Platinum Equity actively seeking associates for a summer 2027 start date. This is a section dedicated towards providing updates for our post-grad Buyside Associate Recruiting platform: Buyside Recruiting & Interview Prep Platform | The Pulse.

If you’re a senior or first year analyst looking to get the fuck out of banking—-you need to be on this platform. Live job updates and 14+ LBO modeling case studies with answers

New SA 2027 released apps:

Ares: Large, credit-focused asset manager (SA 2027)

KKR: Mega-fund PE (SA 2027)

Blackstone: Mega-fund (SA 2027)

Bain Capital: Elite asset manager, PC intern (SA 2027)

Readystate: Quant (SA 2027)

Jane Street: Multi-strat HF, quant intern (SA 2027)

Global Atlantic: Insurance arm of KKR (SA 2027)

Oak Hill Advisors: Large credit shop (SA 2027)

Abrams Bison Investments: HF (SA 2027)

New Buyside Associate released apps:

Oaktree: Elite asset manager (summer 2027 start)

Platinum Equity: UMM PE (summer 2027 start)

AKKR: Growth equity arm of KKR (summer 2027 start)

Premium Database:

The database is updated weekly and contains 300+ Investment Banking and Consulting internships/full-time positions along with:

Interview tips for specific companies

Interview prep material

Applications and deadlines linked so that you can apply with one click

Insider information about the application process

Professionals to network with

Buyside deadlines, interview prep, and people to network with for the sweatiest of students

We send the updated dataset every week with the latest banking and consulting job postings. We released our 136th update today.

Students we have been helping have already landed roles at Blackstone, Goldman, J.P. Morgan, Jefferies, Citi, and Solomon.

To get access to the database and the weekly updates, you make a one-time investment of $65 Credit Card / Debit Card: (ThePulsePrep—Stripe.com) that grants you annual access to the updated database (please reach out for additional payment options). If you don’t find our services helpful, we simply ask for feedback on an area we can improve upon and will refund your $65.

This is a small investment for a huge payout when you secure your dream offer!

Premium Database——>Database for investment banking, consulting and buyside roles | The Pulse

Market Update:

Liquid Gold

As you all know, the U.S. captured Venezuela’s President over the weekend.

Unc Had That Shit On Frfr

Maduro was captured on the basis of being a Narco-Terrorist. That drug money can be convincing and Maduro was aiding cartel exports of illegal drugs such as cocaine and fentanyl into the United States. This is exactly 36 years after the U.S. captured Noriega in Panama.

What does this mean?

Access to an incredible supply of oil

U.S. Dollar remains king

Strengthening of free markets in the Americas

-A Brief History on Venezuela’s Economy-

Venezuela is a developing country with unbelievable potential. Unfortunately, the government didn’t govern well and the economy is a total shithole now.

In the 1970s, Venezuela was the wealthiest country in South America thanks to its gigantic oil reserves. In fact, Venezuela is believed to have the largest supply of liquid gold in the world. So, how did everything get fucked up?

Too much state influence. The government got too involved and nationalized core economic functions such as oil production, banking, etc. Even the Central Bank is not an independent entity. Historically, this playbook has not worked out well.

Instead of responsibly shelving funds generated by oil exports, the government doubled down on spending and would even print new money to cover older obligations. This is a classic start to a hyperinflationary cycle.

-Today’s Picture-

A brief snapshot of key economic indicators:

Unemployment rate: 5.5% (some sources say 35%?)

GDP growth: 8.7% YoY

Inflation: 172% YoY (yikes)

Ok, so we have a hyperinflationary economy with surprisingly strong employment (if those figures are reliable) and strong GDP growth—well aligned with developing countries. This isn’t great, but it’s not horrible, right?

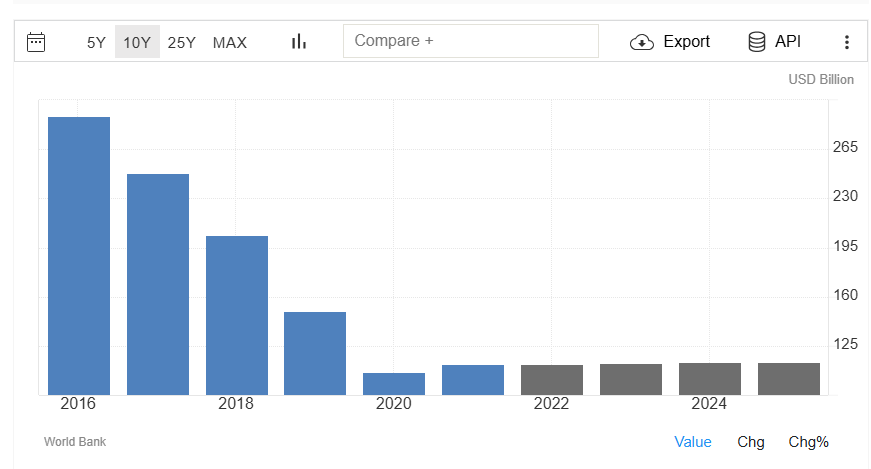

Take a look at this chart:

Venezuela GDP Since 2016 (Source: Trading Economics)

You’re looking at a country that has experienced a 60% drop in GDP within 10 years. Holy shit.

-What’s Next-

Well, we now have access to over 300 billion barrels of oil and can likely expand influence in neighboring countries such as Guyana and Suriname who boast more untapped potential. All of that liquid gold provides us with substantial negotiating power with BRICS.

Just another step towards reinstating U.S. independence from foreign entities—-a build off of the tariff play from earlier in the year.

A related point, greater control of Venezuelan oil supports global demand for U.S. dollars which provides additional insurance that the U.S. dollar will remain the global reserve currency for the foreseeable future. Dollar supremacy helps keep domestic borrowing rates low as foreign demand bids up Treasury auctions.

Similar to the U.S.’s South American influence in the 1960s, the step to capture Maduro maintains free market dominance in the West. Venezuela’s economy is currently a quasi-public economy. The United States is obviously a strong advocate for free markets. My best bet is that the United States is going to support a more democratic government regime…time will tell if this works out.

Disclosure: Nothing written here is financial advice or should be used for investment decisions.

Learning Point of the Week:

The Paper LBO

For undergrad recruiting, a paper LBO can be a really scary question to tackle. It acts more like a case study and requires mental math, understanding of LBO mechanics, and fundamental investment analysis.

You won’t see these in every interview, but some of the sweaty Elite Boutiques are notorious for dropping a Paper LBO.

However, once you practice a few you’ll realize that these really aren’t that bad. I honestly think they’re easier than many multi-step accounting questions or merger math questions.

I put together a Paper LBO template alongside a written answer key + video walk-through to make sure that you crush this if you ever see it: Paper LBO at The Pulse | The Pulse.

Going Forward:

Got an Offer?

Give us a shout out on LinkedIn and we will pay you $50. All we need is your venmo and a tag in your post.

Please reach out to us with any questions about recruiting or if you’re interested in meeting the team! ([email protected])

We are happy to chat, review resumes, or help set up a coaching session.

Proudly Produced,

The Pulse

“The Pulse” #136

Make sure you receive us every Sunday!

Everyone: reply to this email with a "Yo" or “hey” or “hell yeah”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions